Famous Footwear parent company Caleres, Inc. became the latest retailer to lower its fiscal full-year guidance after reporting second-quarter fiscal 2024 sales and earnings. The company reported sales of $683.3 million, down 1.8 percent year-over-year (y/y). Direct-to-consumer sales represented approximately 75 percent of total net sales.

- Famous Footwear sales increased 1.5 percent y/y to $420.3 million in the second quarter, partly attributed to “a later-than-expected back-to-school season.” Famous Footwear comps were down 2.9 percent y/y for the period.

- Brand Portfolio sales declined 5.1 percent to $285.5 million, compared to $300.9 million in the second quarter of 2023, said to be due to operational reporting challenges in connection with its SAP ERP implementation and pockets of weak seasonal demand.

“Caleres reported second-quarter results that were below expectations. While our brands and products continue to resonate with consumers and we remain confident in our long-term vision, our second-quarter results in both segments fell short of our potential. Our system’s implementation led to a lack of visibility that prevented us from delivering our expected results. We also experienced weak seasonal demand, and back-to-school business came later than expected,” said Jay Schmidt, president and CEO of Caleres, Inc. “Despite the sales miss, our gross margin remained strong, driven by the Brand Portfolio. At the same time, Famous Footwear gained market share in the strategically important Kids category. Furthermore, back-to-school sales surged in August, bringing the season total in line with our expectations.”

Schmidt said the company is confident in its ability to get back on track after addressing the issues from the ERP implementation that temporarily impacted visibility.

“We are also accelerating certain restructuring actions to improve the efficiency and effectiveness of our teams,” he added. “Looking ahead, we are confident in our ability to deliver earnings per share in line with our revised guidance. Longer-term, we believe we are exceptionally well positioned to execute our strategic plan, invest to fuel our growth initiatives, and drive sustained value for our shareholders.”

Income Statement Summary

Consolidated gross margin (GM) improved 30 basis points y/y to 45.5 percent of sales.

- Famous Footwear GM slipped 120 basis points y/y to 45.0 percent of sales.

- Brand Portfolio GM improved 140 basis points y/y to 42.7 percent of sales.

SG&A, as a percent of net sales, was 39.3 percent, and it was said to reflect planned investment in marketing at certain Lead Brands, international expansion, and the implementation of the integrated SAP platform. The company said restructuring actions will result in $7.5 million in annualized SG&A savings and $2 million in SG&A savings in fiscal 2024.

Net earnings amounted to $30.0 million, or 85 cents per diluted share, in the second quarter, compared to net earnings of $33.9 million, or 95 cents per diluted share, in the second quarter of 2023, and Adjusted net earnings were calculated at $35.2 million, or Adjusted EPS of 98 cents per diluted share, in the second quarter of 2023.

Balance Sheet Summary

Inventory was flat at quarter-end compared to the end of the second quarter of 2023.

Borrowings under the asset-based revolving credit facility were $146.5 million at the end of the period, down $98 million from the second quarter of 2023, and included the benefit from a deferred vendor payment of $49 million.

Capital Allocation Update

During the quarter, Caleres said it continued to invest in value-driving growth opportunities while at the same time returning cash to shareholders through a dividend. In the near term, the company expects to continue to focus on reducing debt and expects borrowings under its asset-based revolving credit facility to be less than $100 million by 2026.

Caleres said it will continue to consider business performance and market conditions as it evaluates all opportunities for free cash flow, including share repurchases, as the year progresses.

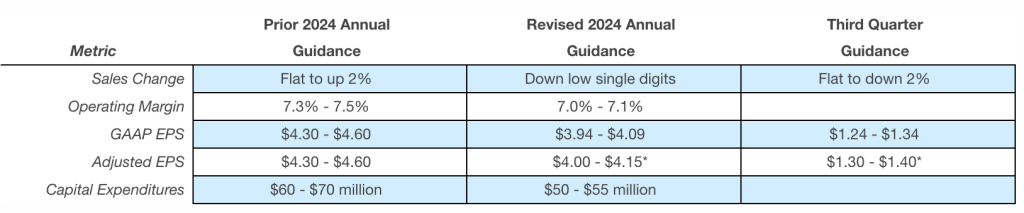

Fiscal 2024 Outlook

Caleres is revising its fiscal 2024 financial outlook. As previously noted, its fiscal 2024 is a 52-week year and compares to a 53-week year in fiscal 2023. The revised assumptions are summarized as follows:

* Adjusted EPS excludes 6 cents per share ($3 million) expected to occur in the third quarter.associated with restructuring costs.

Image courtesy Famous Footwear