The National Retail Federation (NRF) reported that U.S. retail sales spending slowed again in February after January slowed from December. Still, the latest month posted positive year-over-year growth, according to the CNBC/NRF Retail Monitor for February.

“Consumer spending dipped slightly again in February due to the combination of harsh winter weather and declining consumer confidence driven by tariffs, concerns about rising unemployment and policy uncertainty,” NRF President and CEO Matthew Shay said. “Unease about the probability of inflation and paying higher prices for non-discretionary goods has the value-conscious consumer spending less and saving more. But, for the moment, year-over-year gains reflect an economy with strong fundamentals.”

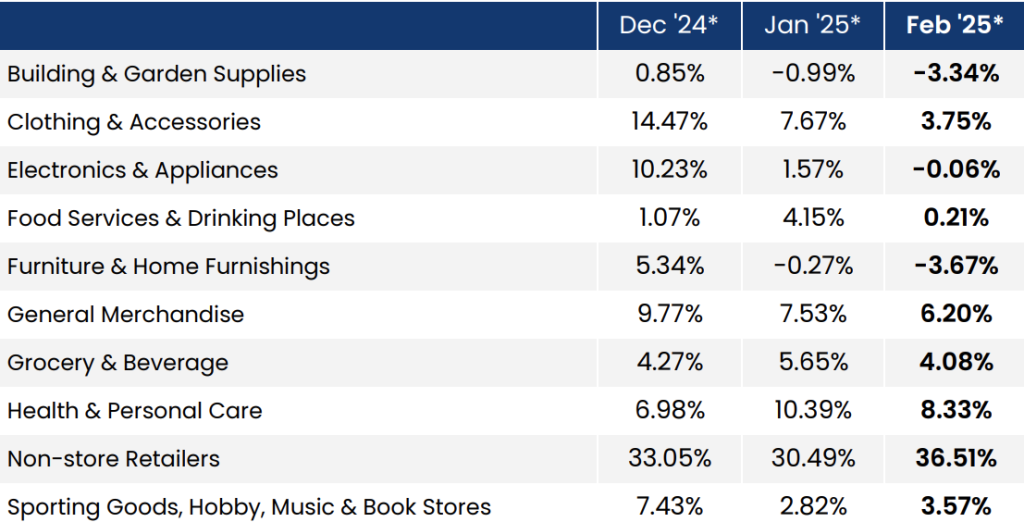

The CNBC/NRF Retail Monitor projected that total retail sales, excluding autos and gas, were down 0.22 percent seasonally-adjusted month-over-month (m/m) but up 3.38 percent unadjusted year-over-year (y/y) in February. That compared with a decrease of 1.1 percent m/m and an increase of 5.4 percent y/y in January.

SGB Media rounds all variance percentages under 1 percent to the closest hundredth of a percent and any variances 1 percent or higher to the closest tenth of a percent.

The CNBC/NRF report’s calculation of Core Retail Sales, excluding restaurants, auto dealers and gas stations, was also down 0.22 percent m/m in February but was up 4.1 percent y/y. That compared with a decrease of 1.3 percent m/m and an increase of 5.7 percent y/y in January.

Total sales were up 4.4 percent y/y for the first two months of the year, and core sales were up 4.9 percent. That compares with 3.6 percent growth for the full year in 2024.

The results came in after the NRF reported that the 2024 holiday selling season was successful, as core retail sales grew 4.0 percent y/y during the period.

“The February monthly downturn came after President Donald Trump announced 10 percent tariffs on goods from China and 25 percent tariffs on goods from Canada and Mexico at the beginning of February,” the NRF observed in the data. “The Canada/Mexico tariffs were immediately delayed by a month, then delayed again for most goods until April 2 last week, but the tariffs on China were doubled to 20 percent.”

The NRF said the University of Michigan’s Index of Consumer Sentiment dropped to 64.7 in February from 71.7 in January, marking the second monthly decline after five months of small gains.

The CNBC/NRF Retail Monitor reportedly uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions to tabulate the report results, which do not need to be revised monthly or annually.

January sales were up in six out of nine categories on a yearly basis, led by Non-store retailers that included E-commerce and Catalog businesses,

Health and Personal Care stores and General Merchandise stores.

The Sporting Goods, Hobby, Music, and Bookstores segment was up 0.9 percent m/m seasonally-adjusted and up 3.6 percent y/y unadjusted after a strong 2.8 percent y/y gain in January and a very strong December trend.

Year-Over-Year Change in Retail Sales, Unadjusted

Download a PDF of the CNBC/NRF Retail Monitor Report for February 2025 here.

Image courtesy NRF, Data and chart courtesy CNBC/NRF