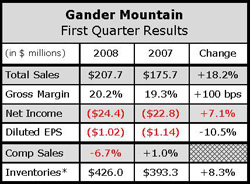

Gander Mountain Co. reported sales climbed 18.2% to $207.7 million for the first quarter ended May 3, thanks to $19.7 million in direct marketing revenue from the recently acquired Overton's business and the opening of eight new stores.

18.2% to $207.7 million for the first quarter ended May 3, thanks to $19.7 million in direct marketing revenue from the recently acquired Overton's business and the opening of eight new stores.

Comps decreased 6.7%, compared to a 1.0% increase in Q1 2007, dragged down by lower sales of big ticket items like ATVs, boats and some mens apparel. Sales were also lower at Overtons, which focuses on marine products. The result was a net loss for the first quarter — normally GMTNs weakest — of $24.4 million, or $1.02 per share, compared to a net loss of $22.8 million, or $1.14 per share.

However, company President and CEO Mark Baker said the real news was GMTNs improving margins and cleaner inventory. Gross profit grew 24.1% to $42.0 million for the first quarter. As a percent of sales, GM increased 96 basis points to 20.2%, thanks largely to Overtons, which was acquired in December.

The most critical number, Baker said, involved SG&A. While it rose 14.1% to $59.0 million during the quarter, it declined 100 basis points as a percentage of sales to 28.4%. At that SG&A level, which Baker said GMTN can sustain all year, the company should be able to return to profitability this year on $1 billion in sales even if comps continue in the negative mid-single digit range, he said.

“Our first quarter retail operating performance held flat in spite of operating eight additional stores and their square footage,” said Baker. “Put another way, our losses per square foot improved by 12%.”

Retail inventory per square foot in open stores, excluding in-transit and pre-opening inventory, declined 10.8% to $62.72 as GMTN continued reducing SKUs and doing a better job of marking down slow-selling merchandise earlier. On a trailing 12-month basis, retail sales per square foot were $161.85 versus $174.76, down 7%. Average customer ticket increased 5.7% to $58.53 for the quarter.

Vazquez said GMTN has expanded footwear assortments in some stores by as much as 25% with emphasis on casual, cross trainers and hikers as part of a broader change in merchandising aimed at increasing margins. In the first quarter, for instance, stronger sales of apparel, footwear, private label and the addition of Overtons helped push up initial merchandise margins by 104 basis points. Overtons helped because as an online and catalogue retailer, it has lower selling costs. It also sells a higher proportion of higher-margin private label gear than Gander Mountain stores. In fact, Overtons elevated GMTNs private label sales by 200 basis points to 11% of total sales.

Baker said firearm sales, particularly ammunition and accessories, had rebounded since the third and fourth quarter. Powersports, saltwater fishing and selected apparel items also showed comp growth, while mens sportswear and outerwear, marine accessories and camping were laggards. There was also a growing trend toward used firearms, which plays into GMTNs expanding gunsmith program, which enables it to buy, refurbish and resell used guns.

In the second quarter, GMTN expects a boost from the Overton's business, which peaks in the spring and summer. Margins will also improve as Gander Mountain sells more of its own brands through Overtons catalogues. The company is now distributing Overtons catalogues at its stores and to credit card customers and expects to launch its own e-commerce site and catalogues later this year.