Cherokee Global Brands reduced its guidance for this year and offered a soft outlook for fiscal 2019 while noting that the retail climate has impacted growth across many of its brands.

For the current year representing fiscal 2018, gross profit is now expected to be in the range of $36 million to 38 million, down from $39 million to $41 million previously. Adjusted EBITDA is expected to be in the range of $7 million to $9 million versus a range of range of $10 million to $12 million previously.

In its initial guidance for fiscal 2019, Cherokee said it expects gross profit in the range of $33 million to $37 million and adjusted EBITDA in the range of $7 million to $9 million.

On a conference call with analysts, Jason Boling, CFO, said its updated guidance accounts for its year-to-date performance, specifically the retail headwinds encountered as it transitioned its namesake Cherokee brand from the Target chain to new licensing partners.

Tony Hawk licensing revenue in Canada, while growing with the year-over-year increase of 20 percent, is still behind original projections. The bankruptcy of Sears Canada combined with the overall retail environment also impacted its revenue forecast.

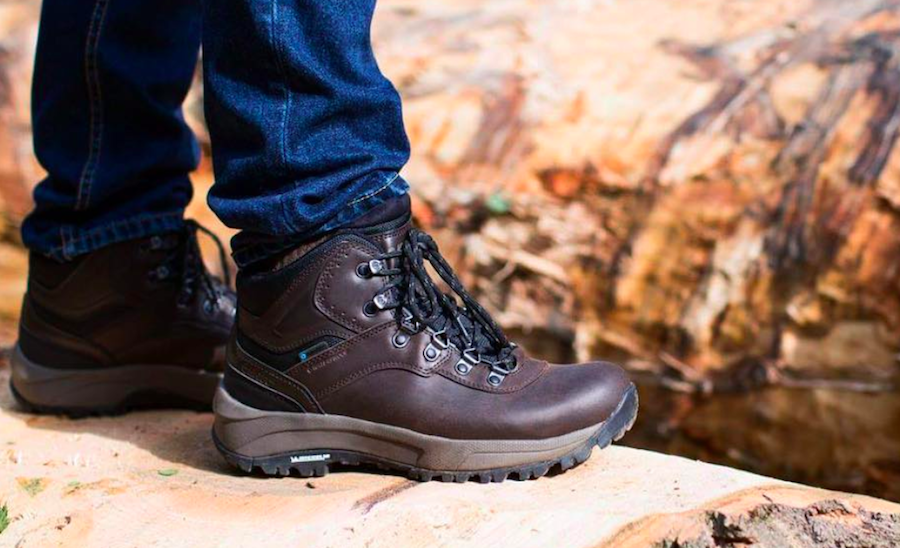

Hi-Tec’s transition from its legacy operating model to its new licensing model is also being affected by the challenging retail climate. Finally, the transition of the Flip Flop Shops business model is driving slower franchise shop openings as well as leading to the closing of underperforming franchise locations.

The net loss for quarter came to $2.5 million, or 18 cents per share, compared to a net loss of $873,000, or 10 cents, a year ago. Excluding charges related to the Hi-Tec integration and certain accounting, legal and professional fees, the adjusted non-GAAP net loss for the quarter was $740,000, or 5 cents per share, compared to net income of nearly $700,000, or 8 cents, in the prior-year period.

Consolidated revenues were $11 million, which are comprised of royalty revenues and indirect product sales. Royalty revenues were $7.9 million in the period compared with $6.5 million in the prior-year period.

On the call, Henry Stupp, CEO, highlighted its agreement reached in November with Cerberus that amended its loan agreement. The new banking agreement is expected to allow the company to move its debt from current to long-term at year end. Said Stupp, “Our amended agreement with Cerberus enhances our ability to focus on the future sustainable and profitable growth of our four brand including Cherokee, Tony Hawk, Hi-Tec and Magnum.”

He noted that the company appointed John McClain, a former c-level executive for several publicly traded and apparel enterprises, as chairman of its audit committee, further shore up its operating and financial functions. A strategic review of its current operations is being conducted with a particular emphasis on reducing expenses and growing cash flow.

But the company is also taking several steps to jumpstart growth, including the hiring in October of Mark Conway as chief branding revenue officer and the development of new compelling structured marketing initiatives to enhance its retail placement, sell-through and visibility of its brands in the market.

Said Stupp, “We will continue to strengthen our brands and the value proposition associated with our new unique 363 platform that emphasize this product development, marketing and brand expansion and consumer insights.”

Regarding its brands, Stupp said Hi-Tec, acquired about a year ago, was “undoubtedly more costly and time-intensive than we originally forecasted.” But the integration is complete and new financial leadership should support more normalized operating expenses in the business going forward. Hi-Tec is expected to transition to solely a royalty model in early fiscal 2019.

In the third quarter, gross profit for Hi-Tec was $4.9 million, led by the strong performance of its Hi-Tec Magnum and Intersector brands

In Europe, Hi-Tec’s core licensees are now distributing products in over 90 countries and saw a “very successful” fall launch of men’s and women’s Hi-Tec apparel and accessories.

In the U.S. and Canada, Hi-Tec is in the midst of expanding the product offering with the launch of men’s and women’s apparel and accessories slated for late summer, early fall 2018. The product is expected to launch in leading department stores, specialty stores, outdoor retailers and expanded e-commerce next summer.

The Intersector brand’s sales are up more than 50 percent year-over-year at Wal-Mart and will be expanding to categories such as cold weather accessories and essentials, including socks.

Cherokee delivered royalty revenue of $2.6 million in the quarter a decrease of $1.5 million from the prior year period, largely due to the transition from Target. Cherokee recently reached an agreement for the Pan-European distribution of the Cherokee brand. Cherokee apparel and accessories for men, women and children will be offered in over 10,000 doors in approximately 30 countries.

In North America, Cherokee continues to make progress in the multi-category launch in the Cherokee brand in the US although finding partners has been “slower than we had originally hoped.”

Cherokee formed a partnership with Save the Children to support its positioning.

“Today’s retail and consumer environment necessitates that we continue to evolve our playbook and retail customers through the channels and mediums that they rely on the most,” said Stupp. “While growing our presence through digital and social media, emphasizing the story-telling nature of the Cherokee brand and our focus on families and communities for a partnership with saving the children.”

Tony Hawk delivered revenue of $1.4 million in the quarter, up 10 percent over the prior-year period. Strong increases were seen in both in both domestic and international markets

At the end of the third quarter Hawk product was distributing approximately 1,500 doors in the U.S. and over the next year is expected to reach over 3,000 points of distribution in addition to a growing e-commerce presence. The company feels the brand remains historically underrepresented in specialty, regional department stores and mass market retailers and expects to expand its online presence at amazon.com and walmart.com.

In the U.S., Tony Hawk offers a wide assortment of men’s and boys’ apparel, footwear and accessories. The brand is in discussion to add new licensees for additional product categories including essentials in both domestic and international markets.

Flip Flop Shops’ sales of $390,000 in the quarter represented a 10 percent increase. Same-store sales grew 5 percent. Seven under-performing stores were closed in the first half.

Stupp said the current year has been “disappointing” for Flip Flop Shops but the company remains confident it will be able to increase store openings through a combination of shop in shops, freestanding stores, its new floating retail concept and by partnering with new master franchisees in new territories. Flip Flop Shops recently signed a master franchise agreement in India and is finalizing deals in for Spain and Portugal.

The Magnum footwear brand, also acquired in the Hi-Tec purchase, adds new multi-year government contracts that will add revenue in fiscal 2019.

“In summary, despite the challenges we face this year. We are pleased with the progress that we have made over the past few months, through the actions taken, we have meaningfully improved our financial liquidity, short up our financial controls and position the company for future profitable growth,” said Stupp.

He added, “We have a clear vision for our future and are squarely focused on our high growth brand opportunities. As we look ahead we will continue to scale our portfolio brands from category, channel and geographic diversification. We’ll maintain discipline around operating efficiency and productivity as well as leveraging our free cash flow to accelerate the repayment of long-term debt.”

Photo courtesy Hi-Tec