Foot Locker, Inc. reported a significant drop in earnings in the third quarter on an 8 percent same-store sales decline but both earnings and sales topped analyst expectations amid progress on its Lace Up turnaround plan. For the year, the sneaker retailer slightly lowered its EPS guidance while slightly raising its sales targets.

Sales of $1,986 million in the third quarter topped analysts’ consensus estimate of $1,966 million. Earnings on an adjusted basis of 30 cents per share exceeded analysts’ consensus estimate of 23 cents.

Mary Dillon, president and chief executive officer, said in a statement, “We delivered third-quarter results that were ahead of our expectations as strong execution and early progress against our Lace Up plan improved conversion trends across channels. Looking forward, we are updating our outlook to reflect the momentum we have in our strategic initiatives into the fourth quarter, which includes strong results over the Thanksgiving week period, against the backdrop of ongoing consumer uncertainty. As such, we are narrowing our 2023 outlook and still expect to end the year with inventory levels flat to down slightly, as compared with the prior year.”

Dillon continued, “As we move into the fourth quarter, we are thrilled to be partnering with the NBA as an official league marketing partner in the U.S. Combined with the recent rollout of our Home Court experience, we believe this will drive deeper engagement with our customers and cement Foot Locker’s leadership at the center of basketball and sneaker culture. We look forward to rounding out our reset year and building on our progress in 2024 and beyond, and we are confident we are on the right path to delivering longer-term shareholder value.”

Third Quarter Results

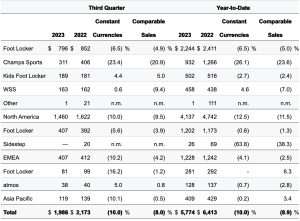

Total sales decreased by 8.6 percent, to $1,986 million, as compared with sales of $2,173 million in the third quarter of 2022. Excluding the effect of foreign exchange rate fluctuations, total sales for the third quarter decreased by 10.0 percent.

Comparable-store sales decreased by 8.0 percent, driven by ongoing consumer softness, changing vendor mix, and a 3 percent negative impact from the repositioning of Champs Sports.

Sales By Banner

Gross margin declined by 470 basis points as compared with the prior-year period, driven by higher markdowns as well as occupancy deleverage and higher shrink.

SG&A increased by 100 basis points as a percentage of sales compared with the prior-year period, with savings from the cost optimization program more than offset by underlying deleverage on the sales decline, inflation, and investments in front-line wages and technology.

Net income was $28 million in the third quarter, as compared with net income of $96 million in the corresponding prior-year period. On a non-GAAP basis, net income was $28 million, as compared with $121 million in the corresponding prior-year period.

For the quarter, the company had earnings of $0.30 per share, as compared with $1.01 per share in the third quarter of 2022. Non-GAAP earnings per share decreased to $0.30 per share, as compared with $1.27 per share in the corresponding prior-year period.

Balance Sheet

At quarter-end, the company’s cash and cash equivalents totaled $187 million, while debt on its balance sheet was $449 million.

As of October 28, 2023, the Company’s merchandise inventories were $1.9 billion, 10.5 percent higher than at the end of the third quarter last year, including an approximate 6.0 percent impact from the strategic pull-forward of inventory into the third quarter to best position the Company for the upcoming holiday season. Excluding the effect of foreign currency fluctuations, merchandise inventories increased by 9.9 percent as compared with the third quarter of last year.

Dividend and Share Repurchases

During the third quarter of 2023, the company paid a quarterly dividend of $0.40 per share for a total of $38 million.

As previously announced, the company has paused dividends to increase balance sheet flexibility in support of longer-term strategic initiatives.

The company did not repurchase any shares during the third quarter.

Investing in Basketball Leadership

On November 16, 2023, Foot Locker and the National Basketball Association (NBA) announced a multi-year partnership under which Foot Locker will serve as an official league marketing partner in the U.S. This collaboration, which builds on a partnership history dating back to 1999, will enable Foot Locker to meaningfully engage with fans throughout the NBA season, including at marquee league events such as NBA All-Star, while celebrating the intersection of basketball and sneaker culture.

Foot Locker also will receive media exposure across league platforms, including on-court virtual signage during national broadcasts and on NBA social media channels. Additionally, the partnership will be extended to Foot Locker’s loyalty program, FLX, providing additional connection points for customers throughout the season.

In early November, Foot Locker rolled out its new global platform, The Heart of Sneakers, featuring a star-studded range of NBA talent including Nike’s Kevin Durant, Adidas Anthony Edwards, Puma’s LaMelo Ball and Under Armour’s Steph Curry, in a holiday campaign. The NBA partnership, supported by authentic brand campaigns, underscores Foot Locker’s history and longstanding connection to basketball and sneaker culture.

Foot Locker also recently began rolling out its Home Court experience in select locations in the U.S. Home Court brings the excitement and passion of basketball to customers in a multi-branded concept designed with elevated merchandising and storytelling. By creating distinct, basketball-led experiences for its customers, as well as players, fans, creators and sneakerheads, Foot Locker is investing in its basketball leadership while also supporting category growth across its brand partners.

Announcing Entry into India

As part of its efforts to pursue growth through license partners in newer markets, while still focusing on core banners and regions, Foot Locker also announced today its entry into India in 2024. The Company has entered into long-term licensing agreements with two strong operators in India, Metro Brands Limited (MBL), one of India’s largest footwear and accessories specialty retailers, and Nykaa Fashion, a highly curated fashion and e-commerce destination showcasing #FirstInFashion selections from both domestic and global brands, attracting over 17.6 million monthly visitors. Under the terms of the agreements, MBL is granted exclusive rights to own and operate Foot Locker stores within India and to sell authorized merchandise in Foot Locker stores. Nykaa Fashion will be the exclusive e-commerce partner and will operate the Foot Locker India website as well as retail authorized merchandise on a Foot Locker branded shop on the Nykaa platform.

These agreements will enable Foot Locker to efficiently access the large and growing sneaker market in India, consistent with the Company’s efforts to strategically pursue growth opportunities in new markets, expand sneaker culture globally and bring Foot Locker’s elevated, multi-brand experiences and strong vendor partnerships to even more people around the world.

Store Base Update

During the third quarter, the company opened 22 new stores, remodeled, or relocated 36 stores, and closed 14 stores.

As of October 28, 2023, the company operated 2,607 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 190 franchised stores were operating in the Middle East and Asia.

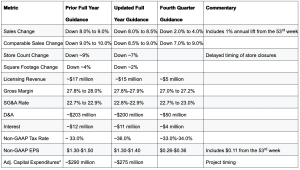

2023 Financial Outlook

Fiscal year 2023 represents the 53 weeks ending February 3, 2024. The company’s full-year 2023 outlook, which includes the 53rd week, is summarized in the table below.

Photo and charts courtesy Foot Locker