EXEC: Foot Locker Touts Benefits Of Multi-Brand Retailing

At the JP Morgan Retail Round Up Conference, Mary Dillon, Foot Locker’s CEO, said while Foot Locker expects to resume growth with Nike by holiday 2023, Foot Locker’s position as a multi-brand retailer will be key to capitalizing on the broadening sneaker opportunity. She said, “Being a multi-branded retailer matters because consumers want choice and they love to shop across brands.”

EXEC: Fanatics Faces Scrutiny After NHL Uniform Announcement

Last week’s announcement that Fanatics would replace Adidas as its “Official On-Ice Uniform Outfitter” marked another major step forward for the sports licensing powerhouse. However, the harsh reaction from hockey fans on social media and from some in the media shows Fanatics has work to do to improve its reputation before the deal starts in the 2024/25 season.

EXEC: Lululemon Delivers Blowout Holiday Quarter, Bullish 2023 Outlook

Lululemon Athletica, Inc. took a massive impairment charge in the fourth quarter to cover write-offs and the restructuring of its Mirror’s connected-fitness business. However, shares of Lululemon are up about 15 percent in -pre-market trading Wednesday as fourth-quarter results topped estimates and an upbeat outlook was provided for 2023.

SFIA Webinar: Pickleball Post-Pandemic Tops Participation Growth Rate

At a recent webinar exploring SFIA’s 2023 Sports & Fitness Topline Participation Report, Tom Cove, president and CEO of SFIA, highlighted the substantial progress in improving America’s activity rates and detailed which activities benefited from the pandemic, including pickleball.

EXEC: Analysts Divided On Nike’s Q3FY23 Performance

Some Wall Street analysts were pleased with Nike’s progress in working down inventory levels and reviving China in the fiscal third quarter ended February 28; others were concerned that the growth is mainly from promotions.

EXEC Q&A: Dave Spandorfer, Co-Founder & CEO, Janji

In February, Janji, the Boston-based running apparel brand, and Oiselle, a Seattle-based women athletic apparel brand, announced they were partnering on a merger of niche brands in the run space. Here, Dave Spandorfer, co-founder and CEO of Janji, talks about the reasons behind the merger, the mission behind each brand and the Janji story.

Report: Adidas Ends Partnership With Beyoncé, Shutters Ivy Park Line

Add Beyoncé to the list of collaboration woes for Adidas. According to reports from The Hollywood Reporter and TMZ, Adidas ended its partnership with Beyoncé and shuttered the Ivy Park athleisure line.

Xtep Intl Sees 2022 Surge In Merrell, Saucony and K-Swiss Brands In PRC

Xtep International Holdings Ltd, together with its subsidiaries, reported that Group revenue rose 29.1 percent to an all-time high of RMB12.93 billion in 2022. The gains were across brands, with Merrell and Saucony leading growth, followed by K-Swiss.

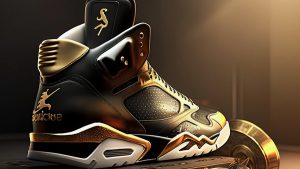

YouGov Study: Sneakerheads Emerge As Powerful Buying Force

Over the past year, the number of Sneakerheads, defined as consumers willing to spend $100 or more on sneakers, is up 18 percent in the U.S., according to YouGov’s latest report, “The Sole Obsession: Inside the World of Sneakerheads.”

EXEC: Shoe Carnival Touts Market Share Gains Amid Athletic Footwear Slump

Shoe Carnival Inc. said athletic footwear further weakened due to shifting trends in the fourth quarter ended January 28, but the family footwear chain posted record earnings on higher margins and claimed it’s continuing to build on significant share gains over competitors in recent years.

Mainland Headwear Up 17 Percent In 2022; Mexico Factory Opening Near Texas Border

Mainland Headwear Holdings Ltd. reported that revenue increased 17.1 percent to HK$1.87 billion. Profit generated in the Manufacturing Business was partially offset by a loss for the year in the Trading Business, but Profit to Shareholders still rallied 52.6 percent to HK$195.4 million

Fila Holdings Gets Acushnet, Strong USD Lift As 2022 Sales Top ₩4 Trillion

Fila Holdings reported that consolidated revenue grew 11.3 percent to ₩4.22 trillion for the full year 2022, compared to ₩3.79 trillion in the prior year. Operating profit declined 11.7 percent to ₩435.07 billion in 2022.

KMD Posts Record H1 Results On Triple-Digit Oboz Growth, Double-Digit Rip Curl Gains

KMD Brands Limited reported that fiscal 2023 first-half revenue jumped 34.5 percent to A$547.9 million. The first-half saw continued sales growth for Rip Curl, strong Australian recovery for Kathmandu, and record first-half sales for the Oboz business

EXEC: Nike Warns Of Continuing Margin Pressures Amid Stubborn Inventory Glut

Nike Inc. reported sales and earnings in its fiscal third quarter ended February 28 topped Wall Street targets as strong demand drove broad-based growth across brands, channels and geographies. However, the sportswear giant lowered its margin guidance for its fiscal year as it still has some work to do in whittling down bloated inventories.

EXEC: Foot Locker’s Shares Rise On Upgrades Following Investor Day

Shares of Foot Locker rose 7 percent on Tuesday as analysts at Citi and Evercore upgraded the stock following the retailer’s Investor Day on Monday. Citi’s Paul Lejuez said Foot Locker’s moving in the right direction, turning attention away from malls and the Champs brand and instead focusing on offerings related to kids, loyalty and digital.