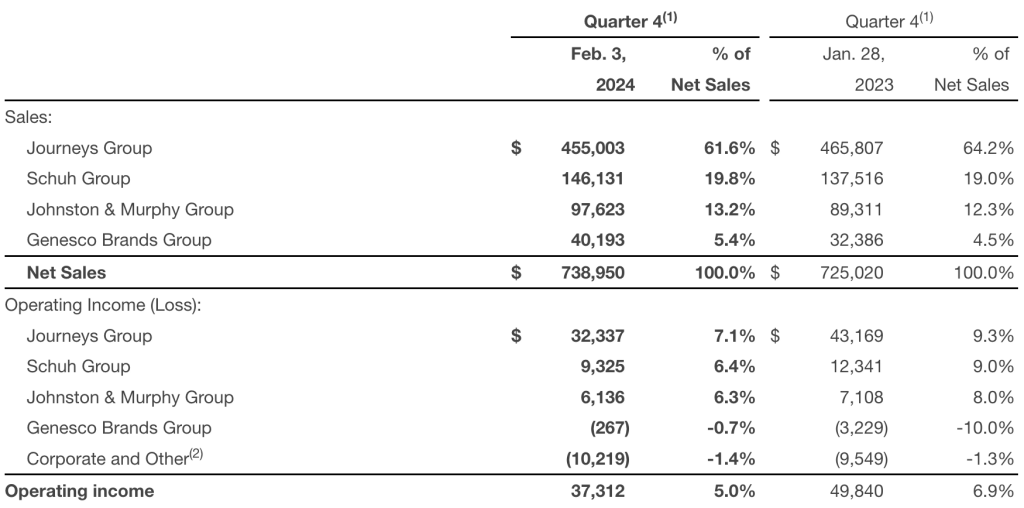

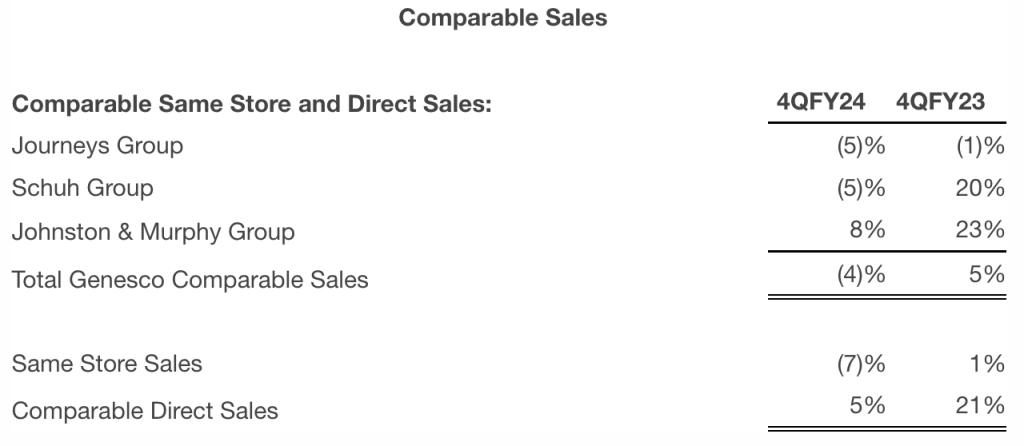

Genesco, Inc., the parent of Journeys, Schuh and Johnston & Murphy, reported net sales for the 14-week 2024 fourth quarter increased 2 percent to $739 million for the period ended February 3, compared to net sales of $725 million in the 13-week fourth quarter fiscal 2023. Excluding the 14th week, sales would have decreased 2 percent for the fourth quarter.

The sales decrease compared to the prior-year Q4 period was said to be driven by decreased store sales, primarily in Journeys Group, partially offset by a 5 percent increase in e-commerce comparable sales, increased wholesale sales and a favorable foreign exchange impact.

The overall sales increase was reportedly driven by a 6 percent increase at Schuh, a 9 percent increase at Johnston & Murphy, and a 24 percent increase at Genesco Brands, partially offset by a decrease of 2 percent at Journeys. On a constant-currency basis, Schuh sales were up 2 percent for the fourth quarter.

Fourth quarter gross margin in Q4 was 46.3 percent of sales, down 10 basis points compared with 46.4 percent in the prior-year quarter. The decrease as a percentage of sales compared to Fiscal 2023 was reportedly due primarily to a change in product mix at Journeys, partially offset by lower freight and logistics costs at both Johnston & Murphy and Genesco Brands.

Selling and administrative expense for the fourth quarter increased 170 basis points as a percentage of sales compared with the prior-year Q4 period.

Adjusted selling and administrative expense for the fourth quarter also increased 170 basis points as a percentage of sales compared with the prior-year Q4 period. Approximately 60 basis points of the increase were attributable to the 53rd week. Adjusting for the 53rd week, fourth quarter expenses were said to be “relatively flat in absolute dollars” when compared to the prior-year Q4 period, despite additional variable expenses associated with the company’s direct sales growth, demonstrating the impact and benefit of cost savings initiatives.

Genesco’s GAAP operating income for the fourth quarter was $37.3 million, or 5.0 percent of sales, compared with $49.8 million, or 6.9 percent of sales in the prior-year Q4 period.

Adjusted for the Excluded Items in both periods, operating income for the fourth quarter was $38.5 million, compared to $51.0 million in the prior-year Q4 period. Adjusted operating margin was 5.2 percent of sales in the fourth quarter of fiscal 2024 and 7.0 percent in the prior-year Q4 period.

For the 53rd week, operating income was an estimated loss of $2.6 million, or approximately 18 cents per share.

The effective tax rate for the quarter was 43.0 percent in fiscal 2024, compared to 19.1 percent in the prior-year Q4 period.

The adjusted tax rate, reflecting Excluded Items, was 22.6 percent in Fiscal 2024 compared to 25.2 percent in the prior-year Q4 period. The lower adjusted tax rate for the fourth quarter, compared to the prior-year Q4 period primarily reflects a reduction in the effective tax rate for jurisdictions in which the company is profitable.

GAAP earnings from continuing operations were $20.3 million in the fourth quarter of fiscal 2024, compared to $39.2 million in the prior-year Q4 period.

Adjusted for the Excluded Items in both periods, fourth-quarter earnings from continuing operations were $28.5 million, or $2.59 per share, in fiscal 2024, compared to $37.1 million, or $3.06 per share, in the 2023 fourth-quarter period.

Cash, Borrowings and Inventory

- Cash as of February 3, 2024 was $35.2 million, compared with $48.0 million as of January 28, 2023.

- Total debt at the end of the fourth quarter of fiscal 2024 was $34.7 million, compared with $44.9 million at the end of the prior-year Q4 period’s fourth quarter.

- Inventories decreased 17 percent on a year-over-year basis reflecting decreased inventory for Journeys and Johnston & Murphy, partially offset by an increase at Schuh.

Capital Expenditures and Store Activity

- For the fiscal 2924 fourth quarter, capital expenditures were $10 million, related primarily to retail stores and digital and omnichannel initiatives. Depreciation and amortization was $14 million.

- During the quarter, the company opened five stores and closed 24 stores. The company ended the quarter with 1,341 stores compared with 1,410 stores at the end of the prior-year Q4 period, or a decrease of 5 percent.

- Square footage was down 3 percent on a year-over-year basis.

Share Repurchases

- The company did not repurchase any shares during the fourth quarter of Fiscal 2024. The company repurchased 1,261,295 shares, 10 percent of its outstanding shares, for $32.0 million, or $25.39 per share during fiscal 2024.

- The company currently has $52.1 million remaining on its expanded share repurchase authorization announced in June 2023.

Store Closing and Cost Savings Update

- The company closed 94 Journeys stores in fiscal 2024 and is targeting up to 50 more closures in fiscal 2025

- The company is now targeting an increased run rate of $45-$50 million in annualized cost reductions by the end of fiscal 2025.

Fiscal 2025 Outlook

- Expects total sales to decrease 2 percent to 3 percent compared to fiscal 2024, or down 1 percent to 2 percent excluding the 53rd week in fiscal 2024;

- Expects adjusted diluted earnings per share from continuing operations in the range of $0.60 to $1.00; and

- Guidance assumes no further share repurchases and a tax rate of 26 percent.

Image courtesy Johnston & Murphy