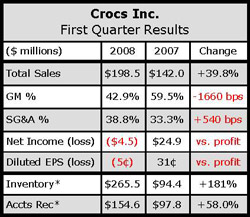

Crocs Inc. posted a net loss for the first quarter as decelerating sales in the U.S. and tighter margins cut into the bottom line. The company blamed much of the issue on early spring sell-through due to cooler weather this year and is indicating that sales have picked up as temperatures have warmed. Still, the at-once business remains challenging. The international business is now clearly overshadowing the domestic business as U.S. sales only grew in the low-teens for the period versus triple-digit growth in the year-ago period. The end result was inventory levels that approached 3X the levels of one year ago.

as decelerating sales in the U.S. and tighter margins cut into the bottom line. The company blamed much of the issue on early spring sell-through due to cooler weather this year and is indicating that sales have picked up as temperatures have warmed. Still, the at-once business remains challenging. The international business is now clearly overshadowing the domestic business as U.S. sales only grew in the low-teens for the period versus triple-digit growth in the year-ago period. The end result was inventory levels that approached 3X the levels of one year ago.

Domestic sales grew at the much slower pace of 11.7%, posting revenues of $92.6 million, compared to $83.0 million for the year-ago period, while international sales increased 79.5% to $105.9 million from $59.0 million for the prior-year period. The international business surpassed the domestic market in size in the first quarter, accounting for 53% of the total business versus just 42% in the year-ago period.

CROX said they “experienced strong demand across the continent,” led by Germany, Spain, Benelux and Italy. They will begin shipping to Russia in the second quarter. Revenue for Canada and Mexico was $8.5 million. Revenue for Europe was $55.3 million. In Asia, first quarter sales increased 93% to $37 million, with Japan leading the way. CROX said they are also seeing “meaningful year-over-year increases” in the Philippines, Malaysia, Indonesia, Australia, Hong Kong and China. Sales in other international markets increased 65% to $5.1 million, with Brazil highlighted as a “stand-out market” for the brand.

Footwear sales accounted for approximately 95% of revenue, and represented 11.1 million units, for an average selling price of $16.33. Classics represented 29% of footwear sales.

Based on the Q1 results, company President and CEO Ron Snyder said that it was “prudent to adopt a more conservative outlook for the remainder of this year” and the company has adjusted its fiscal 2008 projections accordingly. “We have been building inventory and infrastructure to accommodate our projections

,” said Snyder. “We have now taken immediate action to bring costs in line with the revised revenue forecast, and we expect this activity to be completed by the end of Q3 '08.”

CROX is taking a page out of the playbook being used by adidas (see this weeks SEW), Under Armour (SEW_0818) and many other brands. Owned-retail is becoming even more important as they look to liquidate inventory in the U.S. and create a brand image in the international markets. During the first quarter, CROX opened three company-owned stores in Europe. Additionally, three Crocs stores were opened in India, as well as two outlets in the U.S. They ended Q1 with 214 company-owned locations worldwide, including four domestic full priced stores, eight outlet stores, 62 international full priced stores, with six in Europe, 55 in Asia, and one in Canada. They also had 133 domestic kiosks and seven international kiosks, along with 66 licensed stores with 10 locations in Europe, 34 locations in Asia, 6 locations in Mexico, and an additional 16 licensed kiosks in the U.S.

For the balance of the year, the company plans to open full price retail stores in Honolulu, Chicago, San Francisco, Portland and Los Angeles as well as more than 10 outlet stores in the United States. They are also opening four full price and one outlet store in Canada, an additional 10 stores in Europe, and about 15 stores in Asia. The Asian stores were about 16% of that region's total business in the first quarter. Crocs expects to end 2008 with approximately 118 stores and 150 kiosks worldwide.