Dick’s Sporting Goods reported an 8.0 percent increase in its first-quarter profit but results came in slightly below expectations due to a sales shortfall in its golf and hunt categories. More problematic, with weakness in those categories expected to continue at least in the near term, the company significantly reduced its earnings guidance for the year.

Dick’s Sporting Goods reported an 8.0 percent increase in its first-quarter profit but results came in slightly below expectations due to a sales shortfall in its golf and hunt categories. More problematic, with weakness in those categories expected to continue at least in the near term, the company significantly reduced its earnings guidance for the year.

Full-year earnings are now projected to arrive in the range of $2.70 to $2.85 a share, below its previous call for $3.03 to $3.08 a share. That’s slightly above 2013’s full-year profits of 2.69 a share. Dick’s also sees comparable store sales rising 1 percent to 3 percent, rather than 3 percent to 4 percent.

Dick’s SG also forecast a per-share profit of 62 cents to 67 cents for the second quarter, down from year-ago profit of 71 cents a share. The consensus estimate on Wall Street has been 82 cents.

On Tuesday, shares of DKS tumbled $9.56 to $43.60, or 18.0 percent, on the New York Stock Exchange.

In the first quarter, earnings reached $70.0 million, or 57 cents a share, below its guidance between 51 cents and 53 cents.

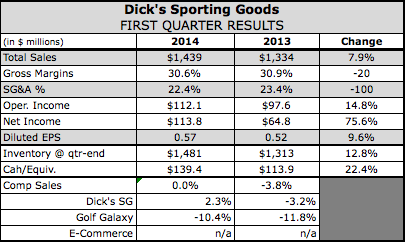

Total sales in the quarter increased 7.9 percent to $1.4 billion. Consolidated same store sales increased 1.5 percent, short of guidance calling for an approximate 3 to 4 percent increase. Consolidated same store sales decreased 3.8 percent, adjusted for the shifted retail calendar due to the 53rd week in 2012. Same store sales for the flagship Dick's SG chain increased 2.3 percent, while Golf Galaxy decreased 10.4 percent.

Gross margins eroded 23 basis points to 30.64 percent. Merchandise margin expanded 30 basis points but was offset by occupancy deleveraged and increased shipping expenses as its e-commerce penetration continued to increase. Excluding a $14.4 million gain on an asset sale, SG&A expenses as a percentage of sales were essentially flat at 23.42 compared to 23.45 percent of sales in the first quarter of 2013.

On a conference call with analysts, Ed Stack, Dick's SG’s chairman and CEO, said its hunting business missed its first quarter plan by approximately $15 million and comped down high teens to last year. Said Stack, “We had anticipated this category to be below last year, as did others in this space, but we underestimated the decline. We all knew the significant increase in sales during the past couple of years was temporary and driven by concerns about legislative action that would broadly change our gun laws.”

He added that the hunting business is anticipated to continue this negative first quarter trend through the second quarter, improve slightly from this trend in the third quarter, and be relatively flat in the fourth quarter.

Overall, Stack said the company continues to be “enthusiastic about the outdoor business” for both Dick's SG and Field & Stream longer term “as we are confident the results here are just right-sizing the business from the panicked buying that began in 2012.” He noted that subcategories of the outdoor business such as paddle sports, hunting and fishing apparel, all grew double-digits.

On the other hand, Stack said the “more concerning and unpredictable issue is the golf business.” While Dick’s SG had anticipated softness, Golf Galaxy was down 10.4 percent and Dick’s SG’s golf business dropped in the high-single digits. The overall golf business missed its first quarter 2014 sales plan by approximately $34 million. Said Stack, “We don't feel we've found the bottom yet in the golf sales number. We now expect this trend could continue for the balance of the year and will impact our prior guidance which assumed a slight improvement in the golf business for the balance of the year.”

He said the problems are three-fold. First, a glut of inventory was developed as a result of the lackluster sales over the past 15 months that is leading to steep markdowns on dated product. The price reductions combined with the increase in inventory of cascaded products caused its AUR on men's drivers to drop 16 percent in Q1 while its units were only down 2 percent.

Second, the core golfer doesn't seem to understand new vendor technologies. Said Stack, “The technology in game improvement possibilities, especially in drivers, are fantastic. But since it's not yet completely understood or embraced, the core golfer has not replaced his equipment and the more casual player has elected to buy closeout products at a lower price.”

Finally, the sport continues to be impacted by a decline in rounds played. Stack noted, “As an industry, all parties are looking at ways to reverse this trend.”

With the hunt and golf categories representing 30 percent of its annual sales, their underperformance impacted Q1 earnings by 6 cents a share. If trends continue it both categories, the impact could add up to 30 cents a share on 2014 earnings. With only approximately 2.5 weeks into the second quarter, golf comps were trending in the negative low teens while hunting is still in the negative high teens. The second quarter is the most critical period for golf.

On the positive side, Stack noted that excluding golf and hunt, Q1 comps would have been ahead 6.6 percent.

“The balance of our business is quite good,” said Stack. “Our women's athletic apparel initiative, which has providing great results with comps in the low teens range, our youth athletic apparel business has done even better than the women's business, although off a smaller base. Team sports, along with footwear, have been strong as well.”

Stack also noted that the men’s apparel business “has still been strong.”

The whole team business “was very good,” driven by baseball. He added Dick’s SG is “pleased with the footwear business and we expect to be pleased with that going forward.”

Dick’s SG is in the process of reallocating space to dedicate more square footage to higher growth and higher-margin categories such as youth apparel and women's apparel, while shifting floor space away from golf equipment and fitness equipment. The transformation of youth apparel has been completed in most of its stores with the remaining stores, as well as expansion of its women's apparel area, expected to be finished in time for back-to-school.

Regarding expansion, new store productivity for Dick's SG stores was 98.1 percent with new stores performing in line with existing stores, said Joe Schmidt, president and COO, on the call. Eight stores were opened in the quarter, bringing its count to 566.

Eight new Field & Stream stores are expected to open in 2014, including one in the second quarter. Schmidt said Dick’s continues to be “very excited about our growth opportunity” Field & Stream. Management continues to learn more about what drives sales and margins at the concept’s existing two doors.

At Golf Galaxy, a relocation of its store in Paramus, NJ to its new format that features a greater focus on golf services and experiential shopping was completed in the quarter.

E-commerce grew in the quarter to 7 percent of overall sales, up from 5.8 percent last year. Dick’s SG moved up to number 72 on the Internet Retailer Top 500 list, up from 94 last year.

Schmidt said a focus has been on improving search engine optimization, enhancing mobile and tablet site performance, and piloting buy online/pick up in store, said Schmidt. In addition to existing in-store kiosks, Dick’s SG is testing a program that equips associates with tablets to enable associates to save out-of-stock situations.

In the Q&A session, Dick’s SG officials were particularly asked about their plan if the golf category continues to erode. Stack said it's too early to explore the need to shrink its store size and other categories have upsides to expand. Women's and youth categories carry “significantly higher” margin rates than golf – “by hundreds of basis points difference” – and their square footage can still be expanded. Team categories, which have already been replacing some hunt space, can also be expanded more.

But he cited TaylorMade’s recent announcement that its Q1 sales were down 34 percent as a sign that the golf industry “has a real issue.”

Stack added, “I don't know where the bottom is yet on the cyclical issue which is not like us. We usually have a pretty good sense of this but right now we're not sure where the cyclical bottom is to the golf business.”