Garmin Ltd. reported operating margins declined at its fast growing Fitness and Outdoor segments as it cranked up spending on advertising and research to stay ahead of the game in the fast growing, but increasingly crowded wearables market.

Garmin Ltd. reported operating margins declined at its fast growing Fitness and Outdoor segments as it cranked up spending on advertising and research to stay ahead of the game in the fast growing, but increasingly crowded wearables market.

GRMN said it expects promotional pricing to intensify in the current quarter as a growing number of brands crowd into the market, but affirmed its earlier guidance for full-year gross and operating margins to come in at 56 percent and 24 percent respectively.

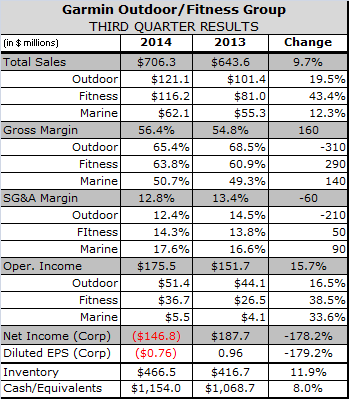

GRMN’s Outdoor segment posted revenue growth of 19 percent in the quarter due to the strong performance of recently introduced products including the Fēnix 2 running watch, the Approach S6 golf watch and Alpha dog training kits. Gross margins dropped 310 points to 65.4 percent due to product mix. Operating margins dropped 110 basis points as GRMN increased spending on advertising 35 percent to 5 percent of sales, up 100 basis points from a year earlier. SG&A costs fell from 14 to 12 percent of sales while R&D spending grew 9 percent but remained at 6 percent of sales.

At the Fitness segment sales growth slowed to 43 percent from 79 percent in the fiscal second quarter as the strong performance of GRMN’s VivoFit activity tracker and other wearable products and categories continued. CEO Cliff Pemble said the sharp drop in the pace of growth was expected given the seasonality of the segments sales. Gross margins increased 300 basis points to 64 percent, but operating margin dropped 100 bps to 32 percent as GRMN more than doubled it spending on advertising, which reached 9 percent of sales compared with 6 percent a year earlier. SG&A and R&D costs rose 49 and 52 percent respectively, but remained flat as a percentage of sales.

GRMN President and CEO Cliff Pemble said the higher spending on advertising and R&D will help GRMN build market share over the near and long term in the rapidly expanding wearables market. He estimated GRMN’s share of the fitness band market grew from the 10 to the mid-teens range during the third quarter.

“We believe these initiatives are already producing positive results and anticipate strong sales in the holiday quarter and beyond as we build market share in the growing global wearables category,” said Pemble. “We have recently announced two additional products in the fitness segment that highlight our commitment to innovation-the Vívosmart, our latest activity tracker which delivers smart notifications, and the Forerunner 920XT, our next generation multisport product with advanced running dynamics and connected features.”

GRMN also launched Connect IQ during the quarter to make it easier for outside companies to develop apps for its wearables, such as the 920XT.

“I think Connect IQ is in response to a lot of requests that we get from customers and partners who want a way to be able to expand the utility of our wearable devices but dont currently have a way to do that,” said Pemble. “In terms of how were positioning that, were not putting that up against the big open players that are out there,” That’s not our objective at all” Pemble said of the open platform the company launched during the quarter.

Revenue in the Marine segment grew 12.3 percent in the quarter driven by the third-quarter acquisition of Fusion, which provides high end audio systems and accessories for boats. As planned, gross margin grew 140 bps and operating margins increased 150 bps to 8.9 percent.

GRMN now anticipates full-year revenues of approximately $2.85 billion, the high end of its prior guidance, with gross and operating margins of 56 percent and 24 percent, respectively. That includes mid-single digit sales growth at the Outdoor segment. GRMN forecast pro forma EPS of approximately $3.10. As indicated last quarter, GRMN anticipates margins to narrow slightly in the fourth quarter as Fitbit, GoPro, Microsoft, Samsung and other brands crowding into the wearables market increase price promotions and advertising to gain market share through the holiday season. GRMN will roll out its Vivosmart, a $200 fitness tracker launched exclusively at Best Buy this summer, to more retailers in time for the holiday shopping season.

“Were promoting the category heavily and, as a result, we expect that well be able to perform well in the fourth quarter with our advertising,” Pemble said.

Pemble added that GRMN foresees incorporating wrist-based heart rate technology, such as that used by the miCoach Smart Run watch Adidas launched a year ago, into its wearables line as the technology becomes more accurate.

Price competition will also remain fierce in the marine market where several competitors are promoting quality products at value prices, including in the inland fishing market where GRMN is expanding.

Pemble added that Garmin Outdoor plans to continue investing in the action camera market “at a pragmatic rate” despite the disappointing launch of its Virb camera this spring. He described GRMN’s inventory of Virb cameras as “manageable.”