Callaway Golf Co. reported first-quarter net sales decreased 14 percent to $442 million from the year-ago quarter due to the negative impact of the COVID-19 pandemic on both the golf equipment and soft goods operating segments globally. The total beat Wall Street’s expectations by $1.6 million

The decrease was partially offset by an increase in net sales in Japan and Korea as well as with Callaway’s TravisMathew business. Changes in foreign currency rates had a $4 million negative impact on first-quarter 2020 net sales.

First-quarter 2020 earnings per share of 30 cents were down from 50 cents in the first quarter of 2019, in-line with Wall Street’s projections. Non-GAAP EPS of 32 cents beat by 2 cents.

The company also announced the completion on May 4 of the issuance of 2.75 percent Convertible Senior Notes due 2026, raising net proceeds of approximately $250 million after certain transaction costs.

“We are pleased that during the first quarter of 2020 our golf equipment market shares remained strong in all of our major markets and that we were able to deliver a profitable quarter despite the negative impact of COVID-19,” said Chip Brewer, president and CEO. “In fact, through early March we were on track for another record sales year, which would have made it our fourth consecutive record year. While the COVID-19 pandemic will have a significant impact on our results in the short-term, we believe we will be well-positioned to emerge from this pandemic. Our golf and outdoor lifestyle businesses support an active and healthy lifestyle that is compatible with a world of social distancing. We are also pleased that we are beginning to see some signs of recovery, particularly in those regions that were first affected.”

Brewer continued, “The issuance of our convertible notes was well received by the market, allowing us to obtain favorable pricing and terms. This additional liquidity will provide a comforting backstop in the event that the duration or impact of the COVID-19 pandemic is longer or more severe than anticipated. I want to emphasize, however, that having this additional liquidity will not lessen our resolve for, and we remain committed to, maintaining our disciplined approach to managing capital and expenses. We believe that this additional liquidity, together with the strength of our brands, our product and geographic diversity, and the operational improvements we have made to date, will enable us to create shareholder value as we emerge from this pandemic.”

Summary of First Quarter 2020 Financial Results

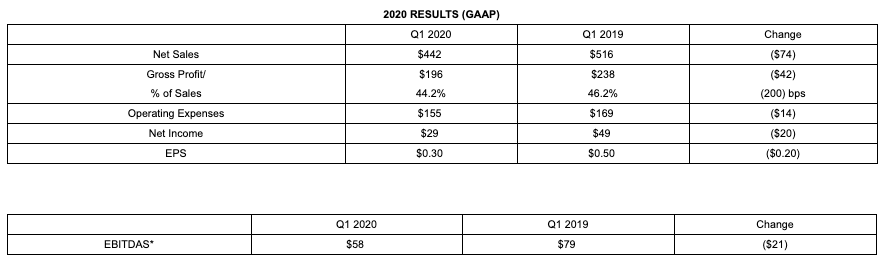

The company announced the following financial results for the first quarter of 2020 (in millions, except EPS):

For the first quarter of 2020, the company’s net sales decreased $74 million (-14 percent) to $442 million, compared to $516 million for the same period in 2019. This decrease reflects the negative impact of the COVID-19 pandemic on both the golf equipment and soft goods operating segments globally. This decrease, however, was partially offset by an increase in net sales in Japan and Korea as well as in our TravisMathew business, for the same period despite the impact of the COVID-19 pandemic. Changes in foreign currency rates had a $4 million negative impact on first-quarter 2020 net sales.

For the first quarter of 2020, the company’s gross margin decreased 200 basis points to 44.2 percent compared to 46.2 percent for the first quarter of 2019. This decrease is primarily attributable to the impact of the COVID-19 pandemic, as well as the negative impact of changes in foreign currency rates, increased tariffs on imports from China, and non-recurring redundant costs associated with transitioning the company’s North American distribution center to a new facility. The gross margins in 2019 were adversely impacted by non-cash purchase accounting adjustments related to the Jack Wolfskin acquisition as set forth in the tables attached to this release.

Operating expenses decreased $14 million to $155 million in the first quarter of 2020 compared to $169 million for the same period in 2019. This decrease was generated by the cost reduction actions the company began in March in response to the COVID-19 pandemic, lower variable expenses associated with the reduced sales and by a reduction in non-recurring acquisition and transition costs related to the Jack Wolfskin acquisition.

First-quarter 2020 earnings per share decreased $0.20 to $0.30, compared to $0.50 for the first quarter of 2019. Earnings per share in 2020 includes $0.02 of non-recurring costs related to the transition to the company’s new distribution facility as well as non-cash amortization expense related to the company’s acquired intangible assets. Earnings per share in 2019 includes $0.13 of non-recurring expenses related to the Jack Wolfskin acquisition as well as non-cash amortization expenses related to the company’s acquired intangible assets.

Convertible Notes Offering

On May 4, 2020, the company consummated its issuance of 2.75 percent Convertible Senior Notes due 2026. The offering was oversubscribed, which allowed the company to increase the size of its $200 million planned offerings to $225 million. As is customary in transactions of this type, the company also granted the initial purchasers the option to purchase an additional 15 percent of convertible notes, which has already been exercised. As a result, the aggregate principal amount of the notes issued was approximately $259 million and the total net proceeds to the company were approximately $250 million after certain transaction costs. The company is bullish on its future prospects and therefore used approximately $32 million of the net proceeds to pay the cost of certain capped call transactions, which are generally expected to reduce the potential dilution to shareholders upon any conversion of the notes. The company intends to use the balance of the proceeds for working capital and other general corporate purposes.

Full-Year 2020

The company previously reported that due to the uncertain duration or full impact of the COVID-19 pandemic, the company is no longer providing financial guidance at this time.

Photo courtesy Calloway/TravisMathew