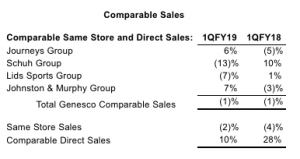

Genesco Inc. reported a loss in the first quarter, but results were a penny better than analyst’s consensus estimates and the company reiterated guidance for the year. Journeys saw “significantly” improved profitability as comps rose 6 percent. Lids’ comps dropped 7 percent but showed improvement over versus the fourth quarter.

Genesco Inc. for the three months ended May 5, 2018 reported a GAAP loss from continuing operations per diluted share of 12 cents a share, compared to earnings per diluted share of 5 cents in the first quarter last year.

Adjusted for the excluded Items in both periods, the company reported a first quarter loss from continuing operations per diluted share of 6 cents, compared to earnings per diluted share of 6 cents last year. Analysts’ consensus forecasts had called for a 7-cent-a-share loss.

Robert J. Dennis, chairman, president and chief executive officer, said: “Our first quarter results in total were within the range of our expectations, as continued strength in our U.S. retail footwear businesses helped to offset in part challenges in our other operating divisions. Journeys in particular delivered robust comparable sales and significantly improved profitability. Johnston & Murphy began the year with accelerating comparable sales and a strong earnings performance as well. While sales trends in the Lids Sports Group remained negative, they improved meaningfully compared with the fourth quarter. Meanwhile, in addition to a strong year-over-year comparison, a number of headwinds in the U.K. pressured Schuh’s performance. Overall, gross margins were up, driven primarily by channel and brand mix and increased full priced selling at Journeys and Johnston & Murphy. However, we deleveraged expenses due to negative store comps, resulting in profitability below last year’s level but consistent with our forecast.

“We are pleased with our start to the second quarter, as the arrival of warmer weather has helped accelerate demand for seasonal product and comps in each one of our businesses. While we remain cautious about Schuh’s near-term prospects, we are encouraged by the signs of improvement in our other major businesses, Journeys in particular. Looking ahead to the remainder of the year, our focus is on executing the key initiatives we have previously outlined aimed at fortifying the leadership positions of each of our concepts and reducing our overall cost structure. We are optimistic that we have the right strategies in place to drive enhanced profitability and greater shareholder value over the longer-term.”

First Quarter Review

Net sales for the first quarter of Fiscal 2019 increased to $645 million from $643 million in the first quarter of Fiscal 2018. Excluding the impact of exchange rates, sales would have decreased 1 percent. Comparable sales were down 1 percent, with stores down 2 percent and direct up 10 percent. Direct-to-consumer sales grew to 11 percent of total retail sales for the quarter, compared to 10 percent last year.

First quarter gross margin this year was 49.9 percent, up 30 basis points, compared with 49.6 percent last year, primarily reflecting channel and brand mix and increased full price selling at Journeys and Johnston & Murphy, partially offset by less full price selling in the company’s other business segments and increased shipping and warehouse expenses.

Selling and administrative expense for the first quarter this year was 49.9 percent, up 80 basis points, compared to 49.1 percent of sales for the same period last year. The increase as a percentage of sales reflects higher expenses relating primarily to selling salaries and benefits and bonus accruals. Without exchange rate increases, expense dollars would have been flat for the quarter due to the impact of store closings, rent and other cost reductions.

Genesco’s GAAP operating loss for the first quarter was $1.8 million this year compared with operating income of $2.8 million last year. Adjusted for the Excluded Items in both periods, the operating loss for the first quarter was $0.3 million this year compared with operating income of $2.9 million last year. Adjusted operating margin was 0.0 percent of sales in the first quarter of Fiscal 2019 and 0.5 percent last year.

The effective tax rate for the quarter was 20.3 percent in Fiscal 2019 compared to 38.3 percent last year. The adjusted tax rate, reflecting Excluded Items, was 15.2 percent in Fiscal 2019 compared to 36.7 percent last year. The lower adjusted tax rate for this year reflects the lower U.S. federal income tax rate following the passage of the Tax Cut and Jobs Act in December 2017 and the inability to recognize a tax benefit for certain overseas losses.

GAAP loss from continuing operations was $2.3 million in the first quarter of Fiscal 2019, compared to earnings of $1.0 million in the first quarter last year. Adjusted for the Excluded Items in both periods, first quarter loss from continuing operations was $1.1 million in Fiscal 2019, compared with earnings of $1.1 million last year.

Cash, Borrowings and Inventory

Cash and cash equivalents at May 5, 2018 were $30.9 million, compared with $43.4 million at April 29, 2017. Total debt at the end of the first quarter of Fiscal 2019 was $105.7 million compared with $138.0 million at the end of last year’s first quarter, a decrease of 23 percent. Inventories decreased 4 percent in the first quarter of Fiscal 2019 on a year-over-year basis.

Capital Expenditures and Store Activity

For the first quarter, capital expenditures were $20 million, which consisted of $12 million related to store remodels and new stores and $8 million related to direct to consumer, omnichannel, information technology, distribution center and other projects. Depreciation and amortization was $20 million. During the quarter, the company opened 21 new stores and closed 35 stores. Excluding Locker Room by Lids in Macy’s stores, the company ended the quarter with 2,558 stores compared with 2,632 stores at the end of the first quarter last year, or a decrease of 3 percent. Square footage was down 2 percent on a year-over-year basis, excluding Lids Locker Room departments in Macy’s stores.

Fiscal 2019 Outlook

For Fiscal 2019, the company is reiterating its previously established full year guidance and still expects:

• Comparable sales to be flat to up 2 percent, and

• Adjusted diluted earnings per share in the range of $3.05 to $3.45.2

Photo courtesy Genesco