Dick's Sporting Goods posted a higher-than-expected jump in second quarter profit on improved margins and stronger comp store sales also unveiled plans to ramp up expansion for 2011. On the downside, the sporting goods retail giant issued a slightly lower-than-expected third quarter earnings outlook and announced plans to close 12 under-performing Golf Galaxy stores.

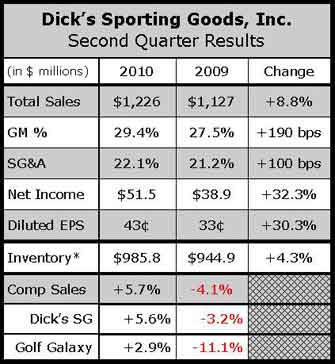

For the quarter ended July 31, EPS of 43 cents a share exceeded a May forecast calling for earnings of 37 cents to 39 cents a share. Sales climbed 8.8% to $1.23 billion. Same-store sales rose 5.7%, topping a May forecast for a 4% to 5% gain following the year-ago decline of 4.1% for the quarter. Comps increased 5.6% at the Dick's SG chain and 2.9% at Golf Galaxy. E-commerce revenues jumped 28% for the period.

The increase at DSG was driven in part by a 5.1% increase in transactions and a 0.5% increase in sales per transaction.

Cannibalization was estimated to have impacted comps by less than 1%.

“The footwear business continued to be really very good,” said Chairman and CEO Ed Stack on a conference call with analysts. “The apparel business continued to be very good, and there were pockets in hardlines that were very good and some of them that were relatively flat.”

While “all the platforms in footwear have been really pretty good,” Stack was particularly “enthusiastic” about the basketball business. He also said the toning category appears to have legs. Said Stack, “Whether they are going to continue to be as strong as they have been, out of the box, we are waiting to see. Reebok is coming out with a new marketing campaign, and we think that will probably re-energize this. But we continue to be enthusiastic about the toning category.”

Management also revealed that the Nike Fieldhouse in-store concept will be rolled out to 20 Dick's SG stores over the next 24 months, primarily in two-level doors. The concept shops range in size from 4,700 to 6,000 square feet. Five Nike Fieldhouse shops are already in place.

About 55 Nike Evolution Plus shops – approximately 3,000 square feet in size will also be installed over the next two years, primarily in single level stores. He said the shops replace existing Nike space but also take some additional space. Said Stack, “It's a move to more premium product, and the early results of this have been very encouraging.”

DSG has also converted 20 of its footwear departments to a shared-service model and expects to have approximately 79 in the format by the close of the year. Said company President and COO Joe Schmidt, “Early results are pretty good, and we think it is going to be additive to our footwear business.”

Golf Galaxy's gross profit margins improved due to reduced promotional activity and a change in merchandising mix. “We are pleased with the improving trend at Golf Galaxy,” said Stack. The closing of the 12 stores will result in a charge of $19 million on a pre-tax basis, or 10 cents a share, in the third quarter. Stack said the closings reflected poor real estate decisions by prior management in either too expensive or weak-traffic locations. The closings are expected to increase earnings from Golf Galaxy by more than 50%, or about 2 cents share. Two Golf Galaxy stores are also now set to open this year, down from five originally planned.

Gross margins improved 190 basis points to 29.4% of sales, driven primarily by a 143 basis point increase in merchandise margins as well as occupancy and freight and distribution leverage. Besides fewer markdowns at Golf Galaxy, higher margins in apparel and footwear at its DSG format as well fewer sales of the low-margin guns and ammo category drove the improvement.

SG&A expenses increased to 22.1% of sales from 21.2% in Q2 last year, due primarily to the anticipated additional recurring expenses of $8 million, or 4 cents a share, related to infrastructure, regionalization, and e-commerce investments. Higher incentive pay due to its current year performance and additional marketing spend on an AdiZero shoe promotion also drove up costs.

New store productivity for Dick's SG stores was 67.4%, down from 72.5% in Q2 last year. Excluding the impact of converted Chick's SG locations, new store productivity would have been 92% for the period. Management noted that its converted Chick's SG stores in Southern California, representing 33% of its new store base, sit in some of the hardest hit regions in the recession. The remodeling of five CSG locations in the quarter also led to a short term negative impact on sales.

Regarding expansion, approximately 26 new DSG stores will open this year. About 40% will be in new markets. In 2011, DKS expects 34 openings, resulting in a unit growth rate of approximately 8% in 2011. Based on an updated review, the company now sees the potential for at least 900 domestic DSG stores, up from at least 800 stores identified in its previous study. The increase is primarily due to success in developing smaller stores less than 50,000 square feet, many aimed at smaller trade areas. It also remains optimistic about expansion opportunities in Southern California as well as Texas.

Third quarter profit is expected to range between 15 cents to 16 cents a share on a 1% to 2% increase in same-store sales. Analysts polled by Thomson Reuters most recently forecast 18 cents a share. Stack said “unusually early cold weather” added 3 cents a share to Q3 2009 results. For fiscal 2010, the company raised its guidance by 3 cents to $1.46 to $1.49 a share.