Finish Line Inc. fell short of its sales goals in fiscal second quarter because it took big positions on basketball styles that failed to resonate with consumers, executives said last week.

Finish Line Inc. fell short of its sales goals in fiscal second quarter because it took big positions on basketball styles that failed to resonate with consumers, executives said last week.

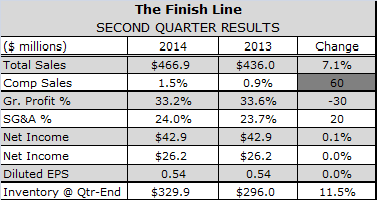

The retailer reported consolidated net sales reached $466.9 million in the fiscal second quartered ended Aug. 30, up 7.1 percent over the prior year period. Comparable store sales increased 1.5 percent, as double-digit gains in online sales more than offset a low-single-digit decline in bricks-and-mortar sales. Net income came in at $26.2 million, or 54 cents per diluted share, flat with a year earlier and below analysts consensus estimate of 60 cents.

We made some errors in judgment and the assortment that we put together in collaboration with our partners at Nike, Chairman and CEO Glenn Lyon said during the retailer’s earnings call Friday. It didnt work in this quarter.

Executives said FINL got its normal and planned allocations of retro product from Nike and Jordan, which sold through well. Performance and off-court styles that have traditionally generated half its revenue did not. Lyons called the disappointing results “a blip on the screen,” rather than a trend.

I assure you, we have been working diligently with our brand partners to improve our assortments and basketball, as well as to continue to elevate our leadership position in running to get sales back in line with our mid-single-digit comp growth expectations, he said.

Despite the assurance, FINLs share price dropped nearly 15 percent Friday, erasing about $205 million in market cap.

FINL had expected comp trends to accelerate in July and August, due in part to what it thought was an improved line up for basketball shoes. However, some Jordan styles it loaded up on, such as the Flight 9.5, did not sell through nearly as expected. FINL saw solid growth with Nike signature product like LeBron and KD as well as with performance products such as Nike Hyperdunk and Zoom Soldier. However, this was not enough to offset softness in its Brand Jordan business, resulting in flat comparable sales amid a nationwide boom.

POS data provided by The SportOneSource Groups SportScanINFO service shows year-to-date sales of Basketball shoes growing more than four times faster in units and seven times faster in dollars than Running shoe sales as of Sept. 20. The data also show Adidas and Jordan gave up a combined 500 basis point of market share in the Basketball shoe market to Nike in the 13 weeks ended Sept. 20.

Overall Footwear sales and average sales price comped up 2 and 3.7 percent respectively, thanks to a mid-single-digit increased in Running sales. Nike 3, 4.0 and 5.0, Nike Lunarglide 6 and Roshe Run all performed very well as did Brooks Adrenaline and Glycerin, Adidas SpringBlade and Under Armours Spine Clutch and SpeedForm. Within Jordan, retro styles such as the True Flight continued to sell through well, while other traditionally strong sellers did not.

At Running Specialty Group (RSG), a collection of 58 specialty running stores acquired through a joint venture FINL took over in April, comps improved, but still declined in the mid-single digits. New senior management installed this summer to restructure the business focusing on working with vendors to develop exclusive product and content for the business. Management is also fine tuning the service model based on best practices at RSGs top performing stores and elevating digital marketing efforts across the stores, which continue to operate under their original names.

We continue to be optimistic about the long-term prospects for the Running Specialty Group, especially if the recent restructuring will allow RSG to better leverage Finish Lines infrastructure to drive growth and profitability in the years ahead, said Lyons. Apparel sales accelerated during the quarter and were up double digits in August, fueled in part by sales of college fleece.

FINL ended the period with about $34 million, or 11.5 percent more inventory, but expects to sell through the slow selling basketball SKUs by over the next three months.

Outlook

FINL affirmed its full-year guidance, saying launches of the Air Max 2015, Adidas Springblade and Under Armour SpeedForm; better basketball assortments; strong sales of casual running shoes and momentum in its Macys business would propel sales in the back half. FINLs fiscal 2015 guidance calls for comp store sales growth in the mid-single digits based on double-digit e-commerce and improving comps at its store. Earnings per share are expected to grow in the high-single- to low-double-digit range with most of the growth coming in the fiscal fourth quarter.

When we added up at the end of the year, we will have had another record performance is what Ill stake my reputation on, Lyon said.

Sales at Macys, where FINL began taking over sales of athletic footwear 16 months ago, are on track to hit the high end of the $175-$195 million forecast for fiscal 2015. The company will switch over the last of 280 Macys stores to its concept in October, when it will shift more of its focus toward sales training, omni-channel initiatives and expanding the kids assortment, which is now available at only 90 Macys. High-single-digit growth in kids sales more than offset flat sales of mens and womens at FINL in the second quarter.

In October, FINL will provide Macy.com customers access to inventory in approximately 50 Finish Line stores. Lyons noted that Finish Line stores at malls that also have a Macy’s shop are outperforming the company average, validating FINLs thesis that managing athletic footwear for Macys would enable it to reach a new customer segment, particularly women.