Citing weakness at its Lids Sports Group, Genesco Inc. reported earnings on an adjusted basis fell 39.4 percent in the second quarter. It also sharply reduced its EPS guidance for the year due to the Q2 shortfall and continued weakness expected at Lids at least in the third quarter. In the second quarter, earnings adjusted to exclude non-recurring items reached $8.0 million, or 34 cents per share, well below Wall Street’s consensus estimate of 55 cents. The non-recurring items were tied to its Schuh Group, network intrusion expenses, asset impairment charges, and lease-exit gains.

Citing weakness at its Lids Sports Group, Genesco Inc. reported earnings on an adjusted basis fell 39.4 percent in the second quarter. It also sharply reduced its EPS guidance for the year due to the Q2 shortfall and continued weakness expected at Lids at least in the third quarter. In the second quarter, earnings adjusted to exclude non-recurring items reached $8.0 million, or 34 cents per share, well below Wall Street’s consensus estimate of 55 cents. The non-recurring items were tied to its Schuh Group, network intrusion expenses, asset impairment charges, and lease-exit gains.

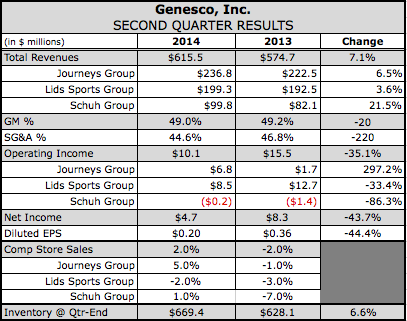

Revenues increased 7.1 percent to $615 million. Consolidated comps, comparable e-commerce and catalog sales, added 2 percent, with a 5 percent increase in the Journeys Group, a 2 percent decrease in the Lids Sports Group, a 1 percent increase in the Schuh Group, and a 2 percent advance in the Johnston & Murphy Group.

On a conference call with analysts, Chairman and Chief Executive Robert Dennis said solid comp performances from Journeys and Schuh helped achieve top-line projections. Store comps were up 1 percent. Direct comps, benefitting from ongoing investments in its digital platform and omnichannel capabilities, jumped 13 percent.

“Unfortunately, all of this wasn't enough to offset a shortfall in sales and gross profit in the Lids Sports Group against our expectations,” said Dennis. Most of bottom-line miss came from a failure to realize a planned gross margin improvement at Lids.

Through Saturday, August 23rd, quarter-to-date comps were plus 4 percent with stores up 4 percent and direct sales up 10 percent, led by Journeys and Schuh.

At its Lids segment, sales in the quarter rose 3.6 percent to $199.3 million. Operating profits slumped 33.4 percent to $8.5 million. The 2 percent comp decline at Lids came on top of a 3 percent decline a year ago. Third-quarter comps for the group were plus 3 percent through last Saturday.

Dennis said second-quarter sales trends in the hat stores were “choppier than expected” and gross margins were down slightly from last year while some gross margin improvement was expected. Said Dennis, “We had anticipated better full-price selling than a year ago when Lids was forced to get more promotional to clean up their snapback inventory. In reaction to softness in sales in the quarter this year, the team reverted to a similar promotional cadence.”

Unfavorable NBA and NHL championship comparisons also impacted results with San Antonio Spurs and the Los Angeles Kings driving far fewer sales this year than the Miami Heat and the Chicago Blackhawks last year.

“As in recent quarters, the broader issue for Lids continues to be a lack of meaningful fashion driver in the hat category,” added Dennis. “Despite the tough quarter, we are cautiously optimistic about the hat stores delivering improved results in the back half of the year, but have hedged that optimism in our revise guidance.”

Comps at its Locker Room and Clubhouse stores were down mid-single digits in the quarter with a strong first quarter due to the Seattle Seahawks Super Bowl win followed by the negative comparisons coming from the Spurs and the Kings championships, partly due to Locker Room’s concentration in the Chicago market. While Lids is optimistic about the potential NFL lift in the second half, Locker Room and Clubhouse may face tough comparisons against the Red Sox/Cardinals World Series matchup depending on this year’s matchups.

Lids remains on target to add a total of 44 new Locker Room and Clubhouse stores this year through a combination of organic expansion and acquisitions over the remainder of the fiscal year. it acquired the 19-door Cardboard Heroes chain in Ohio and Kentucky, “which represents good timing given Manziel and the Browns and LeBron's return to Cleveland,” pointed out Dennis.

Lids opened 62 more Locker Room by Lids departments at Macy's during the quarter, bringing the total 95 departments at quarter end. It’s on track to have 175 departments by year-end. Dennis said management continues top view the Macy’s openings “as a good opportunity to reach consumers that wouldn't typically shop our standalone Locker Room stores

Lids.com’s comps advanced 10 percent on top of the 25 percent increase a year ago. Dennis direct bounced back to double-digit growth from the first quarter “albeit slightly more promotionally driven.” Lids.com continues to benefit from expanded assortments well beyond caps with its newer Locker Room/Clubhouse concepts. Further improvements are expected from a new e-commerce platform launch in the second half.

At Journeys Group, sales rose 6.4 percent to $236.8 million. Operating earnings more than tripled to $6.8 million from $1.7 million. Journey’s store comps were up 5 percent while direct comps up 31 percent on top of the 21 percent gain a year ago.

Dennis said the positive fashion developments seen in the first quarter through ate May gained further momentum in June and July.

“As we head into the back half of the year we expect that the positive trends in non-athletic footwear, which has been a clear point of differentiation for us during the past several back-to-school and holiday periods will fuel improved results of Journeys over the same period a year ago,” said Dennis. “But we also expect that the recent newness on the athletic side will be a meaningful complement to growth, which we haven't experienced during the holidays in some time.”

Quarter-to-date comps for Journeys group were up 5 percent. Digital traffic was up well into the double digits again this past quarter, driven in part by increased mobile and tablet access. Higher conversion rate also contributed to the sales growth.

Dennis also noted that Journeys recently completed a multiyear study of the US teen consumer and found Journeys has “incredible brand awareness among teens” along with a good reputation for its on-trend merchandise, compelling store environment and approachable and fashion-savvy associates. On the other hand, the study showed that Journeys could do a better job reaching a subset of teens representing about half of the population, “who purchase a disproportionate amount of teen footwear and heavily influence their peers.”

With those targeted teens shopping the mall more regularly, Journeys plans to rotate new products and change windows and signage to highlight new product more frequently. Exclusive product to Journeys will be called out more. Layout changes are planned with teens in the target segment looking for a “larger, better lit, more organized store.” The study offered its sponsorship of Vans Warped Tour, which reached 90 percent of the targeted subset, as an example of Journeys’ more-focused marketing focus.

Schuh Group’s revenues advanced 21.5 percent to $99.8 million. The U.K. teen footwear chain lost $197,000 in the period against a deficit of $1.4 million a year ago. Comps turned positive with a 1 percent gain after five quarters of negative comps. Stores were down 1 percent, while the direct business was up 14 percent.

“Similar to Journeys, the emergence of new fashion trends helped boost Schuh's recent sales, and we are cautiously optimistic this will contribute to positive comps during the third and fourth quarters,” said Dennis. “Third-quarter comps for the group were up 5 percent through last Saturday.”

At Johnston & Murphy Group, revenues moved up 3.3 percent to $55.0 million. The chain lost $424,000 against operating earnings of $1.75 million.

Sales in its Licensed Brands, which includes Dockers footwear, inched up 1.8 percent to $24.3 million; operating profits rose 27.3 percent to $1.8 million.

Gross margin in the quarter was 49 percent compared with 49.2 percent last year. It had budgeted an improvement driven primarily by a pickup in Lids gross margin. Said Jim Gulmi Genesco’s CFO, “This did not materialize through a combination of lower-than-expected sales, higher promotional activity, and higher shipping and warehouse costs than we had expected.”

Adjusting for all the non-recurring items, expenses as a percent of sales increased to 46.8 percent and 45.4 percent last year. Almost 50 percent of the increase in expense as a percent of sales was driven by lower EVA bonus accrual reversal compared to last year and a higher contingent bonus expense related to the Schuh acquisition.

The company’s updated full-year earnings guidance calls for earnings between $5.10 to $5.20 a share, down from its previous range of $5.40 to $5.55 a share. In 2013, it earned $5.09 a share.

Genesco’s officials said the decline reflects the shortfall in the second quarter and the lower projections for the Lids group in the back half, particularly in the third quarter. Overall, it expects essentially flat EPS in the third quarter.

It continues to expect a comp increase of 1 to 2 percent this year. For the first half, total comps were up 1 percent and are expected to gain 3 percent in the back half. Gross margins are now expected to be flat for the year, down from expectations of a gain of 50 basis points provided in its last guidance update in May. This is driven primarily by increased promotional activity at Lids and higher shipping and warehouse costs than originally planned.

“While we are disappointed with our second-quarter profitability, we still have a long way to go in the year,” said Dennis. “We still expect a solid back half performance, although with slightly lower expectations primarily related to Lids.”