The National Retail Federation (NRF) reports that retail sales increased again in August as consumer demand and easing inflation overcame slower job growth, according to the CNBC/NRF Retail Monitor, powered by Affinity Solutions.

“Retail sales data shows that consumers continued to spend on household priorities in August,” commented NRF President and CEO Matthew Shay. “This is despite a slowing labor market that is expected to prompt the Fed to finally lower interest rates in September.”

Shay said that even with slower employment growth, unemployment is near historic lows, and ongoing job and wage gains coupled with lower inflation should keep consumers on a solid footing heading into the holiday shopping season.

“Lower interest rates take time to trickle down and won’t provide an immediate boost but should stabilize the economy,” Shay noted.

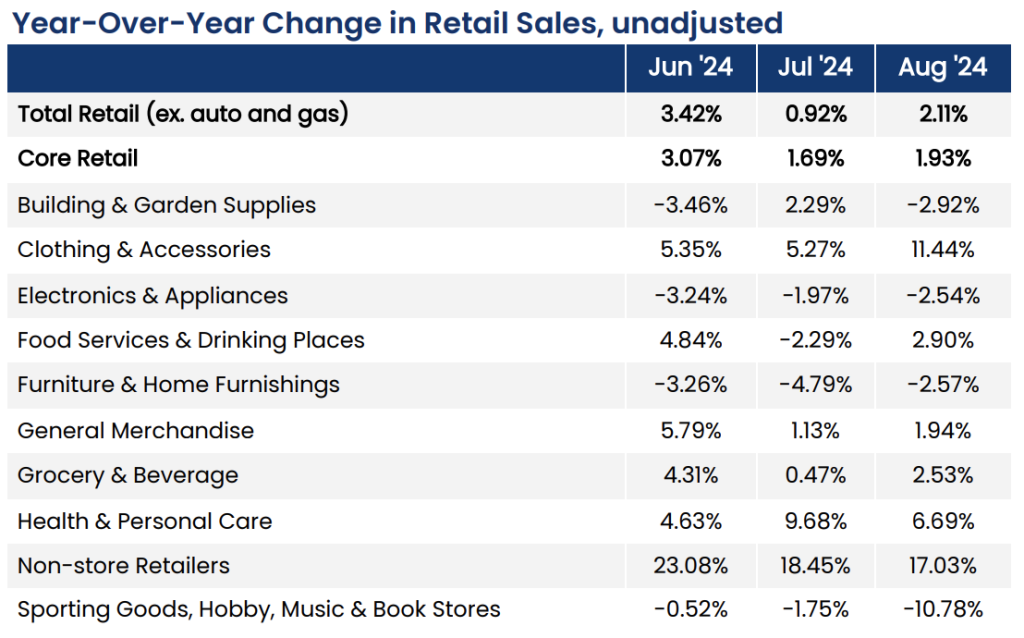

The NRF said total retail sales, excluding automobiles and gas, were up 0.5 percent seasonally-adjusted m/m and up 2.1 percent unadjusted year-over-year (y/y) in August, according to the latest Retail Monitor released on Friday, September 13. That compared with increases of 0.7 percent month-over-month (m/m) and 0.9 percent y/y in the July 2024 report.

The Retail Monitor calculation of Core retail sales, excluding restaurants, automobiles, and gas was up 0.2 percent m/m in August and 1.92 percent y/y versus August 2023; that compared with increases of 1.0 percent m/m and 1.7 percent y/y in July.

For the first eight months of the year (YTD), total sales were up 2.1 percent, and Core retail sales were up 2.3 percent.

The Clothing and Accessories sector, including Footwear retailers, soared in August, jumping 11.4 percent year-over-year after posting year-over-year growth exceeding 5 percent in June and July.

The Clothing and Accessories sector’s August growth was only exceeded by Online business, which jumped 17.0 percent y/y in August. That level of growth was a moderation of the y/y increases in June and July, which grew 23.1 percent y/y and 8.5 percent y/y, respectively. Several retailers reported fiscal second quarter and early August numbers suggesting that customers were more likely to shop in-store than online as the calendar got closer to back-to-school.

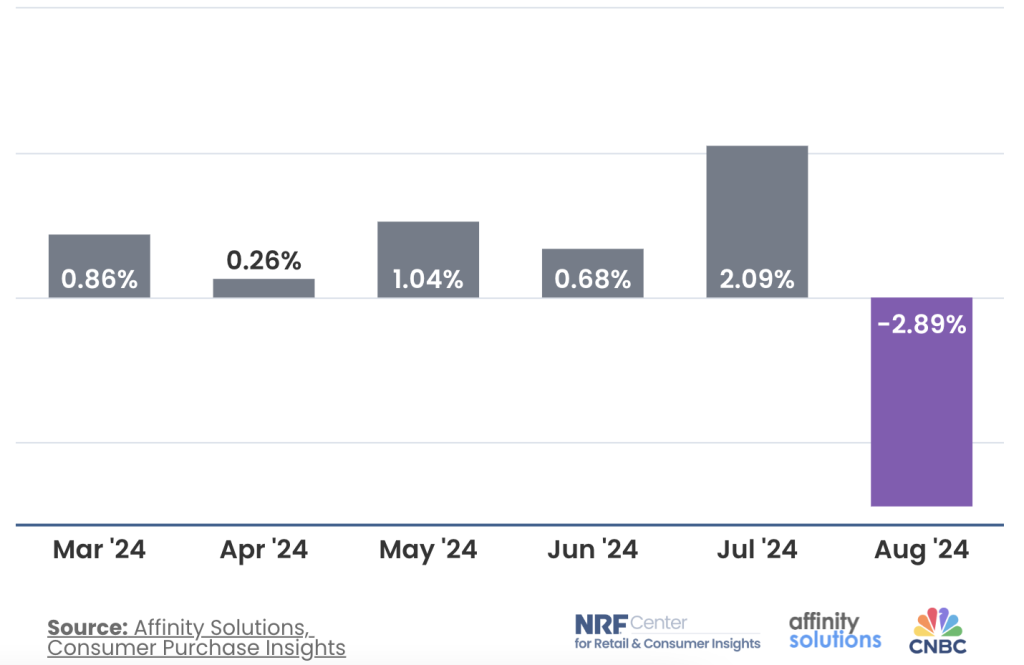

On the other hand, the sector that includes Sporting Goods stores took a hit in August, falling 10.8 percent y/y for the month. Some of this could be explained as early Labor Day cut summer short, a fact that still matters for vacationers across the coasts and lakes region.

Unlike survey-based numbers collected by the Census Bureau, the Retail Monitor uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions and does not need to be revised monthly or annually.

The NRF said August sales were up in five out of nine retail categories on a yearly basis, led by Online sales, Clothing, Footwear and Accessories stores and Health and Personal Care stores. Sales were also up in five categories on a monthly basis. Specifics from key sectors include:

Please note: The Clothing & Accessories sector also includes Footwear retailers.

Sector Notes

SGB Media rounds all variance percentages to the closest tenth of a percent.

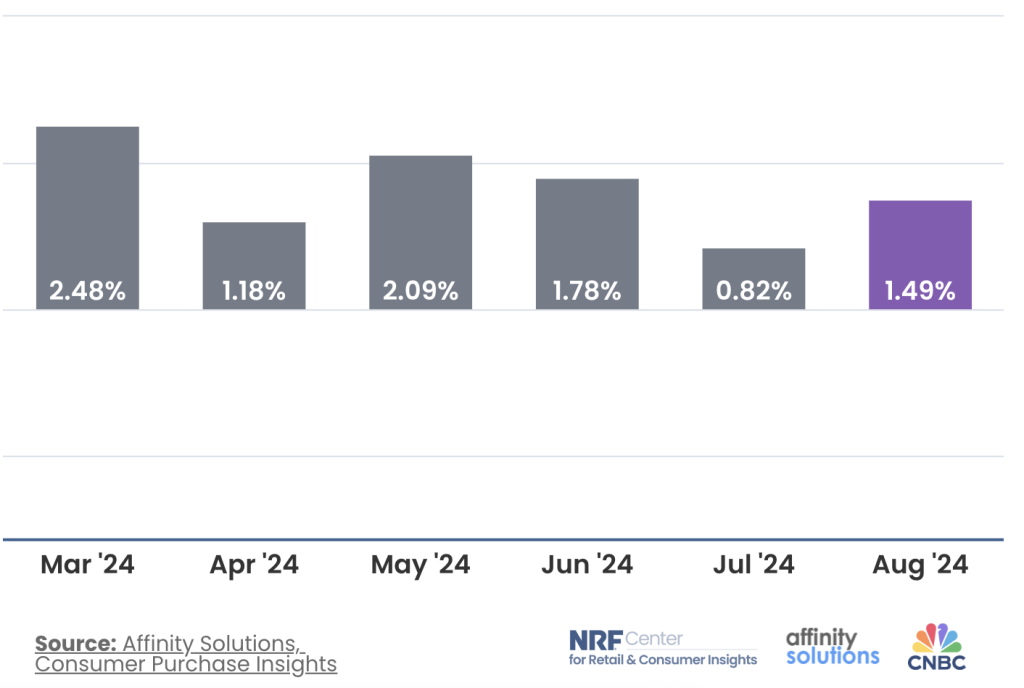

Online and Other Non-Store sales were up 1.5 percent m/m seasonally-adjusted and up 17.0 percent y/y unadjusted.

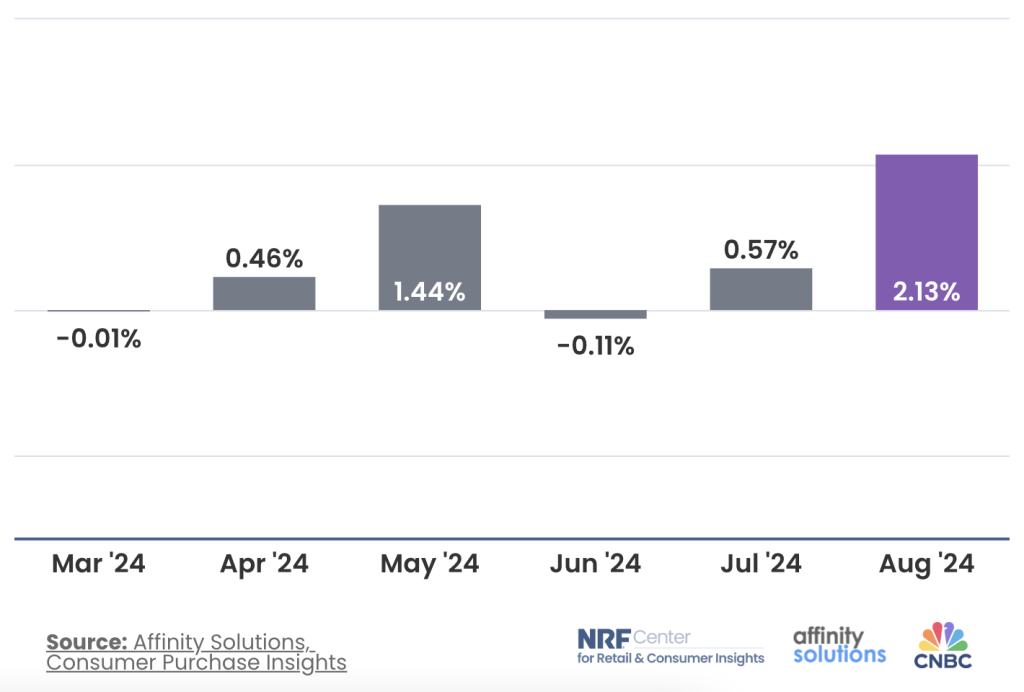

Clothing, Footwear and Accessories stores were up 2.1 percent m/m seasonally-adjusted and up 11.4 percent y/y unadjusted.

Month-over-Month Variances

Sporting Goods, Hobby, Music and Book stores were down 2.9 percent m/m seasonally-adjusted and down 10.78 percent y/y unadjusted.

Month-over-Month Variances

Other Key Sectors

- General merchandise stores were up 0.3 percent m/m seasonally adjusted and up 1.9 percent y/y unadjusted.

- Electronics and appliance stores were down 1.0 percent m/m seasonally adjusted and down 2.5 percent y/y unadjusted.

- Health and personal care stores were up 0.3 percent m/m seasonally adjusted and up 6.7 percent y/y unadjusted.

- Furniture and home furnishings stores were down 0.2 percent m/m seasonally adjusted and down 2.6 percent y/y unadjusted.

- Grocery and beverage stores were up 0.9 percent m/m seasonally adjusted and up 2.5 percent y/y unadjusted.

- Building and garden supply stores were down 1.3 percent m/m seasonally adjusted and down 2.9 percent y/y unadjusted.

To access the full report, go here.

Image courtesy American Eagle