Finish Line Inc. reported third-quarter earnings fell short of Wall Street's expectations as it dealt with merchandise margin pressure. It also lowered its earnings outlook for the year and said it would cut spending to protect profitability until the current pricing environment improves.

Finish Line Inc. reported third-quarter earnings fell short of Wall Street's expectations as it dealt with merchandise margin pressure. It also lowered its earnings outlook for the year and said it would cut spending to protect profitability until the current pricing environment improves.

Excluding the impact of impairment charges and store closing costs, employee resignation costs and the recognition of a one-time tax benefit, the loss in the quarter ended Nov. 29 was $900,000, or 2 cents a share, compared to net income of $2.9 million or 6 cents, a year ago. Wall Street's consensus estimate had been 11 cents a share.

On Friday, after the earnings release, shares of Finish Line slid $5.55, or 19.2 percent, to $23.25.

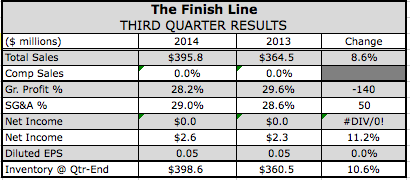

Revenue reached $395.8 million, an increase of 8.6 percent over the prior year period. Finish Line comparable store sales increased 4.5 percent.

On a conference call with analysts, Glenn Lyon, chairman and CEO, said comps improved from the 1.5 percent gain seen in its second quarter, driven by strong gains in its digital business.

As expected, margins in its basketball category were down due to the sell-off of some slow-moving inventory carried over from last quarter. But overall merchandise margins were down greater than projected due to higher than expected markdowns in running footwear.

Lyon said running makes up approximately 40 percent of its footwear business and “isn't currently strong enough from a product innovation standpoint to support full price selling across multiple brands and platforms.”

While some strong running launches are expected over the next few quarters, “the innovation pipeline, which the higher end of the running market is more dependent on, is not at peak strength similar to the environment we were operating in even just a year ago. Therefore until stronger product trends re-emerge, we will be cautious about our margin assumptions,” Lyon said.

As a result, Lyon said Finish Line is revising its capital spending plans with an objected to “moderate certain investments and redirect portions of our spending towards less capital intensive and more consumer-facing projects that have higher immediate returns.”

Lyon added that while the company’s near-term outlook is “more muted than a quarter ago,” the company continues to focus on its long-term strategies of creating a leading omnichannel business with the Finish Line brand and extending its consumer reach through its partnership to operate athletic footwear shops inside Macy’s as well as the expansion of Running Specialty Group, its run specialty segment.

“I am confident that we can partially offset the current margin pressures through expense management and a revised capital spending strategy,” said Lyon. “We will do this while still making important investments that will deliver on our long-term sales and profitability targets.”

In the quarter, the 4.5 percent comp at the Finish Line chain reflected a gain of 7.8 percent in September, a 5.4 percent drop in October, and a 9.2 percent jump in November.

Footwear saw a 5.1 percent comp gain versus a 2 percent increase in the second quarter. Footwear ASPs increased 4.8 percent. Kids led the footwear gains, up low double digits; followed by men's, up low singles; and women's, essentially flat.

Added Sam Sato, president, Finish Line Brand, on the call, “The downside to our strong topline performance was the fact that more of it was price driven than we projected.”

Running comps increased mid-single digits, driven by “more aggressive pricing on several more established platforms across our brand portfolio,” although new items saw strong full-price sales. Added Sato, “Key Nike styles led by Roshe Run sold through very well at full margin and early reads on the new Air Max 2015, which launched in late November, were also very strong.”

Under Armour also stood out in running with strength with its new Scorpio model and new color waves of its SpeedForm platform. Other brands also saw positive gains but were more promotionally driven than recent quarters.

Basketball comps increased mid-single digits in the quarter compared to flat comps in Q2. The bounceback was driven by a mix of full priced selling and higher markdowns. Nike signature products like LeBron and KD as well as performance products such as Zoom Soldier and Trey 5 sold well at regular price.

Retro styles from Jordan also continued to sell through at expected rates. Sato noted that as noted in its second-quarter conference call, “other key Jordan styles, which traditionally represent a meaningful percentage of our basketball revenue, did not resonate as strongly as we expected with our consumers.”

Sato noted that the company “made good progress” in reducing older inventory in the basketball but it came at the expense of margins. Finish Line inventories at the quarter’s end increased 3.7 percent over last year.

Kids’ low-double digit gain was again led by Nike and Brand Jordan although Under Armour and Timberland also contributed.

Soft goods at the Finish Line chain delivered its second consecutive quarter of positive comp growth, increasing 1.3 percent. The gain was by apparel, driven particularly in its license department. Accessories were down due primarily to tough comparisons for socks. Said Sato, “While we are pleased that topline trends are headed in the right direction, this segment is not where we want it to be or believe it can be from a penetration and margin standpoint.”

Sales associated with Macy's reached $51.3 million, up 53 percent versus $33.5 million last year. The shop rollout of all planned 397 store locations were recently completed. Lyon said the company has a more customized merchandising assortment for the shops and also a better staffing model to address traffic.

“With the buildout phase now behind us, we have more time and resources to dedicate toward further improving our men's and women's offerings,” said Lyon. “At the same time, we are committed to capitalizing on the meaningful growth opportunities we believe exist for kid's footwear and also our business on Macys.com.”

Kids are in about 100 shops and will be added to another 20 in the current quarter. Finish Line has also found success enabling browsers at macys.com access to inventory in 50 shops and has added accessibility to another 50.

Running Specialty Group (RSG) sales reached $17 million in the quarter, up 22 percent versus $13.9 million last year. RSG “continues to be a work in progress,” said Lyon. But he added that he has “more confidence than ever that the work we are now doing under the leadership of Bill Kirkendall has the business on the right path towards sustainable growth and profitability.”

During the quarter, the segment acquired Capital RunWalk, Garry Gribble's Running Sports, and Run Colorado, bringing its store count to 66. Said Lyon, “We plan to stay aggressive on the acquisition front given the attractive pipeline of potential deals we believe exists in the market.”

Companywide gross margin decreased 140 basis points to 28.2 percent. Product margin net of shrink was down 150 basis points. Consolidated SG&A expense was 28.8 percent of sales, which deleveraged 20 basis points from last year.

Regarding Black Friday weekend results, comps increased in the low double-digit range over the same Thursday to Sunday period a year ago with stores up low single digits and digital up strong double digits.

“As we look ahead, we are cautiously optimistic about several new product introductions set for the remainder of this fiscal year which we believe will bring some excitement to the market and help partially offset the margin headwinds we are facing,” said Sato. “These include key items from Brand Jordan, new Max Air introductions and updates to Under Armour's SpeedForm.”

For the fourth quarter, Finish Line comps are projected to increase in the low to mid-single digits. Comps to date in December are flat. The adjustments to its near-term capital expenditures included moderating certain technology investments behind its systems transformation. Investments include expanding its CRM capabilities to better engage customer data and support its loyalty program. Finish Line is also examining its expense structure “with an eye towards becoming leaner and more flexible,” said Ed Wilhelm, CFO. More details will be shared on its year-end call in March.

For its fiscal year ended Feb. 28, Finish Line now expects non-GAAP EPS to be flat against year-ago levels. Finish Line comps are projected to increase low to mid-single digits. Previously, it expected Finish Line comps to be up mid single digits and ESP to increase in the high single to low double-digit range.