Callaway Golf Company increased its full year 2017 net sales and earnings guidance after reporting third-quarter profits increased significantly on 30 percent revenue growth.

In the third quarter of 2017, as compared to the same period in 2016, the company’s net sales increased $56 million (30 percent) to $244 million. This increase was led by increases in all operating segments, namely Golf Clubs (+21 percent), Golf Balls (+20 percent), and Gear, Accessories and Other (+72 percent) as well as increases in each reporting region, namely the United States (+33 percent), Europe (+23 percent), Japan (+28 percent), Rest of Asia (+28 percent), and other countries (+23 percent). The increase in the Golf Clubs and Golf Balls segments reflects the continued success of the company’s EPIC line of products as well as the Chrome Soft golf ball franchise. The increase in Gear, Accessories and Other primarily reflects the successful acquisitions of the OGIO and TravisMathew brands which were completed in 2017.

As a result of this significant increase in sales, as well as a 110 basis point improvement in gross margins, the company recognized a significant improvement in profitability during the third quarter of 2017. Due to the seasonality of the company’s business, the company often reports a loss for the third quarter. However, in the third quarter of 2017, the company reported an $11 million increase in operating income to $6 million as compared to an operating loss of ($5) million in the third quarter of 2016. Furthermore, the company’s diluted earnings per share increased 9 cents to 3 cents for the third quarter of 2017 compared to a (6 cents) loss per share for the comparable period of 2016.

“Our third quarter results continue what has been a tremendous year for Callaway,” commented Chip Brewer, President and Chief Executive Officer of Callaway Golf company. “On a year-to-date basis compared to the same period in 2016, our sales have increased $150 million (21 percent), our gross margins have increased 130 basis points, and our Adjusted EBITDA has increased 69 percent. Furthermore, our success over the last couple of years has allowed us to reinvest in our business, including investments in our golf ball plant, and in sales, marketing and research and development, and it has provided us with the wherewithal to acquire the OGIO and TravisMathew brands. We believe these investments and acquisitions will provide benefits for years to come.”

“Looking forward, we are pleased that our year-to-date performance has allowed us to increase our full year sales and earnings guidance,” continued Brewer. “We also continue to be cautiously optimistic about the golf industry overall, thanks to what we believe are improving fundamentals. Lastly, our brand momentum remains strong and we believe we are the No. 1 club and No. 1 hard goods market share brand in every major region around the world.”

Summary Of Third Quarter 2017 Financial Results

For the third quarter of 2017, the company’s net sales increased $56 million to $244 million compared to $188 million for the same period in 2016. The 30 percent increase in net sales is attributable to the strength of the company’s 2017 product line, including continued success of the current year EPIC driver and fairway woods, increased golf ball sales, and increased net sales of gear, accessories and other primarily as a result of the company’s recent acquisitions of OGIO and TravisMathew. For the fourth consecutive quarter, net sales increased in all major regions and reflected market share gains in those regions.

For the third quarter of 2017, the company’s gross margin was 43.1 percent compared to third quarter 2016 gross margin of 42 percent. The 110 basis point increase was primarily due to a favorable shift in product mix toward the higher margin EPIC woods and irons combined with overall higher average selling prices.

Operating expenses increased $15 million to $99 million in the third quarter of 2017 compared to $84 million for the same period in 2016. This increase is primarily due to the addition in 2017 of operating expenses from the consolidation of the OGIO and TravisMathew businesses, higher variable expense due to the increase in sales and $3 million in TravisMathew and OGIO non-recurring deal-related expenses.

Third quarter 2017 earnings per share was 3 cents, compared to a loss per share of (6 cents) for the third quarter of 2016. On a non-GAAP basis, which excludes the impact of the non-recurring OGIO and TravisMathew deal-related expenses and applies an estimated tax rate of 38.5 percent to 2016 pre-tax income as discussed above, the company would have reported earnings per share for the third quarter of 2017 of 5 cents, compared to a loss per share of (3 cents) for the third quarter of 2016.

Summary Of First Nine Months 2017 Financial Results

For the first nine months of 2017, the company’s net sales increased $150 million to $857 million compared to $707 million for the same period in 2016. The 21 percent increase in net sales is attributable to the strength of the company’s 2017 product line, including continued success of the current year EPIC driver and fairway woods, increased golf ball sales, and increased gear, accessories and other primarily as a result of the company’s acquisitions of TravisMathew, OGIO and the company’s apparel joint venture in Japan which was formed in July 2016. In the first nine months of 2017, net sales increased in all major regions and reflected market share gains in those regions.

For the first nine months of 2017, the company’s gross margin increased to 46.8 percent compared to 45.5 percent for the same period in 2016. The 130 basis point increase was primarily due to a favorable shift in product mix toward the higher margin EPIC woods and irons combined with overall higher average selling prices, less discounting and lower promotional activity.

Operating expenses increased $40 million to $301 million in the first nine months of 2017 compared to $261 million for the same period in 2016. This increase is primarily due to the addition in 2017 of operating expenses from the Japan apparel joint venture (which was formed in July 2016), higher variable expense due to the increase in sales and the consolidation of the OGIO and TravisMathew businesses, as well as $10 million in TravisMathew and OGIO non-recurring deal-related expenses.

The first nine months 2017 earnings per share was 62 cents, compared to 70 cents for the first nine months of 2016. The decrease on a GAAP basis was caused by the $10 million of TravisMathew and OGIO non-recurring deal-related expenses in the first nine months of 2017, the $18 million Topgolf gain in the second quarter of 2016 and the difference in effective tax rates as the company did not recognize U.S income tax in the first nine months of 2016 due to the company’s prior valuation allowance. On a non-GAAP basis, which excludes the impact of the TravisMathew and OGIO non-recurring expenses, excludes the Topgolf gain and applies an estimated tax rate of 38.5 percent to 2016 pre-tax income as discussed above, the company would have reported earnings per share for the first nine months of 2017 of 69 cents, compared to earnings per share of 34 cents for the first nine months of 2016.

Business Outlook For 2017

Basis for 2017 Non-GAAP Estimates. The company’s 2017 non-GAAP estimates exclude non-recurring deal-related expenses for the TravisMathew and OGIO acquisitions, which are estimated to be approximately $12 million for full year 2017. The amount incurred in the first nine months of 2017 was $10 million, which was in line with the company’s expectations.

Basis for 2016 Pro Forma Results. In order to make the 2017 guidance more comparable to 2016, as discussed above, the company has presented 2016 results on a pro forma basis by excluding from 2016 the prior 11 cents per share after-tax Topgolf gain. Furthermore, the company excluded from full year 2016 the $1.63 per share non-recurring benefit from the reversal of most of the deferred tax valuation allowance and applied an actual 41.3 percent tax rate for 2016.

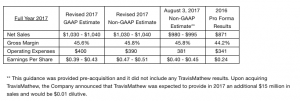

Given the company’s strong financial performance during the third quarter of 2017 and the closing of the TravisMathew acquisition, the company is increasing its full year financial guidance as follows (in millions, except gross margin and EPS):

The company currently estimates that its 2017 gross margin will be in-line with the prior estimate. The company estimates that its 2017 non-GAAP operating expenses will be $9 million higher than previous guidance due primarily to the addition of the TravisMathew business and there also will be slightly higher variable expense related to the projected increased sales.

The company increased its 2017 non-GAAP earnings per share guidance to 47 cents to 51 centsdue to the projected increase in net sales. The company’s 2017 earnings per share estimate assumes a tax rate of approximately 34.5 percent and a base of 96.5 million shares.

Photo courtesy Callaway Golf