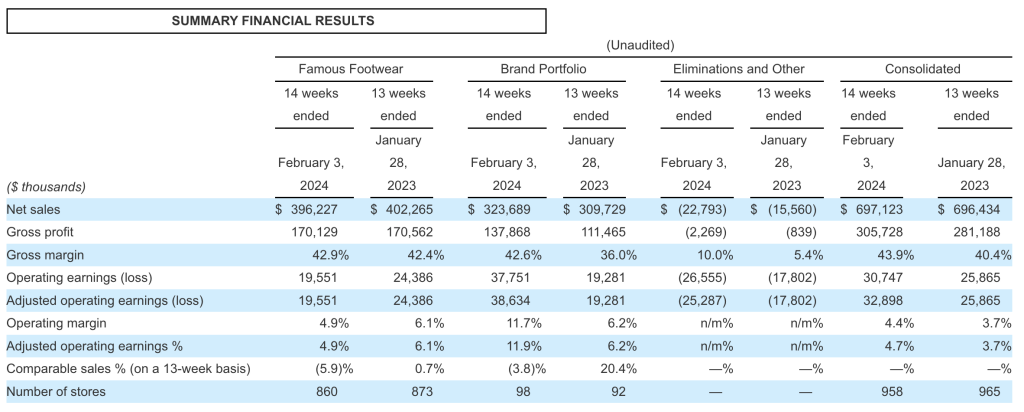

Caleres, Inc., the parent of Famous Footwear and the Naturalizer, Vionic, Allen Edmonds, Blowfish Malibu, and Sam Edelman brands, eked out a slight increase in net sales for the 14-week period ended February 3, increasing just 0.1 percent to $697.1 million, compared to the 13-week fourth quarter ended January 28, 2023. The 14th week in fiscal 2023 added $25.0 million in sales.

- Famous Footwear segment net sales declined 1.5 percent, with comparable sales down 5.9 percent on a 13-week basis. The 14th week in fiscal 2023 added $18.2 million in sales.

- Brand Portfolio segment net sales increased 4.5 percent. The 14th week in fiscal 2023 added $6.8 million in sales.

- Direct-to-consumer (DTC) sales represented approximately 74 percent of total net sales.

The Brand Portfolio reportedly capitalized on ongoing strength in its Lead Brands to power a 4.5 percent increase in year-over-year net sales and a 660 basis-point improvement in gross margin.

Famous Footwear navigated a competitive market environment, capitalizing on pockets of holiday demand and delivering positive sales trends in its Kids business.

Gross profit was $305.7 million for the fourth quarter, compared to $281.2 million in the prior-year quarter.

- Consolidated gross margin was 43.9 percent of sales, a 310 basis-point improvement from the 2022 fourth quarter.

- Famous Footwear segment gross margin of 42.9 percent.

- Brand Portfolio segment gross margin of 42.6 percent.

Selling and administrative expenses were $272.8 million in the 2023 fourth quarter, compared to $255.3 million in the prior-year quarter. SG&A as a percentage of net sales was 39.1 percent.

Net earnings of $55.8 million, or $1.57 per diluted share, compared to net earnings of $40.8 million, or $1.13 per diluted share, in the fourth quarter of fiscal 2022. Earnings per diluted share of $1.57 include:

- Deferred tax valuation allowance releases of 76 cents per diluted share; and

- Expense reduction initiatives of negative 5 cents per diluted share.

Adjusted net earnings were $30.8 million, or adjusted earnings per diluted share of 86 cents, for the quarter, compared to Adjusted net earnings of $23.4 million, or adjusted earnings per diluted share of 65 cents in the fourth quarter of fiscal 2022.

“The Caleres team delivered another strong operational performance in the fourth quarter, culminating in a third consecutive year of adjusted earnings per share in excess of our $4.00 baseline and underscoring the durability of our earnings power,” said Jay Schmidt, president and CEO, Caleres, Inc. “Our fourth quarter results were led by our Brand Portfolio, which achieved a record-setting performance across key financial metrics. Complementing that strong result, Famous Footwear leaned into its competitive advantages to expand market share, particularly in Kids, which has outpaced the total business for 12 straight quarters.”

Fiscal Year 2023 Results

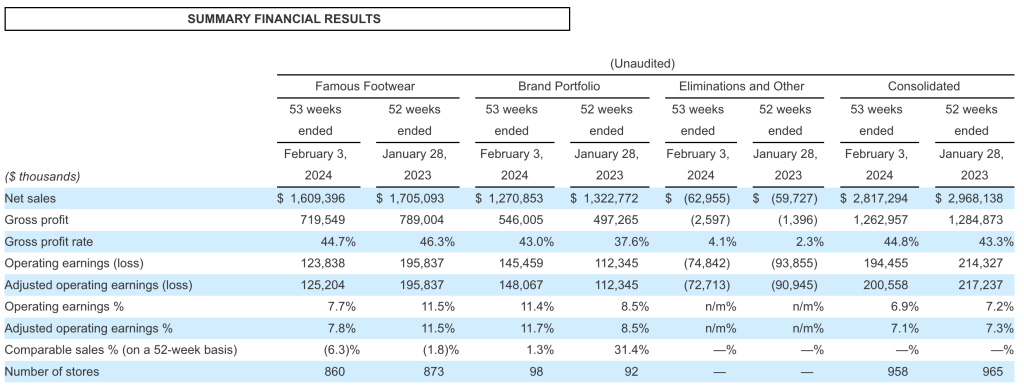

Consolidated net sales were $2.82 billion for the 53-week period ended February 3 (fiscal 2023), compared to $2.97 billion in the 52-week period ended January 28, 2023 (fiscal 2022). The 53rd week in fiscal 2023 added $25.0 million in sales.

- Famous Footwear segment net sales declined 5.6 percent year-over-year, with comparable sales down 6.3 percent on a 52-week basis. The 53rd week in fiscal 2023 added $18.2 million in sales.

- For the full year, Famous gained share in shoe chains in the important Family Channel and achieved record annual sales in the Kids category while generating robust levels of cash flow.

- Brand Portfolio segment net sales declined 3.9 percent. The 53rd week in fiscal 2023 added $6.8 million in sales.

- Direct-to-consumer sales represented approximately 72 percent of total net sales.

Gross profit was $1.26 billion in fiscal 2023, compared to $1.28 billion in fiscal 2022.

- Consolidated gross margin was 44.8 percent of sales.

- Famous Footwear segment gross margin was 44.7 percent.

- Brand Portfolio segment gross margin was 43.0 percent.

SG&A as a percentage of net sales was 37.7 percent.

The Brand Portfolio segment also delivered its best-ever annual adjusted operating earnings, which topped $148 million and was accompanied by an 11.7 percent adjusted return on sales. Notably, the segment led the financial performance of the company.

Net earnings were $171.4 million, or $4.80 per diluted share, for the year, compared to net earnings of $181.7 million, or $4.92 per diluted share, in fiscal 2022. Earnings of $4.80 per diluted share include:

- Deferred tax valuation allowance releases of 75 cents per diluted share; and

- Expense reduction initiatives of negative 13 cents per diluted share.

Adjusted net earnings were $149.3 million, or $4.18 per diluted share, compared to Adjusted net earnings of $167.1 million, or $4.52 per diluted share, in fiscal 2022.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) amounted to $253.5 million and Adjusted EBITDA of $259.6 million, or 9.2 percent of sales.

Balance Sheet

Inventory was down 6.8 percent at year-end, compared to fiscal year-end 2022, due to strategic inventory management, primarily in the Brand Portfolio segment; and

Borrowings under the asset-based revolving credit facility were $182.0 million at the end of the period.

Capital Allocation Update

Caleres continued to reduce the borrowings under its asset-based revolving credit facility, paying down $40.0 million during the fourth quarter. The company also returned $2.5 million to shareholders through its quarterly dividend.

In fiscal 2023, Caleres continued to invest in value-driving growth opportunities while at the same time reduced short-term borrowings by $125.5 million.

The company ended fiscal 2023 with $182.0 million of borrowings. This represents its lowest total indebtedness since the fiscal first quarter 2010.

In addition, Caleres returned $27.4 million to shareholders through share repurchases and dividend payments. Specifically, the company repurchased 763,000 shares of common stock, or approximately 2 percent of shares outstanding, for $17.4 million and an average price of $22.86 per share.

The company returned $10.0 million to shareholders through quarterly dividend payments.

“I am proud of the Caleres team and the tremendous progress we have made across a wide range of strategic objectives,” said Schmidt. “The transformation in earnings power that we have achieved in recent years – combined with our value-driving organizational structure, powerful brands, and best-in-class capabilities – positions us exceptionally well for growth in 2024 and beyond. Our Brand Portfolio, powered by our Lead Brands, has tremendous growth potential, and Famous is poised to strengthen its position as the No. 1 footwear destination for the Millennial family. Looking ahead, we are confident in our ability to execute on our growth strategy, deliver on our long-term financial targets, and create sustained value for our shareholders.”

Fiscal 2024 Outlook

The company introduced its financial outlook for fiscal 2024 and the first quarter of 2024. Fiscal 2024 is a 52-week year and compares to a 53-week year in fiscal 2023.

Caleres expects fiscal 2024 consolidated net sales to be flat to up 2 percent compared to 2023, and earnings per diluted share to be in the range of $4.30 to $4.60 per share. The company said the outlook considers and balances the positive momentum in the Brand Portfolio segment and ongoing companywide cost reduction initiatives against anticipated headwinds that include a forecasted decline in the footwear market, inflationary pressures that could affect consumer demand at Famous Footwear, and higher freight costs.

In addition, for fiscal 2024, the company expects:

- Consolidated operating margin of 7.3 percent to 7.5 percent;

- Effective tax rate of about 24 percent; and

- Capital expenditures of $60 million to $70 million.

For first quarter 2024, the company expects:

- Consolidated net sales to be flat to up 1 percent; and

- Earnings per diluted share in line with fourth quarter 2023 on an adjusted basis.

Image courtesy Famous Footwear/Caleres, Inc.