Columbia Sportswear Sues Two Former Execs For Trade Secrets Theft

Columbia Sportswear Company (CSC) has filed suit against two former executives in Oregon District Court for alleged theft of trade secrets. The two former employees resigned on the same day and joined Huk Gear, the fishing apparel brand owned by Marolina Outdoor, Inc.

EXEC: Puma N.A. Business To Undergo “Transition” Year Amid Off-Price Excess

Puma SE CEO Arne Freundt revealed company sales in North America declined 18.6 percent in the first quarter, and the company now expects a further decrease in 2023 as Puma reduces its exposure to off-price sellers and elevates its position as a sports brand.

Gap Shares Fall As Athleta Parent Poised To Cut Hundreds More Jobs

Gap, Inc., the parent company of active lifestyle banner Athleta, has apparently become far too bloated in its corporate structure for its interim CEO and will undergo at least 500 corporate layoffs to tune the organization to the realities of the current marketplace.

EXEC: Life Time Lifts Earnings Guidance On Improving Membership Growth

Life Time Group Holdings, Inc. raised its earnings outlook for the year after reporting first-quarter earnings topped guidance. On an analyst call, Bahram Akradi, CEO, shown above, said membership attrition had come down steadily each quarter and forecasted that June would be the first month with attrition rates below 2019.

EXEC: Talking Growth Drivers With Oofos President Steve Gallo

Oofos President Steve Gallo spoke recently with SGB Executive about drivers of the company’s robust growth, the active recovery opportunity, plans for the current year, and the recovery brand’s dedicated fans.

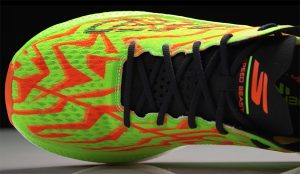

EXEC: Brooks Sues Skechers Over ‘Beast’ Trademark

Brooks Sports Inc. filed a lawsuit against Skechers U.S.A. Inc., alleging the company is infringing on the “BEAST” trademark used on Brooks running shoes since 1992.

Fenix Outdoor Provides Cautious Outlook On Inventory And Macro Concerns

Fenix Outdoor International AG reported sales climbed 9 percent in the first quarter on strength in the Americas and German regions as well as with the Fjällräven and Hanwag brands. Profits were down slightly, and Fenix Outdoor warned that results in upcoming quarters could be pressured by elevated inventories and promotions in the marketplace.

EXEC Q&A: Jim Duffy, Managing Director, Consumer And Retail, Stifel Financial Corp.

SGB Executive talked to Jim Duffy, veteran sell-side industry analyst at Stifel Financial Corp., about the headwinds and tailwinds facing the active lifestyle space, his favorite stocks, the DTC trend, his affinity for covering the active lifestyle space, and the company’s sponsorship of the U.S. ski team.

Stella Intl Sees Q1 Factory Revenues Slide As Athletic And Casual Brands Pull Back

Stella International Holdings Limited, a developer, manufacturer and retailer of footwear and leather goods, reported that first-quarter revenues decreased 25.8 percent to approximately $284.6 million, compared to revenue of about $383.3 million for the comparable 2022 period.

EXEC: Surveys Show Macroeconomic Pressures Derailing Sustainability Progress

Recent surveys timed to Earth Day, April 22, indicate economic pressures are working against sustainability measures despite continued commitments and show that consumers are challenged by rising inflation in support of “green” products.

Designer Brands Reveals Amounts Paid For Keds And Topo Athletic

Designer Brands, the parent of DSW, paid $123.3 million to acquire the Keds business from Wolverine World Wide and paid $19.1 million to acquire majority ownership of Topo Athletic, according to the company’s recently-released annual report.

REI Logs Loss In 2022 Amid Investments; Sales Growth Slows Sharply

REI Co-op reported a loss in 2022, impacted by lower margins but said it made significant investments in its employees, community and other areas. Sales reached $3.85 billion in 2020, up 4.1 percent year-over-year after posting a 36 percent increase in 2021.

Melody Ehsani Leaving Role As Foot Locker Women Creative Director

Melody Ehsani, CEO of the Melody Ehsani brand and creative director at Foot Locker Women, is leaving her role at Foot Locker.

EXEC: SFIA Study Finds Industry Cautiously Optimistic On 2023

SFIA’s 2023 State of the Industry Report finds the outlook for the sports and fitness industry remains strong, although current macroeconomic headwinds and uncertainty have dimmed that optimism slightly from 2020 and 2021 levels.

Yue Yuen Enters India In Move To Diversify Footwear Manufacturing

Yue Yuen reported diversifying its footwear manufacturing capabilities by entering India to access labor and as it looks for access to manufacturing outside of China. Yue Yuen is China’s largest athletic and outdoor footwear manufacturer, serving some of the more iconic brands in the U.S. and European markets.