Garmin Ltd. reported adjusted earnings rose 32 percent in the third quarter ended September 29, easily ahead of Wall Street’s target. Revenues rose 8 percent. Strong gains were seen by the Marine segment, running up 28 percent; Aviation, 17 percent; Fitness, 14 percent and Outdoor, 13 percent. Garmin lifted the company’s full-year EPS guidance.

Highlights for the third quarter 2018 include:

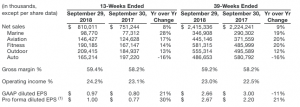

- Total revenue of $810 million, growing 8 percent over the prior year, with marine, aviation, fitness and outdoor collectively growing 16 percent over the prior year quarter and contributing 80 percent of total revenue.

- Gross margin of 59.4 percent compared to 58.2 percent in the prior year quarter.

- Operating margin of 24.2 percent compared to 23.1 percent in the prior year quarter.

- Operating income was $196 million, growing 13 percent over the prior year quarter.

- On a GAAP basis, earnings rose 21.9 percent to $184.2 million, or 97 cents share. On a pro-forma basis, earnings climbed 32.0 percent to $190.5 million, or $1.00, from $144.3 million, or 77 cents, a year ago. Wall Street’s consensus estimate had been 76 cents.

- Shipped the 200 millionth product within the quarter.

- Opened the first phase of the company’s Olathe campus expansion, more than doubling aviation product manufacturing capacity

- Announced the acquisition of FltPlan.com, a leading electronic flight planning and services provider, expanding its ability to offer premium flight services to its customers.

Executive Overview from Cliff Pemble, President and Chief Executive Officer

“During the third quarter, we continued our strong performance achieving double-digit revenue growth in four of our five segments and double-digit growth of consolidated operating income,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “We are well positioned for the remainder of 2018 with a solid lineup of products and are raising our EPS guidance to reflect our strong performance.”

Marine

The marine segment posted robust revenue growth of 28 percent driven by organic growth across multiple product categories and its recent acquisitions. Gross and operating margins were 59 percent and 14 percent, respectively. For the fourth consecutive year Garmin was recognized as the Manufacturer of the Year by the National Marine Electronics Association (NMEA), winning a total of six awards including the prestigious NMEA Technology Award. Garmin said it recently announced the 2019 line up of marine electronics including the GPSMAP 8600 series, the first product line compatible with the combined Garmin and Navionics chart content. Garmin said it remains focused on innovations and achieving market share gains within the inland fishing category.

Aviation

The aviation segment posted strong revenue growth of 17 percent. Gross and operating margins increased to 76 percent and 35 percent, respectively, resulting in operating income growth of 49 percent. Growth in the quarter was broad based across multiple product categories. Gulfstream recently selected its ADS-B In solution for their new production and aftermarket G280 business jets. During the quarter, Garmin announced the acquisition of FltPlan.com, a leading electronics flight planning and service provider, and have begun integration into Garmin Connected Aviation Services such as Garmin Pilot. Garmin said it recently announced the G1000 NXi upgrade for the Piper M500, expanding the addressable market for NXi retrofits. Garmin said it continues to invest in upcoming certifications with its OEM partners and ongoing aftermarket opportunities.

Fitness

The fitness segment posted strong revenue growth of 14 percent primarily driven by strength in wearables. Gross and operating margins were 54 percent and 20 percent, respectively, resulting in operating income growth of 12 percent. During the third quarter, the company launched the vívosmart 4, a smart activity tracker that introduces a wrist-based pulse ox sensor in a slim design, new advanced sleep monitoring and the innovative Body Battery, which monitors individual energy levels. Garmin also announced new vívofit jr. 2 interactive adventures and bands featuring Disney Princess and Marvel’s Spider-Man. Garmin said it continues to pursue opportunities for wearables and cycling within the fitness segment.

Outdoor

During the third quarter of 2018, the outdoor segment grew 13 percent driven primarily by wearable devices. Gross margin improved year-over-year to 65 percent, while operating margin improved to 38 percent resulting in a 16 percent increase in operating income. Garmin recently announced the integration of Spotify on the fēnix 5 Plus series, giving customers the ability to listen to offline music playlists from their wrist. The company also recently introduced Instinct, a GPS smartwatch that is rugged and reliable. Looking forward, Garmin said it remains focused on opportunities in wearables and other product categories within the outdoor segment.

Auto

Revenue from the auto segment declined 16 percent in the third quarter of 2018 primarily due to the ongoing PND market contraction. Gross and operating margins were 43 percent and 9 percent, respectively. Garmin said it recently announced the selection of its integrated camera solution by the Chinese auto company, Geely Auto Group. Looking forward, the company is focused on disciplined execution to bring desired innovation to the market while managing profitability within the segment.

Additional Financial Information

Total operating expenses in the quarter were $285 million, an 8 percent increase from the prior year. Research and development increased 7 percent driven by the incremental costs associated with acquisitions, investments in the outdoor and fitness segments for the development of advanced wearable products and continued innovation in the aviation segment. Selling, general and administrative expenses increased 13 percent driven primarily by personnel related expenses and incremental costs associated with acquisitions. Advertising expenses decreased 4 percent year-over-year.

The effective tax rate in the third quarter of 2018 was 8.5 percent compared to the effective tax rate of 20.5 percent in the prior year quarter. The decrease in the current quarter effective tax rate is primarily due to the benefits from U.S. tax reform and increased benefit from U.S. research and development tax credits.

In the third quarter of 2018, Garmin generated $264 million of net cash provided by operating activities and $234 million of free cash flow. The company continued to return cash to shareholders with its quarterly dividend of approximately $100 million. We ended the quarter with cash and marketable securities of approximately $2.5 billion.

2018 Guidance

Garmin said it increased its 2018 guidance to reflect the strong third quarter performance. Garmin said it anticipates fourth quarter revenue will be relatively flat year-over-year with total full year revenue of approximately $3.3 billion and a gross margin of 58.5 percent. Garmin raised its full year operating margin to approximately 22.0 percent and lowering its full year pro forma effective tax rate to about 16.0 percent resulting in a pro forma EPS of approximately $3.45.

Image courtesy Garmin