Foot Locker, Inc. reported third-quarter earnings rose 15.4 percent to $102 million, or 82 cents a share. Excluding a non-recurring charge, earnings rose to 83 cents from 68 cents, exceeding consensus estimates of 79 cents a share.

Third quarter comparable-store sales increased 6.9 percent.

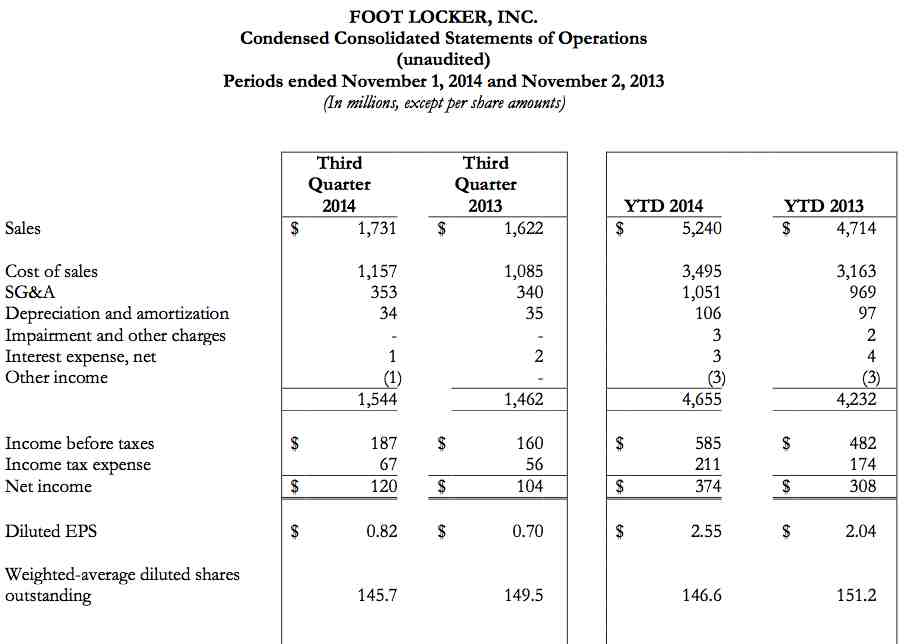

Total third quarter sales increased 6.7 percent, to $1,731 million this year, compared with sales of $1,622 million for the corresponding prior-year period. Excluding the effect of foreign currency fluctuations, total sales for the third quarter increased 7.7 percent.

The company’s gross margin rate increased to 33.2 percent of sales from 33.1 percent in the third quarter of 2013, while the selling, general, and administrative expense rate improved to 20.4 percent of sales from 21.0 percent last year.

“The team at Foot Locker has produced another very strong quarter, marking our 19th consecutive quarter of meaningful sales and profit growth,” said Ken C. Hicks, chairman of the board and chief executive officer. “We are making substantial progress towards our key operational and financial objectives, including net income margin, sales per gross square foot, and return on invested capital. Our banners have strong positions in the athletic marketplace; our financial footing is solid; and we have a depth of talent — at the store, field, and management levels — that is second to none.”

“The company is well positioned to build on the momentum the team has created over the last several years,” said Dick Johnson, executive vice president and chief operating Officer. “It will be a tremendous privilege to lead the organization as we leverage our strengths, which include our global scope, our banner differentiation, our omnichannel capabilities, and our people, in pursuit of the exciting opportunities we have identified to grow and improve the business in the near and long term.”

Year-To-Date Results

Net income for the company’s first nine months of the year increased to $374 million, or $2.55 per share, compared to net income of $308 million, or $2.04 per share, for the corresponding period in 2013. Earnings per share for the nine-month period increased 25 percent compared to the same period in 2013.

Year-to-date sales were $5,240 million, an increase of 11.2 percent compared to sales of $4,714 million in the corresponding nine-month period of 2013. Year-to-date comparable store sales increased 7.1 percent. Excluding the effect of foreign currency fluctuations, total sales year-to-date increased 10.9 percent.

Non-GAAP Adjustment

During the third quarter, the company recorded a $1 million charge related to the integration of Runners Point Group. Excluding this item, third quarter earnings were $0.83 per share on a non-GAAP basis, an increase of 22 percent compared to the company’s non-GAAP earnings of $0.68 per share in the third quarter last year. For the first nine months of 2014, non-GAAP net income was $2.58 per share, an increase of 26 percent over the $2.05 per share earned in the corresponding period of 2013.

Financial Position

As of November 1, 2014, the company’s merchandise inventory was $1,324 million, 0.6 percent higher than at the end of the third quarter last year, while the company’s cash and cash equivalents totaled $916 million and the debt on its balance sheet was $135 million.

During the third quarter, the company repurchased 683 thousand shares of its common stock for $38 million, bringing the 2014 year-to-date repurchase activity to 3.55 million shares for $174 million.

Store Base Update

During the third quarter, the company opened 35 new stores, remodeled/relocated 67 stores, and closed 21 stores. As of November 1, 2014, the company operated 3,474 stores in 23 countries in North America, Europe, Australia, and New Zealand. In addition, 46 franchised Foot Locker stores were operating in the Middle East and South Korea, as well as 27 franchised Runners Point and Sidestep stores in Germany and Switzerland.