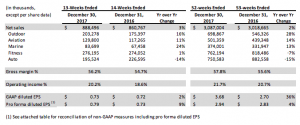

- Total revenue of $888 million, growing 3 percent over the prior year quarter, with outdoor, fitness, marine and aviation collectively growing 9 percent over the prior year quarter and contributing 78 percent of total revenue

- Gross margin improved to 56.2 percent compared to 54.7 percent in the prior year quarter

- Operating margin improved to 20.2 percent compared to 18.6 percent in the prior year quarter

- Operating income of $179 million, representing growth of 12 percent

- GAAP EPS was $0.73 for the fourth quarter, representing growth of 2 percent and pro forma EPS(1) was $0.79 for fourth quarter 2017, representing growth of 9 percent

- Delivered our one-millionth certified aviation product, demonstrating our long history of innovation and contribution to the aviation industry

- Began shipping our updated marine ECHOMAP™ and STRIKER™ products, bringing connectivity to the water

Highlights for the fiscal year 2017 include:

- Total revenue of $3,087 million, growing 2 percent over the prior year, with outdoor, fitness, marine and aviation collectively growing 9 percent over the prior year and contributing 76 percent of total revenue

- Gross and operating margins of 57.8 percent and 21.7 percent, respectively, both improving from 2016 levels

- Operating income of $669 million, representing 7 percent growth

- GAAP EPS was $3.68 and pro forma EPS(1) was $2.94

- Shipped over 15 million units and over 188 million since inception

- Completed the acquisition of Navionics®S.p.A., a privately-held worldwide provider of electronic navigational charts and mobile applications for the marine industry

- Strong demand for the fēnix® line of wearables led to significant growth in our outdoor segment

- Connect IQ™ app store continued growth with over 3,500 apps and over 45 million downloads since inception

- Garmin ranked #41 on Forbes’ “The Just 100: America’s Best Corporate Citizens” and ranked as one of the Global 2000 World’s Best Employers

Executive Overview from Cliff Pemble, President and Chief Executive Officer:

“2017 was our second full year of sales and operating income growth driven by strong sales in our outdoor, aviation and marine segments,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “Entering 2018, we see additional growth opportunities ahead and we believe that we are well-positioned to seize these opportunities with a strong lineup of products.”

Outdoor:

The outdoor segment grew 16 percent in the quarter with significant contributions from wearable devices combined with growth of inReach subscription services. Gross and operating margins improved to 63 percent and 36 percent, respectively, resulting in 26 percent operating income growth. Garmin expects outdoor to continue to be a growth segment in 2018 as we leverage opportunities in wearables and other product categories in the segment.

Aviation:

The aviation segment posted solid revenue growth of 11 percent in the quarter with growth contributions from both aftermarket and OEM. Gross and operating margins remained strong at 75 percent and 32 percent, respectively, resulting in 27 percent operating income growth. During the quarter, Garmin delivered the 500th G1000® integrated flight deck upgrade for King Air aircraft, witnessed continued strength in our ADS-B offerings and Textron Aviation announced our selection as the avionics provider for the Cessna Sky Courier 408. We continue to invest in upcoming certifications with our numerous OEM partners, as well as ongoing aftermarket opportunities for long-term market share gains.

Marine:

The marine segment posted strong fourth quarter revenue growth of 24 percent driven by Garmin’s updated lineup of chartplotters and fishfinders, as well as contributions from their recently acquired Navionics product line. Gross margin improved to 55 percent. During the fourth quarter, they recorded a one-time accrual for a litigation settlement resulting in an operating loss in the marine segment of 13 percent. During the fourth quarter, they began shipping their new connected offerings in their popular ECHOMAP and STRIKER product lines, enabling connectivity through their new ActiveCaptain™ mobile app. Garmin expects marine to be a growth segment in 2018 as they focus on market share gains and new product innovations.

Fitness:

The fitness segment posted revenue growth of 1 percent in the quarter driven by Garmin’s GPS-enabled products, partially offset by declines in their basic activity trackers. Gross and operating margins increased to 53 percent and 21 percent, resulting in a 2 percent growth in operating income. Their recently announced Forerunner® 645 Music brings both music and Garmin Pay™ to a wearable with advanced features such as running dynamics and connectivity. They continue to see growth opportunities in their advanced wearables offset by declines in their basic activity trackers.

Auto:

The auto segment recorded revenue decline of 14 percent in the quarter, primarily due to the ongoing PND market contraction, partially offset by solid growth in OEM and niche categories. Gross margin declined to 41 percent, and operating margin was flat at 9 percent. At the recent Consumer Electronics Show, Garmin announced their new OEM scalable infotainment platform with Amazon Alexa digital assistant integration. Looking forward, they are focused on disciplined execution to bring desired innovation to the market and to optimize profitability in this segment.

Additional Financial Information:

Total operating expenses in the quarter were $320 million, a 3 percent increase from the prior year. Research and development investment increased 3 percent, due to engineering personnel costs and the Navionics acquisition, partially offset by the additional week of expense in 2016. Selling, general and administrative expenses increased 13 percent, due primarily to litigation-related costs and the Navionics acquisition. Advertising decreased 13 percent, primarily due to lower media spend in the fitness segment.

The effective tax rate in the fourth quarter of 2017 was 23.1 percent. The pro forma effective tax rate in the fourth quarter of 2017 was 20.9 percent (see attached table for reconciliation of this non-GAAP measure), compared to an effective tax rate of 19.0 percent in the prior year quarter. The increase in the pro forma effective tax rate is primarily due to the Company’s election to align certain Switzerland corporate tax positions with evolving international tax initiatives and the impact of the release of reserves partially offset by income mix by tax jurisdiction.

In the fourth quarter of 2017, Garmin generated $144 million of free cash flow (see bellow table for reconciliation of this non-GAAP measure) and returned cash to their shareholders with their quarterly dividend of $96 million. They ended the quarter with cash and marketable securities of approximately $2.3 billion.

2018 Guidance:

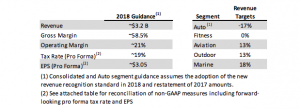

Garmin currently expects 2018 revenue of approximately $3.2 billion as growth in marine, outdoor and aviation is partially offset by ongoing declines in the PND market. We currently expect our full year pro forma EPS will be approximately $3.05 based upon gross margin of approximately 58.5 percent, operating margin of approximately 21 percent and a full-year pro forma effective tax rate of approximately 19 percent.

Photo courtesy Garmin