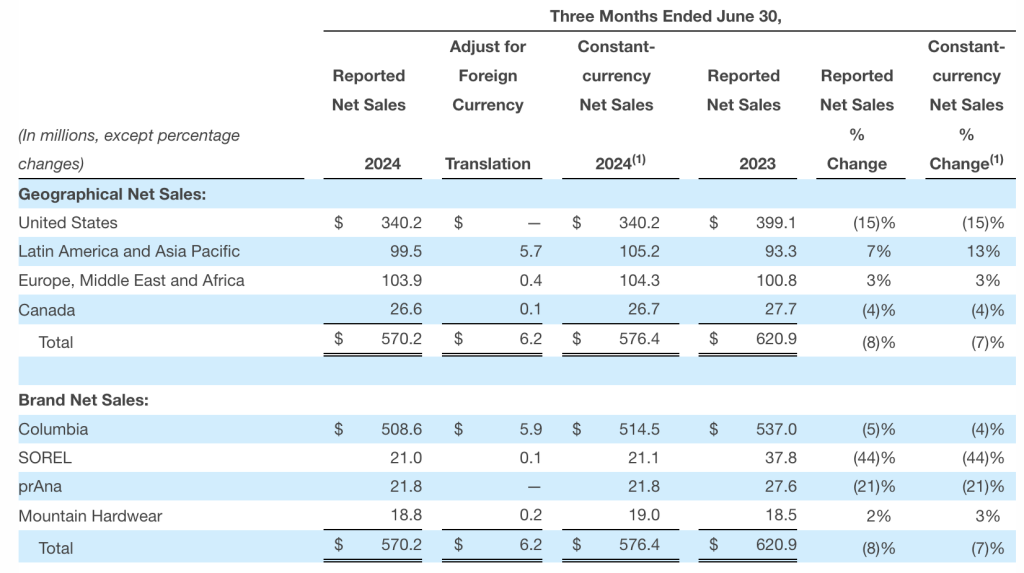

Columbia Sportswear Company reported that second quarter net sales decreased 8 percent, 7 percent constant-currency (CC), to $570.2 million from $620.9 million for the comparable period in 2023. The decline in net sales was said to primarily reflect lower wholesale net sales in the U.S. due to retailer cautiousness, a difficult competitive environment, and generally soft consumer demand.

- Wholesale revenues were down 15 percent for the quarter to $278.4 million, while direct-to-consumer (DTC) inched up 1 percent CC to $291.8 million for the period.

- Apparel,Accessories & Equipment revenues were down 4 percent CC to $464.0 million for the quarter, while Footwear revenues fell 18 percent CC tp $106.2 million for the period.

North America led the world lower as bot the U.S. and Canada both posted negative sales growth for the quarter. From a brand standpoint, the deepest declines came from Sorel and Prana with strong double-digit declines while Columbia brand was down 4 percent CC year-over-year. Mountain Hardwear maintained its growth trajectory, rising 3 percent CC in the quarter versus the year-ago Q2 period.

Second quarter gross margin contracted 270 basis points to 47.9 percent of net sales from 50.6 percent of net sales for the comparable period in 2023. Gross margin contraction was said to primarily reflect the impact of efforts to spur demand and reduce inventory in the U.S., as well as changes in sales provisions, partially offset by lower inbound freight costs.

SG&A expenses were $302.7 million, or 53.1 percent of net sales, compared to $312.5 million, or 50.3 percent of net sales, for the comparable period in 2023. The largest changes in SG&A expenses reportedly primarily reflect lower supply chain and variable demand creation expenses, partially offset by higher direct-to-consumer (DTC) expenses.

Loss from operations was $23.8 million, or negative 4.2 percent of net sales, compared to operating income of $6.2 million, or 1.0 percent of net sales, for the comparable period in 2023.

Interest income, net of $8.3 million, compared to $3.5 million for the comparable period in 2023, reflects higher yields on increased levels of cash, cash equivalents, and investments.

Income tax benefit of $3.2 million resulted in an effective income tax rate of 21.6 percent, compared to income tax expense of $1.2 million, or an effective income tax rate of 12.6 percent, for the comparable period in 2023.

The second quarter net loss amounted $11.8 million, or a loss of 20 cents per diluted share, compared to net income of $8.4 million, or 14 cents per diluted share, for the comparable period in 2023.

The company’s EPS results topped Wall Street estimates, with the per-share loss of 20 cents easily beating expectations for analysts surveyed by Zacks Investment Research for a loss of 31 cents per share. Revenue for the quarter missed Street forecasts.

First Half 2024 Financial Results

Net sales for the first half decreased 7 percent (-6 percent CC) to $1.34 billion from $1.44 billion for the comparable H1 period in 2023.

Gross margin was 49.5 percent of net sales, flat compared to the comparable H1 period in 2023.

SG&A expenses were $652.0 million, or 48.6 percent of net sales, in H1, compared to $659.9 million, or 45.8 percent of net sales, for the comparable period in 2023.

Operating income decreased 67 percent to $20.9 million, or 1.6 percent of net sales, in the first half, compared to operating income of $62.7 million, or 4.3 percent of net sales, for the 2023 first half.

Interest income, net was $17.5 million, in H1, compared to $6.7 million for the comparable H1 period in 2023.

Income tax expense of $8.6 million resulted in an effective income tax rate of 22.0 percent, compared to income tax expense of $15.5 million, or an effective income tax rate of 22.2 percent, for the comparable period in 2023.

Net income decreased 44 percent to $30.6 million, or 51 cents per diluted share, in the 2024 first half, compared to net income of $54.6 million, or 88 per diluted share, for the 2023 first half period.

Balance Sheet as of June 30, 2024

- Cash, cash equivalents, and short-term investments totaled $711.1 million, compared to $302.8 million as of June 30, 2023.

- The company had no borrowings as of either June 30, 2024 or June 30, 2023.

- Inventories decreased 29 percent to $823.6 million, compared to $1.16 billion as of June 30, 2023.

- Cash Flow for the Six Months Ended June 30, 2024

- Net cash provided by operating activities was $108.9 million, compared to $9.7 million for the same period in 2023.

- Capital expenditures totaled $27.8 million, compared to $22.8 million for the same period in 2023.

Share Repurchases for the Six Months Ended June 30, 2024

- The company repurchased 1,414,437 shares of common stock for an aggregate of $110.7 million, or an average price per share of $78.29.

- At June 30, 2024, $234.6 million remained available under Columbia’s stock repurchase authorization, which does not obligate the Company to acquire any specific number of shares or to acquire shares over any specified period of time.

Quarterly Cash Dividend

The Board of Directors approved a regular quarterly cash dividend of 30 cents per share, payable on August 29, 2024 to shareholders of record on August 15, 2024.

Full Year 2024 Financial Outlook

The company’s full year 2024 and third quarter 2024 Financial Outlook are each forward-looking in nature, and the following forward-looking statements reflect our expectations as of July 25, 2024 and are subject to significant risks and business uncertainties, including those factors described under “Forward-Looking Statements” below. These risks and uncertainties limit our ability to accurately forecast results.

- Full Year net sales are expected to decrease 4.0 percent to 2.0 percent (unchanged), resulting in net sales of $3.35 billion to $3.42 billion (unchanged), compared to $3.49 billion in 2023.

- Gross margin is expected to expand 40 basis points to 60 basis points (prior 80 basis points to 120 basis points) to 50.0 to 50.2 percent of net sales (prior 50.4 percent to 50.8 percent) from 49.6 percent of net sales in 2023.

- SG&A expenses, as a percent of net sales, are expected to be 42.4 percent to 43.0 percent (prior 43.0 percent to 43.4 percent), compared to SG&A expense as a percent of net sales of 40.6 percent in 2023.

- Operating income is expected to be $256 million to $288 million (prior $259 million to $291 million), resulting in operating margin of 7.7 percent to 8.4 percent (prior 7.7 percent to 8.5 percent), compared to operating margin of 8.9 percent in 2023.

- Interest income, net is expected to be approximately $28 million.

- Effective income tax rate is expected to be 24.0 percent to 25.0 percent (unchanged).

- Net income is expected to be $215 million to $239 million (prior $217 million to $240 million), resulting in diluted earnings per share of $3.65 to $4.05 (unchanged). COLM said the diluted earnings per share range is based on estimated weighted average diluted shares outstanding of 59.3 million (unchanged).

Foreign Currency

- Foreign currency translation is anticipated to decrease 2024 net sales growth by approximately 70 basis points (prior 20 basis points).

- Foreign currency is expected to have an approximately 7 cents negative impact on diluted earnings per share (prior 4 cents) due to negative foreign currency transactional effects from hedging of inventory production, as well as unfavorable foreign currency translation impacts.

Cash Flows

- Operating cash flow is expected to be at least $350 million (unchanged).

- Capital expenditures are planned to be in the range of $60 million to $80 million (unchanged).

Third Quarter 2024 Financial Outlook

- Net sales are expected to be $927 million to $959 million, representing a decline of 6 percent to 3 percent from $985.7 million for the comparable period in 2023.

- Operating income is expected to be $94 to $107 million, resulting in operating margin of 10.1 to 11.2 percent, compared to operating margin of 13.7 percent in the comparable period in 2023.

- Diluted earnings per share is expected to be $1.27 to $1.43, compared to $1.70 for the comparable period in 2023.

Image courtesy Columbia