The National Retail Federation (NRF) has reported that U.S. retail sales spending grew again in April after growth in March and declines in January and February. The NRF’s Chief Economist, Jack Kleinhenz, noted this week that those citing top-line GDP figures this spring could be overstating the weakness in the U.S. economy, and the retail trends the last two months appear to support his thesis.

The retail trade association said that many consumers moved up buying products in April to avoid higher prices expected to come with tariffs, while in March, the NRF reported that gains remained moderate as consumers continued to be concerned by the rising tariffs. These somewhat divergent observations reflect the overall feeling of uncertainty in the market that is often cited by retailers and vendors as they lack a clear roadmap for which path the Trump Administration will take.

If the new trade deal announced between the U.S. and the UK on May 8, and the planned meeting between U.S. Treasury Secretary Scott Bessent and his Chinese counterparts in Switzerland this weekend, indicate the direction, the back half may provide more clarity.

“Spending rose again in April, driven largely by consumers continuing to pull purchases forward to stay ahead of tariffs that will inevitably lead to higher prices,” observed NRF President and CEO Matthew Shay. “Despite declines in confidence caused by the economic uncertainty that has come with tariffs, consumer fundamentals remain intact, supported by low unemployment, slower-but-steady income growth, and solid household finances. Consumers maintain their ability to spend and have strong reasons to spend now before tariffs can drive up prices or cause shortages on store shelves,” Shay continued.

SGB Media analysts have argued that for those tracking weekly sales, screaming “tariffs!” each time a week is ahead or behind last year’s levels, the shifting trends are perhaps based more on the shifting calendar rather than tariffs. The Easter holiday, and accompanying Spring Break, shifted from March in 2024 to April in 2025, and that alone was enough to throw off the months. A year-over-year analysis of the combined two-month period would yield a better view of the trends.

The CNBC/NRF Retail Monitor estimated that Total Retail Sales, which excludes autos and gas, were up 0.72 percent seasonally-adjusted m/m and up 6.8 percent unadjusted y/y in April. That compared with increases of 0.60 percent m/m and 4.8 percent y/y in March.

SGB Media rounds all variance percentages under 1 percent to the closest hundredth of a percent and any variances 1 percent or higher to the closest tenth of a percent.

The CNBC/NRF report’s calculation of Core Retail Sales, excluding restaurants, auto dealers and gas stations, was up 0.90 percent m/m in April and up 7.1 percent y/y versus April 2024. That compared with March 2025 increases of 0.40 percent m/m and an increase of 5.1 percent y/y.

Total sales were up 5.1 percent y/y for the first four months of the year, and core sales were up 5.5 percent.

“In addition to strong tariff-driven spending, year-over-year comparisons were likely boosted because Easter fell in April this year after falling in March last year,” the NRF observed.

The CNBC/NRF Retail Monitor reports using actual, anonymized credit and debit card purchase data compiled by Affinity Solutions to tabulate its report results, which it need not revise monthly or annually.

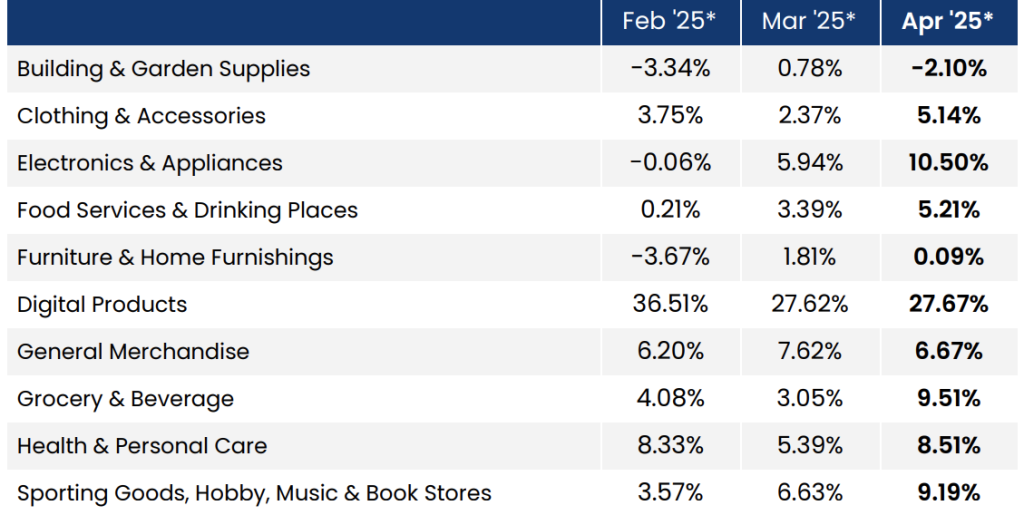

The NRF said April sales were up in every category but Building & Garden Supplies on a year-over-year basis, led by Digital Retailers, Electronics & Appliances, Grocery & Beverage, and the Sporting Goods, Hobby, Music, and Bookstores segment.

Growth in the Clothing, Footwear and Accessories Stores sector accelerated from the March trend, while the sector that includes Sporting Goods stores was up 9.2 percent y/y unadjusted after a strong 6.6 percent y/y gain in March.

Year-Over-Year Change in Retail Sales, Unadjusted

Download the CNBC/NRF Retail Monitor Report for April 2025, here.

Image courtesy Zara, Data/Chart courtesy CNBC/NRF Retail Monitor