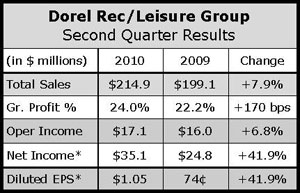

Double-digit growth in the sales of Cannondale bicycles, parts and accessories drove revenues up 7.9% to $214.9 million at Dorel Industries Inc.’s Recreational/Leisure division in the second quarter.

Year-to-date revenues at the division, which owns the Schwinn, GT, Mongoose and Cannondale cycling brands, rose 10.0% to $396.6 million over the comp period a year ago.

After excluding the impact of new business acquisitions and foreign exchange fluctuations, organic growth accounted for approximately half the growth for both the quarter and year-to-date period.

Growth at the division’s Cycling Sports Group (CSG), which focuses on selling into the IBD channel, was driven by demand for elite racing bicycles, such as the Cannondale SuperSix carbon frame bikes, which sell for thousands of dollars. Sales of the Cannondale brand were up in the double digits, but countered by weak sales of the company’s other brands due in part to lack of inventory.

Cannondale has been selling well in the U.K., where the brand was introduced last October alongside Dorel’s other bike brands.

Schwinn experienced a strong increase in POS year-over-year, due to the multi-million dollar advertising campaign launched in mid-April, excellent retailer support and good early spring weather.

While contributing to a 21.3% increase in selling, general and administration costs, executives said the campaign helped propel Schwinn parts and accessory sales to double-digit growth in the quarter. Unfortunately, Dorel could not fully capitalize on the campaign in the mass channel due to a lack of supply it attributed to a global shortage of ocean containers. Dorel said inventory levels have since corrected.

Earnings from operations at the Recreation/Leisure division improved 6.8% to $17.1 million compared to $16.0 million in Q2 2009. Gross margin improved 180 basis points for the quarter, due principally to a more profitable product mix.

However, the weakening euro caused a net quarterly loss of $2 million, with most of that coming from CSG, which derives half of sales from outside the United States.

Looking ahead, Dorel CFO Jeffrey Schwartz said he expects revenues to continue to exceed prior year levels but expects freight rates will continue to pressure margins in the third quarter. Those trends may reverse in the fourth quarter. Meanwhile, the Euro has already gone from 1.23 per dollar to the 1.32 range since the end of the second quarter. Still, challenges at Dorel’s Juvenile division, which make car seats, cribs and other juvenile products, will likely eat into Dorel’s consolidated earnings in the back half of the year, Schwartz said.