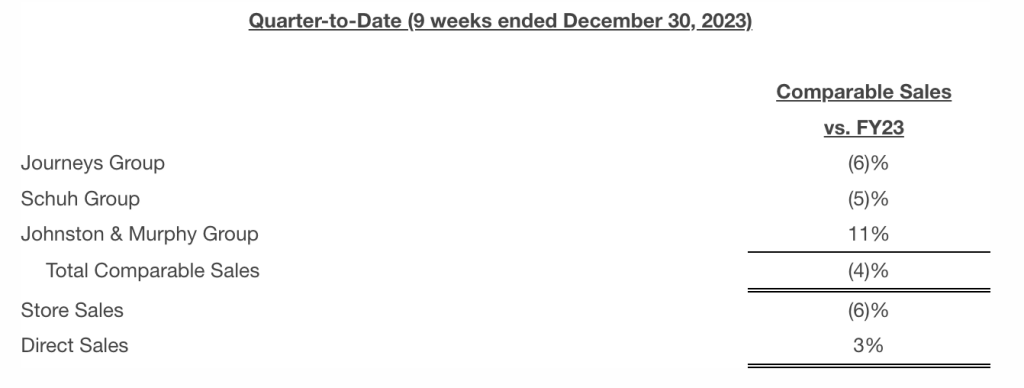

Genesco, Inc. reported that comparable sales, including stores and direct sales, decreased by 4 percent for the quarter-to-date period ending December 30, 2023. Same-store sales fell 6 percent, and sales for the company’s e-commerce businesses increased 3 percent on a comparable basis.

Comparable sales changes for each retail business for the period were as follows:

Mimi E. Vaughn, Genesco board chair, president and chief executive officer, said, “Following a positive start to the holiday season, sales decelerated in the weeks approaching Christmas, as consumer shopping trends remained choppy and peak shopping days were not enough to offset the lulls in between.”

Vaughn said the trend was pronounced at Journeys, where store results were pressured despite a more promotional stance. “While consumer appetite for key items remained strong, there was less interest in boots, which are a meaningful part of our winter assortment,” Vaughn said.

Still, momentum reportedly remained strong at Johnston & Murphy, helping to counter the lower-than-expected results at Journeys, while online business continued to “post solid gains.”

With fourth-quarter sales trending below our expectations, GCO now expects total year-adjusted EPS to be in the range of 65 cents to 85 cents compared with the company’s prior view of a range of $1.50 to $2.00.

“We expect we will be near the midpoint of this range,” Vaughn continued. “Looking forward, we are on course to enter fiscal 2025 with clean inventories, and we will continue our efforts to better align our merchandise assortments with current consumer demand while also reshaping our cost base. These actions, combined with our other strategic initiatives to elevate and evolve the Journeys business, are aimed at driving improved long-term value.”

Genesco’s report and Vaughn’s comments come as the company plans to present at the 2024 ICR conference in Orlando, FL this week.

Image courtesy Genesco/Johnston & Murphy