DSW Inc.s fourth quarter revenues increased 15.7% to $402.6 million, due in large part to a double-digit increase in comp store sales. Comps advanced 12.9% versus a 7.2% decline in the prior-year period. By segment, comps at DSW stores rose 14.1%, driven by increases in traffic, conversion, and average unit retail. Comps at the retailers leased department business increased 2.7%.

Earnings reached $13.4 million, or 30 cents a share, against a loss of $7.5 million, or 17 cents, a year ago.

The momentum that we began to feel in the third quarter of 2009 actually accelerated in the fourth quarter, said DSW President and CEO Michael McDonald on a conference call with analysts.

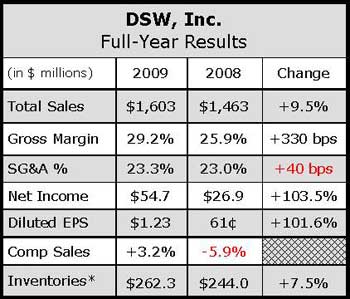

Merchandise margins jumped 560 basis points to 44.4% of sales reflecting higher regular priced sales and a lower markdown rate. Occupancy expense rates decreased due to rent concessions. Gross margins lifted 860 basis points to 29.2% of sales. SG&A expense decreased 110 basis points to 22.9% of sales.

McDonald said that over the fall selling season, women’s, men’s and athletic footwear all had comp increases versus declines last spring. A focus on key items led to a blow-away boot season with the boot category alone accounting for over half of its fall season sales growth.

Debbie Ferree, DSWs vice chairperson and chief merchandising officer, also said the chain is primarily carrying Skechers in toning. But she said with new products coming in from Reebok, L.A. Gear, New Balance and Dr. Scholls, toning could be as high as 3% plus penetration to our business, so were getting exceptionally strong sell-throughs right now. Were very excited about it.

For 2010, earnings are expected between $1.35 and $1.45 a share, which compares with $1.23 in 2009. But shares fell last week after the company forecast low-single digit comp gains for the year and earnings to decline in the back half due to tough comparisons. DSW also doesnt expect its margin rate to increase off the historical record highs of 2009.