Gander Mountain took much of the sting out of its grim  third quarter earnings report Thursday by announcing it had acquired an online retailer it said would drive more sales to its money losing chain of 115 stores. Executives at the Minneapolis-based outdoor sporting goods retailer said they would tap the brakes on their store expansion program in 2008 so they could focus on tapping expertise at newly acquired online retailer Overtons to beef up Gander Mountains online offerings and re-launch its catalogue after a 10-year hiatus.

third quarter earnings report Thursday by announcing it had acquired an online retailer it said would drive more sales to its money losing chain of 115 stores. Executives at the Minneapolis-based outdoor sporting goods retailer said they would tap the brakes on their store expansion program in 2008 so they could focus on tapping expertise at newly acquired online retailer Overtons to beef up Gander Mountains online offerings and re-launch its catalogue after a 10-year hiatus.

The $70 million acquisition of Greensboro, N.C.-based Overtons (see sidebar) provided the only bright spot in an otherwise foreboding third-quarter earnings call with analysts.

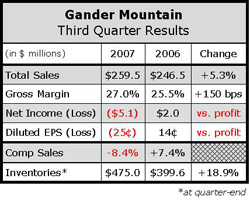

Gander Mountain reported a loss of $5.1 million for the quarter, compared to net income of $1.4 million a year earlier. The company attributed the loss to an 8.4% drop in comp store sales. The losses came on a 5.3% increase in sales, which reached $259 million. “This was not the quarter we anticipated reporting to you,” said Mark Baker, president and CEO. “At negative 8.4%, comps sales were well below expectations for the quarter and the earnings reflect that shortfall.”

Baker attributed falling sales to warmer and drier weather that cut into outerwear sales during the fall hunting season as well as a broad downturn in consumer spending. He said the decline in spending cut across all stores, including those in the south, where the company opened six of its seven net new stores during the quarter.

Sales of firearms, camping and apparel were weak. In the hunting area, equipment and ammunition sales were positive, but sales of guns in the $1,000 to $1,500 range, gun safes and higher priced electronics and optics were weak, said Baker. The combination of warm weather and higher gas prices appeared to be keeping people outdoors, but near home. Sales of fishing and marine products, cooking accessories, grills, smokers and seasonings were positive. However, sales on the camping side of the business, including tents, sleeping bags and paddle sports were soft, as has been the case year-to-date.

Sales of fleece and women's and children's footwear were solid, but warm weather cut into sales of camouflage and outerwear. Sales of Gander Mountain branded product rose to 13% of sales, up 210 basis points from the third quarter of 2006.

While temperatures have more recently fallen in Gander Mountains key Midwest markets, Baker said the company would miss its annual sales target of $1 billion. Chief financial officer Bob Vold said, while the company will make a profit in the fourth quarter, it will lose money for the year.

Gross margins rose 150 basis points to 27% reflecting improvement in pricing, less clearance items and the higher penetration of in-store brands. However, the decline in comp store sales caused operating expenses as a percentage of sales to rise 205 basis points to 20.6%.

General and administration expenses increased 80 basis points to 5.1% of sales, but that was due primarily to one-time severance costs of $1.2 million incurred when the company laid off 40 people in a bid to lower costs long term.

Gander will open just six new stores next year, including three to four relocations, down from the nine it opened this year with two relocations, said Vold. “We are committed to improving operating results before resuming faster level of store expansion,” he said.