The National Retail Federation (NRF) reported that U.S. retail sales “jumped strongly” in December, partly boosted by two busy holiday shopping days during Thanksgiving weekend shifting into the year’s final month. That observation and many others are in the latest CNBC/NRF Retail Monitor Report powered by Affinity Solutions released by the NRF.

“Growth rebounded strongly in December from a misleadingly weaker November as the result of the final two days of the busy Thanksgiving holiday weekend being included in December’s data,” said NRF President and CEO Matthew Shay. “Calendar issues aside, value-conscious customers showed enthusiasm for celebrating loved ones with the right gifts at the right price points for their budgets in December.

“Households are in good financial shape amid low unemployment, growing income and continued deceleration of inflation for goods. We remain confident in our 2024 holiday forecast and retail sales projection for the year,” continued Shay.

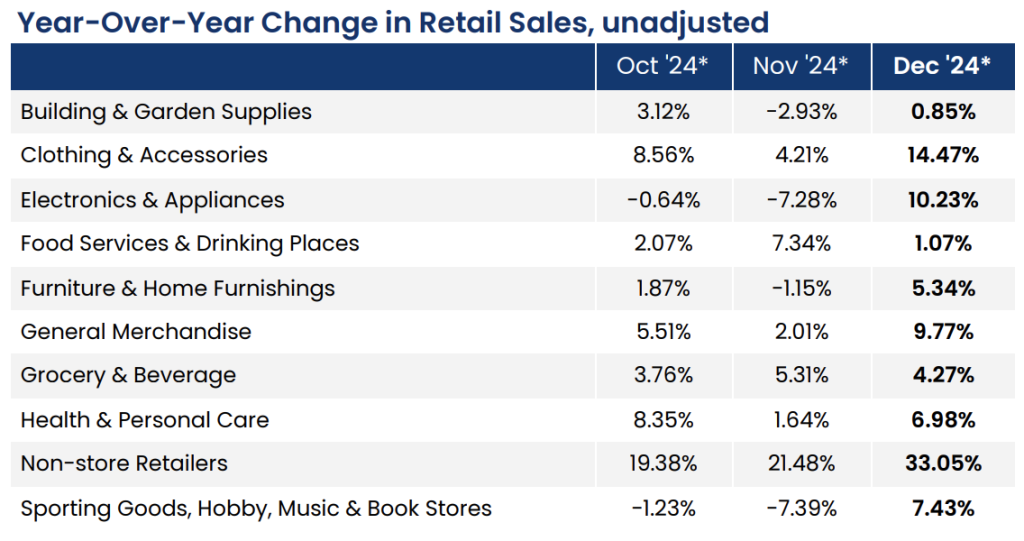

The December CNBC/NRF Retail Monitor Report indicates that total retail sales, excluding autos and gas, were up 1.7 percent seasonally-adjusted month-over-month (m/m) and rose 7.2 percent unadjusted year-over-year (y/y) in December. That compared with increases of 0.15 percent m/m and 2.4 percent y/y in November.

SGB Media rounds all variance percentages under 1 percent to the closest tenth of a percent.

The December CNBC/NRF Retail Monitor Report calculation of Core Retail Sales, excluding restaurants in addition to automobile dealers and gasoline stations, was up 2.2 percent m/m for the month and up 8.4 percent y/y. That compared with a decrease of 0.19 percent m/m and an increase of 1.4 percent y/y in November.

The NRF said the December numbers reflect that the Sunday after Thanksgiving and Cyber Monday both fell in December rather than November because of the later-than-usual Thanksgiving in 2024, “likely giving a meaningful boost to December.”

The Non-Store (Internet and Catalog) channel kept the energy growing in December, with sales surging over 33 percent year-over-year, accelerating from a growth of nearly 22 percent y/y in November.

Other positive sales trends came from Clothing, Footwear and Accessories stores, which saw double-digit y/y growth, and General Merchandise stores, which were up nearly 10 percent year-over-year.

The Sporting Goods sector (Hobby, Music and Bookstores) posted a 7.4 percent increase y/y, flipping the script from November when sales fell by 7.4 percent versus the prior-year November period.

The results follow the NRF’s forecast that 2024 retail sales for the full year and 2024 Holiday retail sales season, November and December), excluding autos, gas and restaurants, would each increase between 2.5 percent and 3.5 percent over 2023.

The NRF bases its forecast on data collected by the U.S. Census Bureau. The organization will announce the final number when the Census Bureau releases December’s results on Thursday, January 16, 2025.

Image courtesy Macy’s

Image courtesy Macy’s