Dr. Martens reported revenue of £908.3 million ($1.13 bn) in its fiscal year ended March 31 against £773.0 million a year ago, representing a gain of 18 percent on a reported basis and 22 percent on a currency-neutral basis.

EBITDA improved to £263.0 million from £222.9 million, up 18 percent on a reported basis and 28 percent on a currency-neutral basis.

Adjusted profit before taxes reached £214.3 million against £150.2 million, representing a gain of 43 percent. Adjusted results exclude non-recurring items connected to its IPO. Profit after tax came to £181.2 million versus £34.7 million, representing a gain of 422 percent.

Financial Highlights

- Americas and EMEA saw reported revenue up 29 percent and 19 percent respectively. APAC, Martens’ smallest region, was heavily impacted by ongoing COVID-19 restrictions, with revenue down 10 percent to £127.1m;

- Direct-to-consumer (DTC) first strategy drove revenue mix to 49 percent, up 6 percentage points. E-commerce revenue was up 11 percent and up 92 percent compared to FY20, with the mix at 29 percent of revenues;

- Retail saw a recovery where COVID-19 restrictions were lifted, with revenue up 86 percent and mix at 20 percent, up 7 percentage points;

- Wholesale revenues were up 5 percent, with continued elevation of the quality of its wholesale partners;

- Gross margin grew 2.8 percentage points to 63.7 percent, driven by increased DTC. This gross margin performance, partially offset by animalization of plc costs, return to business as usual spending and planned increased marketing investment, resulted in an EBITDA margin of 29.0 percent; and

- The Board proposed a final dividend of 4.28p, taking the total dividend to 5.50p, bringing the total payout ratio to 30 percent from 25 percent with respect of the interim payout.

Strategic Highlights

- Brand strength, with the recent comprehensive annual brand survey showing awareness of 72 percent, up 4 percentage points; familiarity of 47 percent, up 6 percentage points; and last 24 months purchased of 8 percent, up 2 percentage points;

- Strong performance of EMEA conversion markets, with growth in Germany and constant-currency revenues in Italy up 122 percent in H2;

- Wholesale order book for AW22 has been written, based on the higher AW22 prices previously communicated, with demand from its wholesale customers;

- Consumer pricing study to be repeated this summer. Doc Martens envisions further pricing headroom as it continues to invest in its brand and product;

- 24 new stores opened in FY22, and FY23 store opening guidance has increased driven by accelerated U.S. store rollout; and

- Continued investment in sustainability, with a detailed roadmap to achieve long-term commitments. In April 2022, Doc Martens launched the first trial of a repair and resale program, with encouraging early results.

Current Trading

(FY23 and medium-term financial outlook)

Dr. Martens said, “For FY23, we now expect high-teens revenue growth, with the upgrade to guidance the result of the price increases which take effect from AW22 and our expectations for volume growth remaining unchanged. In line with our strategic operating model, we continue to expect prices to offset inflation through the P&L. Factory prices for FY23 are now locked in, with a 6 percent increase year-on-year (for AW22 and SS23), and we have good visibility over other operating cost lines. Our wholesale order book is strong and already confirmed at 85 percent of our full-year expectation. DTC trading, since the start of the new financial year, has continued in line with our expectations.

“Our medium-term guidance is unchanged. We continue to expect e-commerce to grow to at least 40 percent mix, with total DTC, including retail, of at least 60 percent mix. We expect the EBITDA margin to reach 30 percent in the medium term, again unchanged. We view all three of these as medium-term milestones, as opposed to ceiling targets, and see potential to expand beyond these metrics in the years beyond.”

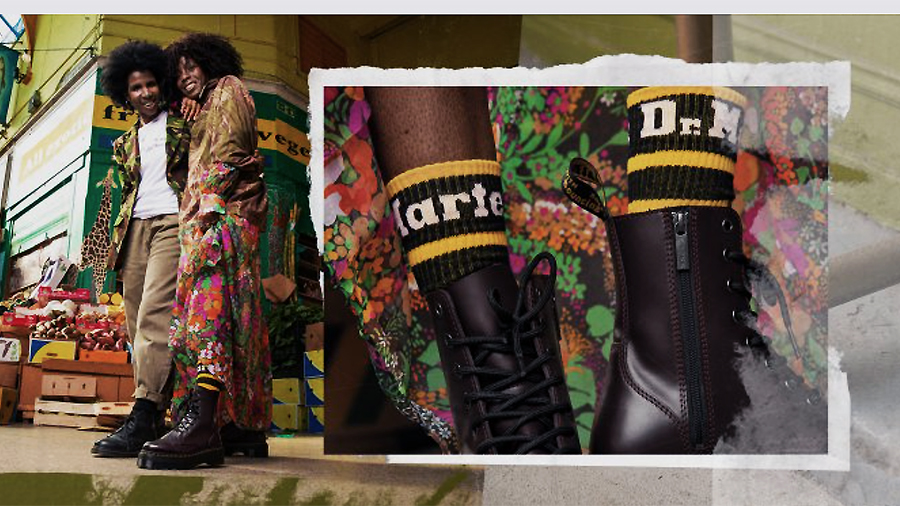

Photo courtesy Dr. Martens