Genesco Inc. reported first-quarter earnings on an adjusted basis slid 13.3 percent and came in 10 cents lower than Wall Street's consensus estimate. But the company reaffirmed its guidance for the full year while citing continued strong gains at its Locker Room and Clubhouse stores, some better trends emerging for Journeys and Schuh concepts, and an overall improving sales trend since April’s start.

Genesco Inc. reported first-quarter earnings on an adjusted basis slid 13.3 percent and came in 10 cents lower than Wall Street's consensus estimate. But the company reaffirmed its guidance for the full year while citing continued strong gains at its Locker Room and Clubhouse stores, some better trends emerging for Journeys and Schuh concepts, and an overall improving sales trend since April’s start.

Excluding non-recurring items, earnings from continuing operations were $19.3 million, or 81 cents per diluted share, for the first quarter compared to Wall Street’s consensus estimate had been 91 cents a share.

On a conference call with analysts, Bob Dennis, Genesco’s chairman, president and CEO, said the first quarter “played out about as we expected” with sales ahead 6 percent companywide and earnings slightly exceeding the basis for its full-year EPS guidance. The lower first-quarter profitability was driven primarily by a reversal of prior year bonus accruals. Management also had “modest expectations” for the period given planned new store openings which are less productive in the first half, and concerns about the “lack of a meaningful new fashion driver” in teen footwear.

Through last Saturday, quarter-to-date comps were plus 3 percent with stores up 2 percent and direct sales ahead 7 percent.

“Since the start of April, buoyed in part by the Easter shift and the arrival of warmer weather, our sales trends have been positive,” said Dennis. “This trend has continued into May and we expect it will improve as the quarter progresses and we begin to lap easier comparisons.

Most encouragingly, Genesco is now seeing some fashion developments in the spring that are giving Journeys' comps a boost. Said Dennis, “We continue to expect comps to accelerate in the back half as casual footwear becomes a bigger percentage of Journeys and Schuh's product mix and as these newly identified product trends take hold.”

Adjusted earnings in the first quarter excludes reflect expenses of $7.7 million, or 21 cents a share, to cover a change in accounting for bonus awards; deferred purchase price payments in connection with the acquisition of Schuh, and network intrusion expenses. The year-ago quarter bottom line included expenses of $10.7 million, or 33 cents a share, covering largely the same non-recurring costs.

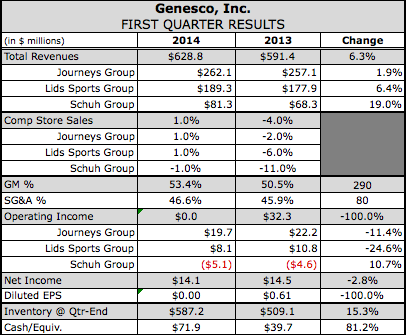

Net sales for the first quarter increased 6.3 percent to $629 million. Consolidated comparable sales, including brick & mortar and e-commerce, increased 1 percent. So far in the second quarter, comps are ahead 3 percent through May 24.

Adjusted gross margin in the quarter was 50.3 percent compared with last year's gross margin of 50.5 percent. This small decrease reflected higher shipping and warehouse costs. Adjusting for all the non-recurring items, expenses as a percent of sales increased to 45.3 percent from 44.3 percent last year.

At Lids Group, sales rose 6.4 percent to $189.3 million. Comps lifted 1 percent versus a 6 percent decline last year. Operating earnings declined 24.6 percent to $8.1 million.

The comp gain was driven by the continued strength at its Locker Room and Clubhouse stores and by solid gains at lids.com. Second-quarter comps for the group were flat through May 24.

The core Lids Hat Stores remains in a “slump” with the important snapback category seeing a slight decline in the quarter. The chain has been hurt by a shift away from the fitted cap category, with many competitors able to compete in snapbacks. Said Dennis, “We think we need a new fashion trend of a meaningful size there to get excitement in the hat stores revved up again. And we don't have visibility on that at the moment.”

At Locker Room and Clubhouse stores, comps increased high-single-digits in the quarter. The locations saw sales increase “dramatically” around ‘game day’ events, most recently with its MLB locations in the quarter. They also benefited from a high-concentration of stores in Seattle with Super Bowl merchandise sales. The Derek Jeter farewell tour and the success of Masahiro Tanaka lifted its New York stores. It ended the quarter with 129 Locker Room and 32 Clubhouse locations and plans include adding a total of 44 new Locker Room and Clubhouse stores through a combination of organic expansion and acquisitions over the remainder of the year.

Lids also had 33 Locker Room by Lids departments inside Macy's departments at the quarter’s end, opening 7 in the period, and expects to reach 175 locations this year. Dennis said management continues to be “optimistic” about the Macy’s/Lids partnership.

Lids.com’s comps increased 5 percent in the quarter on top of a 29 percent jump a year ago. The year-ago period included the World Baseball Classic, played every four years. Excluding sales of country specific merchandise related to the tournament, Lids.com’s core online business was up 9 percent in the quarter. Quarter-to-date sales through May 24 were up 15 percent.

Growth at Lids.com is expected to be boosted in the future by efforts to expand its offerings well beyond caps and omni-channel efforts to drive improvements in traffic and conversion. Omni-channel efforts include customers now being able to return online-purchased product to a nearby store. Later in the second quarter, online customers will gain access to inventory across Lids’ store network rather than just its warehouse stock. A new lids.com website will debut late summer with an updated look and feel as well as enhanced functionality.

At Journeys Group, revenues increased 1.9 percent in the quarter to $262.1 million. Comps inched up 1 percent, rebounding from a 2 percent decline in the 2013 first quarter. Journey Group’s operating income sunk 11.4 percent to $19.7 million. Through May 24, quarter-to-date comps were up 5 percent.

Dennis said management was pleased with Journey’s performance given the lack of fashion trends and was also encouraged to see the “some positive fashion developments” that should support second-half growth.

Asked in the Q&A session about the shifting trends, Dennis noted that “there is more excitement around casual,” and the casual has been outperforming fashion athletics “for several years now” at Journeys. The mix in the second half will further shift to casual, which will then heavily feature boots. He declined more specifics for competitive reasons.

Direct remained strong for Journeys, comping up 19 percent against a 26 percent gain a year ago. Web traffic was up “well into double-digits,” primarily through mobile and tablet access, as paid search efforts and additional catalog drops paid off. Conversion was also “up nicely.”

Journeys is ahead of Lids in omni-channal initiatives, including providing customers access to Journeys entire inventory through in-store touch screens, and being able to check online if an item is in stock at a nearby store. A new order management platform went live in May that will give enhanced order status for customers. A flagship location on 34th St. in New York City opened in the quarter, replacing one that was sold back to the landlord last year.

At Schuh Group, the U.K footwear chain that’s similar to Journeys, sales grew 19.0 percent in the quarter to $81.3 million. Comps slid 1 percent versus a drop of 11 percent last year and a 7 percent decline in the fourth quarter. Stores were flat while the direct business was down 6 percent. The segment reported an operating loss of $5.1 million against a loss of $4.6 million a year ago. Clearance sales to reduce overstocks pulled down gross margins.

Second-quarter comps for the group were up 1 percent through May 24. Said Dennis, “We are cautiously optimistic that Schuh, like Journeys, may be seeing some early signs of improvement in fashion trends.”

Despite missing a “fashion driver” recently like Journeys, Schuh has continued to exceed the pro-forma projections that served as the basis for Genesco’s acquisition and its new stores continue to perform to expectations. A new warehouse will open in the back half of 2014 to support future growth. It ended the quarter with 98 permanent locations and remains on schedule to add a total of 15 stores this year.

At Johnson & Murphy, sales in the quarter grew 8.5 percent to $63.4 million. Comps dipped 1 percent, impacted by its heavy concentration its stores in the Northeast, which was hit by several winter storms in the period. Operating profits improved 16.8 percent to $4.5 million.

In its Licensed Brands segment, primarily Dockers footwear, sales advanced 10.6 percent to $32.5 million. Operating profits ran up 20.5 percent to $3.5 million.

Based on first quarter performance and current visibility, Genesco reaffirmed its full-year guidance calling for EPS in the range of $5.40 to $5.55, a 6 percent to 9 percent increase over Fiscal 2014's adjusted earnings per share of $5.09. The guidance assumes a comparable sales increase in the low single digit range. Lids comp expectations were “trimmed that a little bit” given the continued underperformance at its flagship Lids locations but expectations for the rest of its segments remained the same.