Blaming a “wickedly competitive environment,” Cabela’s Inc. said aggressive discounting caused the hook & bullet chain to fall short of its earnings goals in the fourth quarter.

Blaming a “wickedly competitive environment,” Cabela’s Inc. said aggressive discounting caused the hook & bullet chain to fall short of its earnings goals in the fourth quarter.

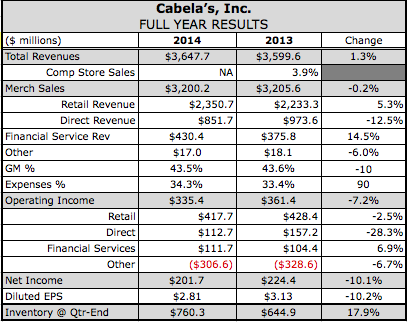

HIGHLIGHTS

Earnings, adjusted for certain items, slumped 16.4 percent to $79.3 million, or $1.11 a share, missing Wall Street’s consensus estimate of $1.35 a share.

Merchandise gross margin decreased 150 basis points to 35.1 percent.

Next-Generation continued to strongly outperform legacy stores. Its Outpost format is underperforming and no new openings are planned.

On a conference call with analysts, Tommy Millner, president and CEO, said while the company was pleased with the strong performance of its new stores, growth of market share in most of its major categories, and continued strong performance of Cabela's CLUB, larger investments in advertising and promotion, combined with higher-than-expected redemption rates of certain promotions, led to earnings to come in below original expectations. Said Millner, “While these factors kept us from meeting our expectations, we could not be more pleased with our ability to take market share and build the strength of our brand throughout the quarter.”

Cabela’s saw “strong consumer demand” prior to Black Friday but transactions soon “softened” and more promotional environment led to added promotions and marketing events throughout the second half of the quarter. Customers also took advantage of certain promotions at significantly higher rates than historically and the chain now expects redemption rates to trend higher than it has previously experienced.

Comps decreased 5.5 percent in the quarter, which represented its third straight quarter of sequential improvement. Encouragingly, power sports and ammunition categories both comped positively. Comps are down less than 1 percent through the first six weeks of the current year, “with encouraging performance” in power sports, ammunition, hunting equipment, fishing, camping, and optics.

Direct revenue fell 5.4 percent as a result of a greater-than-expected decline in ammunition and other shooting-related categories, as well as the impact of cannibalization from its new retail stores. Millner said that as its retail in-stock levels of ammunition improved, customers have shifted back to making ammunition purchases in stores. Direct sales of ammunition were down double-digits.

Asked about the outlook for ammunition and guns for 2015, Millner noted that ammunition has clearly benefited from in-stock rates of ammunition in retail improving over 800 basis points compared to the year before. In November and December, more ammunition than any year during those months except for 2012.

Guns were down about 7 percent on a comp basis in the quarter but returning to more normalized purchasing levels. Modern sporting rifles and shotguns are seeing improvement and the overall category is selling at levels similar to the 2009 to 2010 time frame. Ralph Castner, CFO, said, “Guns have been a little bit more volatile.”

Regarding new stores, the 18 Next-Generation stores open for all of 2014 had sales per square foot of nearly $450, outperforming its legacy store base by roughly 43 percent. Same-store sales outperformed its legacy base by approximately 59 percent in profit per square foot. The Next Generation format ranging between 80,000 and 100,000 square feet – features museum-quality wildlife displays and are positioned as tourist destinations.

Said Millner, “The exceptional performance of these new stores continues to give us great confidence in our future store openings, with our 2015 store openings marking our entrance into many highly anticipated markets.”

Its Outpost stores averaging 40,000 square foot underperformed expectations. Following the opening of its Ammon, ID store, no more Outpost openings are planned “as we reevaluate the profitability and return on capital of these stores.” All its Outpost stores are cash flow positive and no closings are planned. Of its 64 stores, only eight are Outpost stores, and they represent 4.8 percent of its total retail square footage.

Overall, Cabela's plans to open 13 new stores, adding roughly 1 million square feet of retail space, or a 14.6 percent increase in square footage. Five openings have been identified or 2016.

Cabela's CLUB revenue increased 9.9 percent to $113.3 million, primarily attributable to interest and fee income, as well as interchange income. Charge-offs remained at “extremely low levels” at 1.74 percent of sales in the quarter.

Despite the markdown pressures in the quarter, the market share gains, new store performance, and solid growth at Cabela's CLUB is expected to help Cabela’s return to a low-double-digit growth rate in revenue, and a high-single to low-double-digit growth rate in diluted earnings per share for full-year 2015. Additionally, it expects Q1 2015 diluted EPS to be roughly in line with the first quarter, a year ago.