The Forzani Group Ltd. said same-store sales rebounded strongly in May after dropping off in the fiscal first quarter due to a late spring and the anticipated difficulty of matching sales from a year earlier when the Winter Olympics in Vancouver spurred sales of Team Canada hockey jerseys.

Canadas largest sporting goods retailer — soon to be acquired by its competitor, Canadian Tire — reported that overall retail system sales, which includes corporate and franchise sales, increased 6.2 percent for the first four weeks of the current fiscal second quarter on top of the prior year’s increase of 5.8 percent.

Same-store sales for May were up 7.1 percent at corporate locations on top of last years 4.3 percent gain and increased 4.6 percent at franchise stores, compared to the prior year’s decline of 8.4 percent.

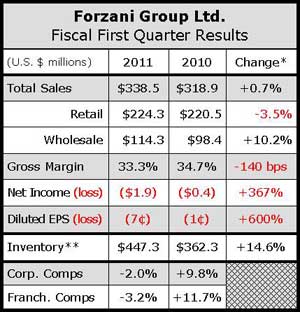

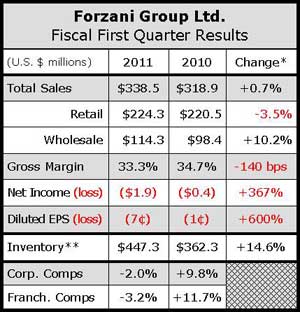

By contrast, FGL’s total revenue for the first quarter ended May 1 reached CN$329.7 million ($339 mm), up a mere 0.7 percent from the year earlier quarter. A 10.2 percent increase in wholesale sales to third parties and franchisees more than offset a 3.5 percent decline in retail sales. Comp store sales for the period declined 2.0 percent compared to an increase of 9.8 percent a year earlier.

By contrast, FGL’s total revenue for the first quarter ended May 1 reached CN$329.7 million ($339 mm), up a mere 0.7 percent from the year earlier quarter. A 10.2 percent increase in wholesale sales to third parties and franchisees more than offset a 3.5 percent decline in retail sales. Comp store sales for the period declined 2.0 percent compared to an increase of 9.8 percent a year earlier.

FGL warned in April that sales in March had declined 3.3 percent as sales of higher-margin Team Canada hockey jerseys fell off a year after the Olympics. Unseasonably cold weather throughout the balance of the quarter, meanwhile, delayed sales of key spring categories. Sales of cycling and in-line skates declined CN$4.1 million, or 32 percent, in the quarter, on a same-store basis.

Excluding bikes, in-line skates and Olympic sales, comparative stores sales in FGLs corporate stores were up 1.8 percent in the first quarter versus the prior-year period. Moreover, executives said FGL is well on its way to recovering spring sales lost to cold weather as consumers return to its stores to snap up bikes and skates.

Gross margins slipped 140 basis points to 33.3 percent of sales in the quarter, due to a decline in high margin licensed Olympics-oriented products as well as an increase in the percentage of late season clearance items versus new spring stock. SG&A, meanwhile, remained flat at 51.2 percent of sales. That led to a nearly five-fold increase in the net loss to CN$1.9 million (-$2 mm), compared to a net loss of CN$400,000 a year earlier.

Still, FGL CEO Bob Sartor praised the companys first quarter performance, and its agreement to be acquired in a friendly merger with Canadian Tire Corporation at a nearly 50 percent premium to its stock price.

“Despite cool and wet weather throughout much of the country for most of the spring, and double-digit Olympic year comparables, we managed to generate a small increase in our corporate revenue for the quarter on the strength of our wholesale division” said Sartor. “Our ongoing commitment to executing on our strategic plan and driving costs out of our business through best practices and simplification are clearly evident in the strength of our results, despite considerable headwinds. As I noted last year, with each step forward, we are improving FGL’s prospects for long-term growth and profitability.”

FGLs so-called Capital Light Strategic Plan launched in April, 2009 calls for the company to close smaller, less productive stores and fold some specialty shops into its larger, full-line stores. FGL eventually expects to cut the number of specialty banners in its franchise division from 10, even as it franchises more of its Hockey Experts, Atmosphere (outdoor) and S3 (surf, skate, snow) stores.

In the first quarter, for example, FGL added 18 Nevada Bobs Golf boutiques, seven Hockey Experts concepts shops, 12 Soccer concept shops, two Atmosphere concept shops and one S3 concept shop in Sport Check locations. This approach is aimed at maximizing FGLs leverage in lease negotiations and reducing store operating expenses as a percentage of revenues. In the first quarter, however, that ratio actually rose 210 basis points to 34.2 percent of corporate store revenue, more than offsetting gains made last year.

At the end of the quarter, FGL operated 529 stores, or 23 less than a year earlier. Those stores contained 1.1 percent less retail selling space compared with a year earlier. Corporate stores totaled 317, down 20 doors from a year earlier, while franchise stores totaled 212, down three.

During the quarter, FGL decreased the number of corporate stores by four, closing two Sport Mart stores, one Athletes World store, and two Sport Chek stores, while opening one Sport Chek store. The franchise division had a net reduction of one store during the quarter, as FGL franchisees opened two stores (one Atmosphere and one S3) while closing three (two Sports Experts and one Nevada Bob’s Golf).