Genesco Inc. reported first-quarter earnings that topped expectations as sales exceeded plan, led by an 8 percent increase from Journeys Group, while expenses benefited from cost-containment efforts. The performance marked the company’s third consecutive quarter of positive comparable sales increases. Guidance was reiterated for the year

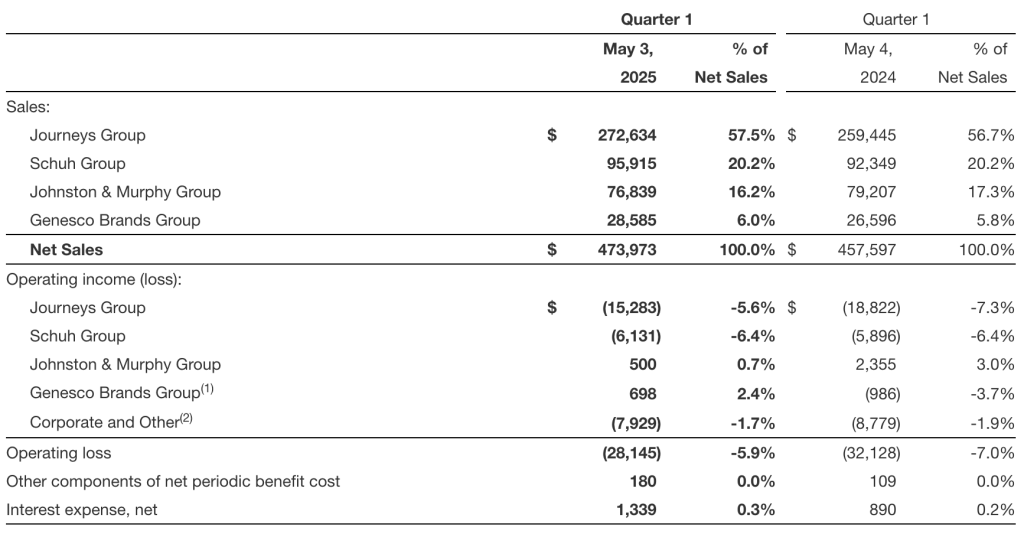

Net sales for the first quarter of Fiscal 2026 increased 4 percent to $474 million compared to $458 million in the first quarter of Fiscal 2025. The net sales increase reflects a 5 percent increase in comparable sales, including a 7 percent increase in e-commerce comparable sales and a 5 percent increase in same-store sales, and increased wholesale sales, partially offset by the impact of net store closings.

The overall sales increase of 4 percent for the first quarter of Fiscal 2026 compared to the first quarter of Fiscal 2025 was driven by an increase of 5 percent at Journeys, an increase of 4 percent at Schuh and a 7 percent increase at Genesco Brands, partially offset by a decrease of 3 percent at Johnston & Murphy. On a constant-currency basis, Schuh sales were up 1 percent for the first quarter this year.

Segment Performance (in $ thousands)

Profitability & Expenses

Gross margin for the first quarter this year was 46.7 percent compared to 47.3 percent last year. Adjusted gross margin for the first quarter this year of 46.7 percent decreased 90 basis points as a percentage of sales compared to 47.6 percent last year. The decrease as a percentage of sales compared to Fiscal 2025 is due primarily to changes in brand mix at Journeys and Schuh, promotional activity at Schuh and lower margins at Genesco Brands related to liquidation of product for sunsetting licenses.

Selling and administrative expenses for the first quarter this year of 52.5 percent decreased 170 basis points as a percentage of sales compared with last year primarily reflecting decreased occupancy and performance-based compensation expenses as well as other cost savings initiatives.

Genesco’s GAAP operating loss for the first quarter was $28.1 million, or 5.9 percent of sales this year, compared with a loss of $32.1 million, or 7.0 percent of sales in the first quarter last year. Adjusted for the excluded items in the first quarters of both Fiscal 2026 and 2025, the operating loss for the first quarter was $27.9 million this year compared to a loss of $30.0 million last year. Adjusted operating margin was a loss of 5.9 percent of sales in the first quarter of Fiscal 2026 compared to a loss of 6.5 percent in the first quarter last year.

The effective tax rate for the quarter was 28.5 percent in Fiscal 2026 compared to 26.7 percent in the first quarter last year. The adjusted tax rate, reflecting excluded items, was 26.7 percent in Fiscal 2026 compared to 26.0 percent in the first quarter last year.

GAAP loss from continuing operations was $21.2 million in the first quarter of Fiscal 2026 compared to a loss of $24.3 million in the first quarter last year. Adjusted for the excluded items, the first quarter loss from continuing operations was $21.5 million, or $2.05 per share, in Fiscal 2026, compared to a loss of $22.9 million, or $2.10 per share, in the first quarter last year.

Image courtesy Journeys/Genesco Inc.

See below for additional SGB Executive coverage of Genesco’s first quarter, including CEO and CFO insight into tariffs, guidance and category performance.

EXEC: Journeys Gets Q1 Boost from Athletics Momentum, Saucony’s Return and Hoka’s Arrival