Garmin reported better-than-expected quarterly profit in the second quarter ended June 30 and raised the company’s full-year forecast. The gains were led by Marine and Aviation, both growing 24 percent and Outdoor, advancing 23 percent. Fitness increased 8 percent.

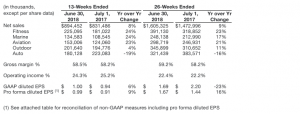

Highlights for the second quarter 2018 include:

• Total revenue of $894 million, growing 8 percent over the prior year, with fitness, marine, aviation and outdoor collectively growing 17 percent over the prior year quarter and contributing 80 percent of total revenue

• Gross margin of 58.5 percent compared to 58.2 percent in the prior year quarter

• Operating margin of 24.3 percent compared to 25.2 percent in the prior year quarter

• Operating income was $218 million, growing 4 percent over the prior year quarter

• GAAP EPS was $1.00 and pro forma EPS(1) was 99 cents. Wall Street’s consensus estimate was 87 cents a share.

• Launched the vívoactive 3 music, expanding our music offerings into the advanced wellness category

• Introduced the new revolutionary Panoptix LiveScope delivering the first and only live scanning sonar for recreational fishing

• Launched the fēnix 5 Plus series of watches with built-in color maps, Garmin Pay mobile payments, music storage and added Pulse Ox sensor technology for blood oxygen saturation awareness to the fēnix 5X Plus

Executive overview from Cliff Pemble, president and chief executive officer: “We achieved strong second quarter consolidated revenue growth led by robust double-digit growth in our fitness, marine and aviation segments,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “We introduced revolutionary products and are pleased with our performance in the first half of 2018. The results we achieved thus far in 2018 give us confidence to raise our full year guidance, and we look forward to the remainder of the year.”

Fitness

During the second quarter of 2018, the fitness segment posted robust revenue growth of 24 percent driven by strength in advanced wearables and cycling. Gross margin was consistent year-over-year at 56 percent while operating margin increased to 23 percent, resulting in operating income growth of 40 percent. During the second quarter, the fitness segment launched the vívoactive 3 music, expanding its music offerings into the advanced wellness category. The fitness segment also launched new Edge and Varia cycling products providing growth to its cycling category with innovative new products and a continued focus on cyclists’ safety. The fitness segment continues to see opportunities for advanced wearables within the fitness segment.

Marine

The marine segment posted robust revenue growth of 24 percent driven by organic growth across multiple product categories and its Navionics acquisition. Gross margin increased year-over-year to 59 percent. Operating margin declined to 21 percent; however operating income grew by 14 percent. During the second quarter of 2018, the marine segment introduced the award-winning Panoptix LiveScope, a live-scanning sonar that allows anglers a real-time clear image in front of, below and around their boat. Additionally, Garmin was selected as the exclusive marine electronics supplier to Sportsman Boats beginning in model year 2019. The marine segment remains focused on innovations and achieving market share gains within the inland fishing category.

Aviation

The aviation segment posted robust revenue growth of 23 percent. Gross and operating margins were strong at 74 percent and 34 percent, respectively, resulting in operating income growth of 34 percent. Growth was primarily driven by its ADS-B offerings and recent new product introductions such as the G5 indicator system, TXi displays and the GFC 500/600 autopilots. The aviation segment introduced the G3000H integrated flight deck for the Part 27 turbine helicopter market. In addition, Garmin was recently selected by Tactical Air Support to provide a tandem integrated flight deck to their fleet of F-5 supersonic aircraft. The aviation segment continues to invest in upcoming certifications with its OEM partners and ongoing aftermarket opportunities.

Outdoor

During the second quarter of 2018, the outdoor segment grew 4 percent with growth contributions from all product categories. Gross and operating margins remained strong at 64 percent and 36 percent, respectively. The outdoor segment launched the fēnix 5 Plus series, adding color maps, Garmin Pay mobile payments and music to all three watch sizes. The segment also expanded its sensor technology with the addition of Pulse Ox to the fēnix 5X Plus for blood oxygen saturation awareness for athletes and outdoor enthusiasts. The outdoor segment launched the inReach mini, a compact satellite communicator that allows for two-way communication from anywhere. Additionally, the Outdoor segment has seen positive customer response to its premium golf offerings. Looking forward, the outdoor segment remain focused on opportunities in wearables and other product categories within the outdoor segment.

Auto

The auto segment recorded a decline in revenue of 19 percent in the second quarter of 2018, primarily due to the ongoing PND market contraction. Gross and operating margins were 42 percent and 7 percent, respectively. Looking forward, Garmin’s Auto segment is focused on disciplined execution to bring desired innovation to the market and to optimize profitability in this segment.

Additional Financial Information

Total operating expenses in the quarter were $306 million, an 11 percent increase from the prior year. Research and development increased 11 percent driven by the incremental costs associated with acquisitions, investments in the outdoor and fitness segments for the development of advanced wearable products and continued innovation in the aviation segment. Selling, general and administrative expenses increased 14 percent, driven primarily by personnel-related expenses and incremental costs associated with acquisitions. Advertising expenses increased 4 percent year over-year but were relatively flat as a percentage of sales.

The effective tax rate in the second quarter of 2018 was 19.4 percent compared to the effective tax rate of 24.5 percent and the pro forma effective tax rate of 21.4 percent in the prior year quarter (see attached table for reconciliation of this non-GAAP measure). The decrease in the current quarter effective tax rate is primarily due to the benefits from U.S. tax reform.

In the second quarter of 2018, Garmin generated $224 million of net cash provided by operating activities and $157 million of free cash flow (see table below for reconciliation of this non-GAAP measure). The company continued to return cash to shareholders with its quarterly dividend of approximately $100 million. Garmin ended the quarter with cash and marketable securities of approximately $2.4 billion.

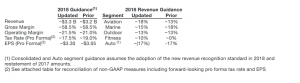

2018 Guidance

Based on the performance in the first half of 2018, Garmin is updating its full year guidance. Garmin now anticipates revenue of approximately $3.3 billion driven primarily by higher expectations for its fitness and aviation segments partially offset by slightly lower expectations for the marine segment. Garmin’s outlook for the outdoor and auto segments are unchanged. The company anticipates its full year pro forma EPS will be approximately $3.30 based on gross margin of about 58.5 percent, operating margin of about 21.5 percent and a full year pro forma effective tax rate of about 17.5 percent.