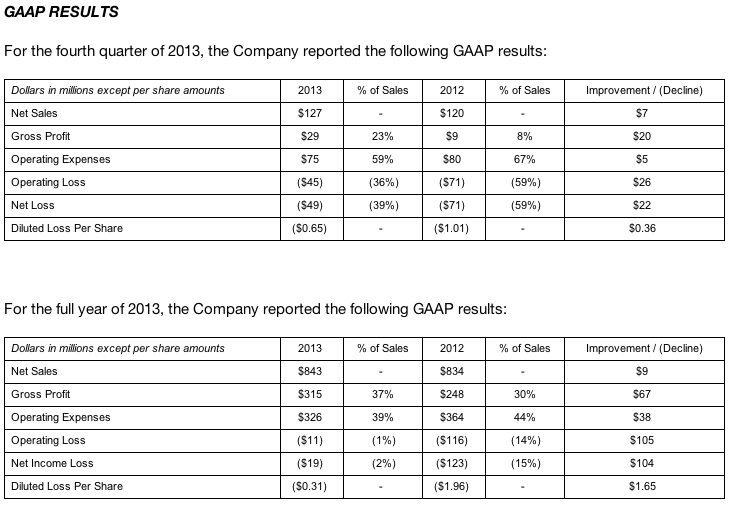

Callaway Golf Company shrunk its loss in the fourth quarter, to $49 million, or 65 cents a share, from $71 million, or $1.01, in the same period a year ago. Revenues grew 5.8 percent to $127 million from $120 million.

Led by a more than $55 million (28 percent) increase in driver and fairway woods sales, the company's full year results include sales growth as well as significant improvements in gross margins and operating expenses. As a result, the company's operating income/loss improved by $105 million to a loss of $11 million compared to a loss of $116 million in 2012, and on a non-GAAP basis was profitable for the first time in several years. Given this significantly improved financial performance, along with the initial trade reception to the company's 2014 product line, the company's annual guidance announced today predicts a return to profitability in 2014 on a GAAP basis.

The company achieved these financial results despite a late start to the golf season in the Americas and Europe due to weather, adverse changes in foreign currency rates, and a significantly reduced base business resulting from the 2012 sale of the Top-Flite and Ben Hogan Brands and the transition to a licensing arrangement for apparel and footwear in North America. As compared to 2012, the sale of these brands and licensing arrangements negatively impacted 2013 sales by approximately $57 million for the full year (approximately $4 million for the fourth quarter). In addition, as compared to 2012, changes in foreign currency rates negatively affected 2013 net sales by approximately $40 million for the full year (approximately $8 million for the fourth quarter). Unfortunately, these factors mask the strength of the company's improved performance of its current business. For example, compared to 2012, on a constant currency basis, the company's current business, which excludes the sold or licensed brands and businesses, actually achieved 14 percent sales growth for the full year of 2013 (17 percent sales growth for the fourth quarter of 2013). Overall, these results reflect not only the continued success of the company's turnaround plan but also the increased hard goods market share and brand momentum the company experienced in 2013.

NON-GAAP FINANCIAL RESULTS

In addition to the company's results prepared in accordance with GAAP, the company has also provided additional information concerning its results on a non-GAAP basis. The non-GAAP results exclude charges related to the company's previously announced cost-reduction initiatives and the gain on the sale of the Top-Flite and Ben Hogan brands. The non-GAAP results are also based upon an assumed tax rate of 38.5 percent. The manner in which the non-GAAP information is derived is discussed in more detail toward the end of this release and the company has provided in the tables to this release a reconciliation of this non-GAAP information to the most directly comparable GAAP information.

For the fourth quarter of 2013, the company reported the following non-GAAP results:

“We are pleased with our financial results during the first full year of our new operating model,” commented Chip Brewer, President and Chief Executive Officer. “Despite challenging market conditions throughout much of the year, we were able to grow sales of our current business, on a constant currency basis, by 14 percent. This sales growth, together with the benefits resulting from the many actions we have taken this year to improve our operations, have a resulted in a $74 million improvement in non-GAAP operating income and even more on a GAAP basis. In fact, this year we achieved positive operating income on a non-GAAP basis for the first time since 2008, which is an important milestone in our turnaround and clear evidence we are on the right track.”

“We have made great progress to date in our turnaround,” continued Mr. Brewer. “In addition to refocusing our business on golf equipment and more performance-oriented products, leveraging our strengths in research and development, and changing our approach to sales and marketing, we have also retired all of our preferred stock, increased our presence on tour, and completed the transition of our golf ball and golf club manufacturing platforms. The progress we made continued through the fourth quarter with improvements in sales, gross margins, and operating expenses. We believe that this continued progress and the initial positive trade reception to our 2014 product line position us for a good start to the new golf season and a return to creating shareholder value in 2014.”

Business Outlook

Although the company in recent years has provided guidance on a pro forma basis, for 2014 the company has provided guidance on a GAAP basis as it has completed its previously announced cost reduction initiatives and it does not currently foresee any significant one-time charges in 2014. The company's GAAP financial guidance is based upon a forecasted income tax provision, taking into account the company's deferred tax valuation allowance, and is not based upon an assumed tax rate as was the case with prior non-GAAP estimates.

The company provided the following 2014 full year estimated financial guidance on a GAAP basis as follows:

- Based upon foreign currency rates at the beginning of the year, net sales for the full year 2014 are currently estimated to range from $880 to $900 million, compared to $843 million in 2013. Any changes during the year to the foreign currency rates would affect net sales and the company's estimates.

- Gross margins are estimated to improve to approximately 41.7 percent, compared to 37.3 percent in 2013. These improvements are expected to result from the positive full year impact of the many supply chain initiatives implemented as part of the turnaround strategy as well as anticipated improved pricing and mix of full price product sales.

- Operating expenses are estimated to be approximately $345 million, compared to $326 million in 2013. The increase in operating expenses is due to a planned increase in investments in tour and marketing, higher variable sales related expenses, and inflationary pressures.

- Pre-tax income is estimated to range from $15.0 to $19.0 million, with a corresponding tax provision of approximately $6.5 million. On a comparable GAAP basis, pre-tax income in 2013 was a loss of $13.3 million with a corresponding tax provision of $5.6 million.

- Fully diluted earnings per share is estimated to range from $0.12 to $0.16 per share on a base of 78.0 million shares, compared to a 2013 GAAP loss per share of $0.31 on a base of 72.8 million shares.