SGB Executive Sports & Fitness

EXEC: Post Earnings Call, Analysts See Slow Recovery for Nike

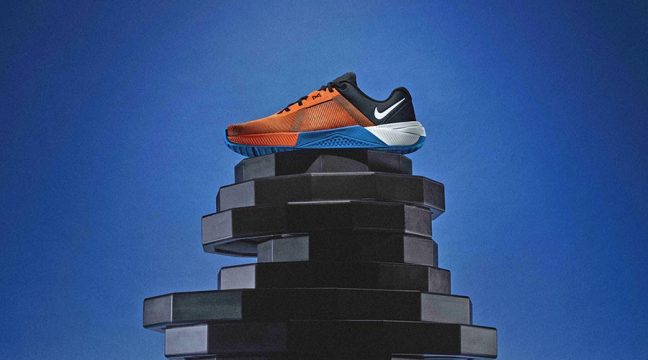

Shares of Nike, Inc. fell about 7 percent on October 2. SGB Media spoke with eleven Wall Street analysts to explore Nike’s turnaround prospects. Several remain bullish on Elliot Hill’s return as CEO; however, a return to healthy growth might only happen in calendar year 2026.

CCM Hockey Agrees to Acquisition by European PE Firm Altor

The Canadian equipment brand owned by Birch Hill Equity Partners agreed to be acquired by the Swedish private equity firm Altor. The transaction is expected to close by the end of 2024.

EXEC: Beyond Yoga Acceleration Seen as Key Focus for Levi Strauss Going Forward

Through a transformational pivot to operating as a DTC-first company, Levi Struss & Co. is narrowing its focus to realize the full potential of the Levi’s brand as well as accelerate Beyond Yoga.

EXEC: Rip Curl and Oboz Parent Taps Former Nike Exec as New CEO

The parent company to the Rip Curl, Oboz and Kathmandu brands has named former Nike executive and current KMD Board member Brent Scrimshaw as its new group CEO. Michael Daly has given notice to the Board of his resignation.

EXEC: Basic-Fit Sees Top 20 Investor Pressure Board to Sell Fitness Company

Buckley Capital Management, LLC and its affiliates are confident that there is significant interest from private equity, and implored Basic-Fit’s management and the Board to initiate a strategic review process.

EXEC: Nike Signals Uphill Struggle as New CEO Settles In

On Nike’s first-quarter analyst call, Matt Friend, EVP and CFO, said Nike is finding success with some new products, particularly in running, and the hiring of Nike veteran Elliott Hill as CEO was enthusiastically received by Nike’s employees. However, he warned that business conditions worsened in the quarter with online traffic, retail sales across the marketplace and spring orders all coming in lighter than planned.

EXEC: U.S. Now Largest Region for JD Sports; Finish Line Banner to Retire

The parent of the JD, Hibbett, Finish Line, DTLR, and Shoe Palace retail brands in the U.S. and JD and others worldwide saw revenue grow 5.2 percent to £5.03 billion in the first half, including £61 million from 10 days of Hibbett sales.

EXEC: Sports Direct Parent’s Bid for Mulberry Rejected

Luxury handbag maker Mulberry Group Plc rejected a takeover approach from Frasers Group, the parent of Sports Direct, and announced plans to proceed with its emergency fundraising to support a turnaround.

Analysts: Nike Could Cut Guidance Tonight

Several analysts expect Nike will lower guidance for the second straight quarter when it reports first-quarter results after the market’s close on Tuesday due in part to weakness in China but also to lower the bar for incoming CEO, Elliott Hill.

Iconix Completes Acquisition of Salt Life in Bankruptcy Proceedings

Brand management company Iconix International Inc., in partnership with the Hilco Consumer-Retail Group (HCR), has completed its acquisition of the Salt Life apparel brand for $38.74 million after previous owner Delta Apparel Inc. filed Chapter 11 bankruptcy in late June. All 28 of Salt Life’s stores will close following the company’s bankruptcy sale as the brand’s new ownership transitions to a wholesale and e-commerce business model.

EXEC: SEC Charges Terminated Foot Locker Exec with Insider Trading

Barry Siegel, the former senior director of order planning management for North America, agreed to a civil settlement after allegedly using material nonpublic information about sales and inventories to short FL shares prior to two Foot Locker earnings announcements in 2023.

EXEC: Leatt Partners with ZyroFisher in Distribution Deal for UK and Ireland

ZyroFisher will begin distributing Leatt products in the UK and Ireland in Spring 2025, with pre-orders starting November 2024, providing a larger portfolio of mountain bike-oriented protective products.

EXEC: Golden Goose Gets Strong DTC Lift to Post DD Growth in First Half

DTC net revenues reached €226.8 million, accounting for 73 percent of total revenues in the first half on 18 percent year-over-year growth. Wholesale revenues were down 5 percent y/y to €74.6 million in H1, accounting for 24 percent of total net revenues in the period.

Cultural Shift: Lululemon’s Global Wellness Report Finds Wellbeing Burnout

Lululemon’s fourth annual 2024 Global Wellbeing Report underscores a move towards a more personalized approach to well-being amid a fast-paced digital lifestyle. For market stakeholders, understanding the nuanced needs of consumers is key for success in this evolving landscape.

EXEC: Giant Group Subsidiary Acquires Stages Cycling Assets Out of Chapter 11

SPIA Cycling, Inc., a subsidiary of Taiwan-based The Giant Group, has successfully acquired key assets of the Stages Cycling brand from its owner companies, some of which filed for Chapter 11 bankruptcy protection in June.