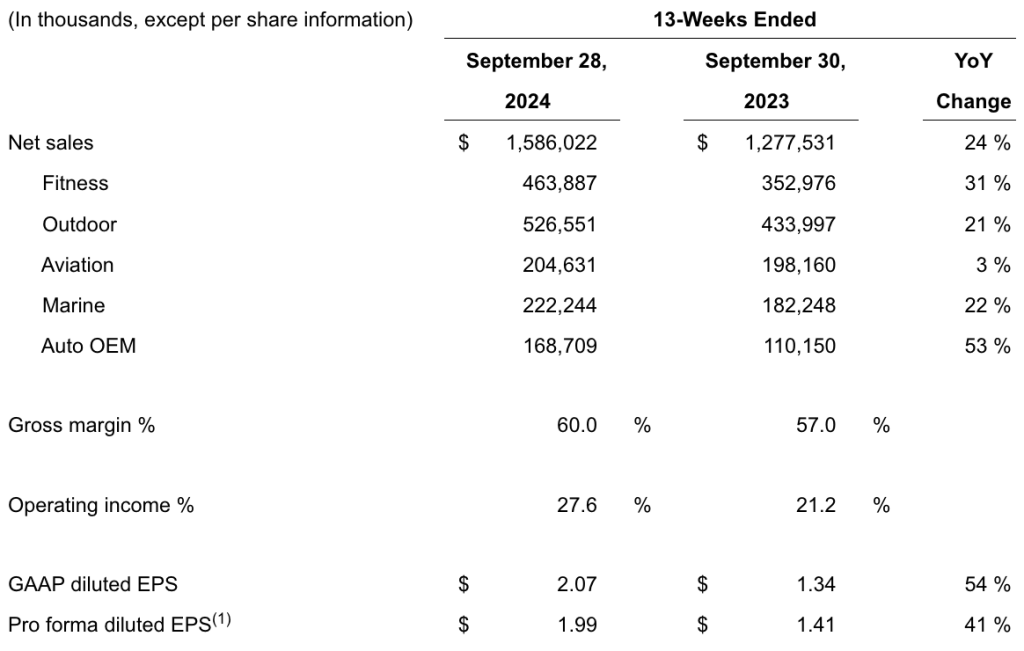

Garmin Ltd. posted consolidated revenue of $1.59 billion for the third quarter ended September 28, a 24 percent increase compared to the prior-year third quarter.

Fitness

Revenue from the Fitness segment increased 31 percent to $463.9 million in the third quarter with growth across all categories led by strong demand for wearables. Gross margin was 61 percent of sales and operating margins were 32 percent of sales in the segment, resulting in $148 million of operating income.

During the quarter, Garmin said it hosted its annual Garmin Health Summit to recognize innovative digital health solutions utilizing Garmin products, and to celebrate the 10th anniversary of Garmin Health. Also, during the quarter the company announced updates to Garmin Coach, adding training plans for cyclists in addition to the existing training plans for runners, reportedly making it easier to prepare for an event, pursue a personal milestone or improve overall fitness.

Outdoor

Revenue from the Outdoor segment increased 21 percent to $526.6 million in the third quarter primarily due to growth in adventure watches. Gross and operating margins were 68 percent and 40 percent, respectively, resulting in $209 million of operating income.

During the quarter, the company said it launched both the highly anticipated fēnix 8 series, adding brilliant AMOLED displays, cutting edge features, a built-in speaker, microphone, and an LED flashlight, and the Enduro 3, a lightweight ultraperformance GPS smartwatch purpose-built for ultra-endurance athletes with up to 320 hours of battery life in GPS mode with solar charging. Garmin also launched the inReach Messenger Plus, its first satellite communicator with photo and voice messaging in addition to two-way texting, location sharing and SOS capabilities, expanding a user’s ability to stay in touch beyond cell service.

Aviation

Revenue from the Aviation segment increased 3 percent to $204.6 million in the third quarter, with growth said to be driven by aftermarket product categories. Gross margin was 75 percent of sales and operating margins were 22 percent of sales, resulting in $44 million of operating income.

During the quarter, Garmin announced Runway Occupancy Awareness, which uses ADS-B information to help reduce the risk of runway incursions and provide added confidence to pilots navigating busy and complex airports. Garmin said it is the first to bring this new safety feature to market. The company also said it recently unveiled its new G3000 Prime, which redefines the integrated flight deck experience with sleek, intuitive, all-touchscreen displays and a highly flexible open architecture system that seamlessly adapts to serve a broad and dynamic market.

Marine

Revenue from the Marine segment increased 22 percent to $222.2 million in the third quarter, said to be primarily driven by the acquisition of JL Audio. Gross margin was 55 percent of sales and operating margins were 17 percent, resulting in $38 million of operating income.

During the quarter, Garmin said it announced several new products to enhance a user’s time on the water, including Fusion ApolloT marine speaker and subwoofer series, the GCTM 245/55 marine cameras, and the GPSMAP 9500 black box system. The company also recently announced the acquisition of Lumishore, a leader in marine LED lighting as the company continues to focus on providing seamless integration throughout the boat.

Auto OEM

Revenue from the Auto OEM segment increased 53 percent to $168.7 million in the third quarter, said to be primarily driven by growth in domain controllers. Gross margin was 20 percent and the operating loss narrowed to $1 million as efficiencies improved with higher sales volumes.

During the quarter, the company said it successfully launched the Garmin-designed domain controllers across all remaining BMW Group car lines.

Income Statement Summary

- Gross margin expanded 300 basis points year-over-year to 60.0 percent of sales in the quarter.

- Operating margins improved to 27.6 percent of sales in Q3, from 21.2 percent of sales in the year-ago quarter.

- Operating income amounted to $437 million, a 62 percent increase compared to the prior-year quarter. Total operating expenses in the third quarter were $514 million, a 12 percent increase over the prior year.

- Both R&D and SG&A expenses increased 12 percent, said to be driven primarily by personnel related costs.

- The effective tax rate in the third quarter was 17.9 percent compared to the effective tax rate of 8.0 percent and the pro forma effective tax rate of 7.2 percent in the prior-year quarter. The increase in the current quarter effective tax rate was said to be primarily due to the increase in the combined federal and cantonal Switzerland statutory tax rate in response to global minimum tax requirements.

- GAAP EPS was $2.07 for the third quarter and pro forma EPS was $1.99 per share, representing 41 percent growth in pro forma EPS over the prior-year quarter.

Balance Sheet and Cash Flows Summary

Garmin ended the quarter with cash and marketable securities of approximately $3.5 billion.

In the third quarter of 2024, the company reportedly generated operating cash flows of $258 million and free cash flow of $219 million.

The company paid a quarterly dividend of approximately $144 million and repurchased $20 million of the company’s shares within the quarter, leaving approximately $270 million remaining as of September 28, 2024 in the share repurchase program authorized through December 2026.

2024 Fiscal Year Guidance

Based on the performance in the first three quarters of 2024, Garmin adjusted its full year guidance and now anticipates revenue of approximately $6.12 billion and pro forma EPS of $6.85 based on gross margin of 58.5 percent, operating margin of 24.0 percent and a full year effective tax rate of 16.5 percent.

Dividend Recommendation

The board of directors has established December 27, 2024, as the payment date for the next dividend installment of 75 cents per share with a record date of December 13, 2024.

At the 2024 annual shareholders’ meeting, Garmin shareholders, in accordance with Swiss corporate law, approved a cash dividend in the total amount of $3.00 per share, payable in four equal installments on dates to be determined by the board in its discretion. The first and second payments were made on June 28, 2024 and September 27, 2024.

Image courtesy Garmin