According to the Department of the Treasury’s most recent Firearms and Ammunition Excise Tax (FAET) Collection Report, firearm and ammunition manufacturers reported excise tax obligations to be $95.3 million in the fourth calendar quarter of 2010, up 3.9 percent compared to the same period in 2009.

Manufacturers of firearms and ammunition pay the federal excise tax — a major source of wildlife conservation funding — on all consumer firearms and ammunition manufactured (11 percent on long guns and ammunition and 10 percent on handguns).

The report, which covers the time period of Oct. 1 through Dec. 31, shows that $27.29 million was due in taxes for Pistols and Revolvers, $31.99 million for Firearms (other)/ Long Guns and $36.11 million for Ammunition (shells and cartridges).

Compared to the same time period in 2009, tax obligations were up 13.42 percent for Pistols and Revolvers, up 7.43 percent for Firearms (other)/ Long Guns and down 4.87 percent for Ammunition (shells and cartridges).

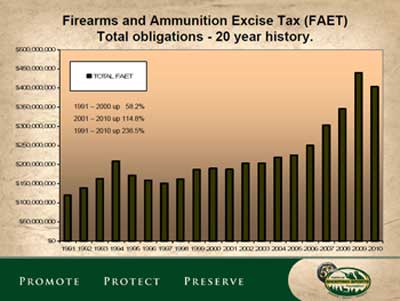

FAET obligations for calendar year 2010 totaled $403,665,626, an 8.2 percent decrease, compared to calendar year 2009 obligations of $439,575,098.