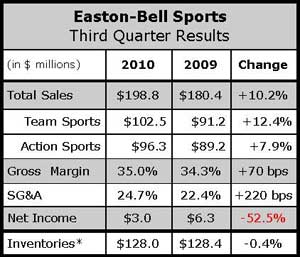

While one of its biggest competitors in football helmets is taking it in the chin, Easton-Bell Sports, Inc. is busy building on its helmet businesses – from football and other team sports to snow sports and cycling. Revenues increased 10.2% to $198.8 million.

Still, the company saw negative impact from higher SG&A expenses offset gains in gross margin, cutting net income in half versus the year-ago period.

Net earnings reached $3.0 million versus $6.3 million a year ago, a 52.4% decline attributed primarily to $4.1 million in increased incentive based compensation. The decline also reflected higher interest costs and the impact of foreign currency fluctuations.

Team Sports net sales increased 12.4% to $102.5 million in the third quarter due to increased sales of football equipment and reconditioning services, and baseball, softball and ice hockey equipment. Sales of Riddell football equipment and apparel increased approximately 14%, including 25% growth in the youth helmet business, thanks to strong “rush orders” at the end of the season. The company had good success with helmet programs at both The Sports Authority and Hibbett.

Additionally, favorable exchange rates account for 120 basis points, or $1.1 million, of the growth.

Action Sports net sales increased 7.9% to $96.3 million due to double-digit increases in sales of snow sports helmets and goggles and strong demand for power sports helmets and cycling components. That growth was partially offset in the mass channel by lower sales of licensed youth cycling helmets. Sales to key specialty independent bike and snow retailers increased approximately 16% compared to the third quarter of 2009. Sales of Giro helmets and goggles were up 35% and 28% respectively compared to the third quarter of 2009. Sales of Easton cycling products rose 24% on the strength of an expanded line of wheels.

Overall gross margins rose 70 basis points to 35.0% of sales. On the Team side, improvement came primarily from a better sales mix and improved margins in baseball and softball bats, which are now sourced overseas, and favorable foreign currency exchange rates. These gains were partially offset by closeout sales of team sports apparel and higher sales of lower-margin youth football equipment. In Action Sports, margins increased 220 basis points thanks to reduced sourcing costs in Asia, where the company has been able to partner with vendors on lean manufacturing initiatives to lower returns and inventory write-offs.

CEO Paul Harrington said the company has locked in costs, but not prices, for products that will be introduced during the first two to three quarters of next year. Rising commodity costs could be a factor in Fall/Winter 2011 and 2012, however, particularly in the area of carbon fiber.

Company operating expenses increased $8.6 million during the quarter, reaching 24.6% of net sales. The ratio was flat with the third quarter of 2009 when excluding $4.1 million of increased incentive compensation expense. The remaining increase is due primarily to higher variable selling expenses associated with the sales growth and increased marketing expenses for investments in product and brand initiatives.

The company's adjusted EBITDA for the quarter was $27.9 million. When normalized for the increased incentive compensation expense, EBITDA increased by 17.7% compared to the third quarter of 2009.

Harrington said momentum continues to build at Riddell on the T

eam Sports side of the business. The Easton-Bell Helmet Technology Center opened in Scotts Valley, CA. during the quarter and Riddell boosted spending on its new e-commerce site, which racked up sales gains of 39% in the quarter.

When asked whether Jarden Corp.’s Rawlings unit was taking market share, Harrington said “we haven’t seen anything with our school base.” Rawlings is re-entering the market this fall for the 2011 season after a decades-long hiatus. Riddell is expected to continue taking orders for its new 360-Degree, or 3D, football helmet and other gear for the 2011 football season until the end of November.

In the baseball bat business, Easton will shift its focus in 2011 to the $200 to $250 price point — below its sweet spot of $250+ range just a few years ago.

On the Action Sports side, the new Giro Bevel snow helmet is selling extremely well in one of snow sport’s hottest categories. The Bevel can be quickly sized using dials in the rear of the helmet long used in Giro cycling helmets. Harington said they are being well received because they allow retailers to carry fewer sizes.

Giro is shifting development toward the $100-$110 range next year from the $140-$150 range. Price points in the cycling components business, however, are expected to remain stable thanks to continuing innovation with carbon fiber and other materials.