Brunswick reported consolidated net sales of $1.58 billion in the fourth quarter of 2022, up from $1.43 billion in the fourth quarter of 2021. Diluted EPS for the quarter was $1.93 on a GAAP basis and $1.99 on an as-adjusted basis. Sales growth resulted from steady demand, new product introductions and pricing implemented in previous quarters, partially offset by unfavorable changes in foreign currency exchange rates.

All segments contributed to the strong operating earnings and margin growth versus the fourth quarter of 2021, with net sales

growth, coupled with prudent cost containment efforts, being partially offset by higher input costs and spending on growth initiatives, our ACES innovation strategy, and new product technology.

Additionally, versus the fourth quarter of 2021:

- Propulsion segment reported a 17 percent increase in sales due to continued gains in global sales volume, favorable product mix, and higher prices compared to the prior year. Robust operating earnings growth resulted from increased sales and lower operating expenses, offsetting higher inflationary costs and investments in capacity expansion.

- Parts and Accessories segment reported an 8 percent decrease in sales as the impact of

unfavorable foreign currency exchange rates, return to more normal seasonality in the marine

channel, and slower retailer restocking continued in the quarter. Segment operating margins

increased in the quarter with the slight net sales decline more than offset by pricing net of costs and lower operating expenses. - Boat segment reported a 26 percent increase in sales with higher wholesale volume partially offset by selective discounting. Freedom Boat Club, which is part of our Business Acceleration division, delivered another strong quarter, contributing approximately 5 percent of sales to the segment.

- Segment operating margin was 10.8 percent as increased sales, improved mix, and pricing more than offset continued cost inflation.

Review of Cash Flow and Balance Sheet

Cash and marketable securities totaled $613.0 million at the end of 2022, up $245.5 million from year-end 2021 levels. Net cash provided by operating activities during the year of $580.4 million includes net earnings net of non-cash items, partially offset by the impact of higher working capital needs, including increased inventory levels to ensure manufacturing continuity necessary to meet demand and rebuild pipeline inventories.

Investing and financing activities resulted in net cash used of $332.4 million during 2022, including the issuance of $750.0 million of 10-year and 30-year notes in the first quarter for general corporate purposes and $42.5 million cash benefit from cross-currency swap settlements, net of $450.0 million of share repurchases, $388.3 million of capital expenditures, $108.6 million of dividend payments, $93.8 million of cash paid for acquisition of businesses, net of cash acquired,

and $59.1 million of long-term debt repayments.

2023 Outlook

“Despite an uncertain macro-economic backdrop, we remain extremely focused on executing our 2025 strategic plan and are confident we will continue to deliver healthy shareholder returns in 2023. Our strong operational performance and continued investments in new products and growth, coupled with a focus on cost containment activities and a prudent yet flexible capital strategy, provide the necessary controllable levers to drive growth even in uncertain consumer or business environments. The successful launch of our electrified propulsion, boat and power management products this January at the Consumer Electronics Show and the Dusseldorf Boat Show, which generated enormous consumer response, adds to our extensive and unique portfolio and positions us for a very exciting 2023,” said David Foulkes, Brunswick CEO.

Brunswick provided the following guidance for 2023, anticipating:

- U.S. marine industry retail unit sales to be down modestly versus 2022, with premium segments performing better than certain value segments;

- Net sales between $6.8 billion and $7.2 billion;

- Adjusted operating margin of approximately 15 percent;

- Operating expenses flat to increase slightly as a percent of sales, with continued, focused spending on ACES and other growth initiatives;

- Free cash flow in excess of $375 million;

- Adjusted diluted EPS in the range of $9.50 to $11.00; and

- First quarter 2023 flat to slight revenue growth over first quarter 2022, and adjusted EPS

between $2.30 and $2.40.

“Let me close by relaying my extreme appreciation and gratitude to all of our Brunswick employees

around the world as well as our many partners for their incredible execution, innovation, and support to deliver such a fantastic year in a challenging environment,” said Foulkes.

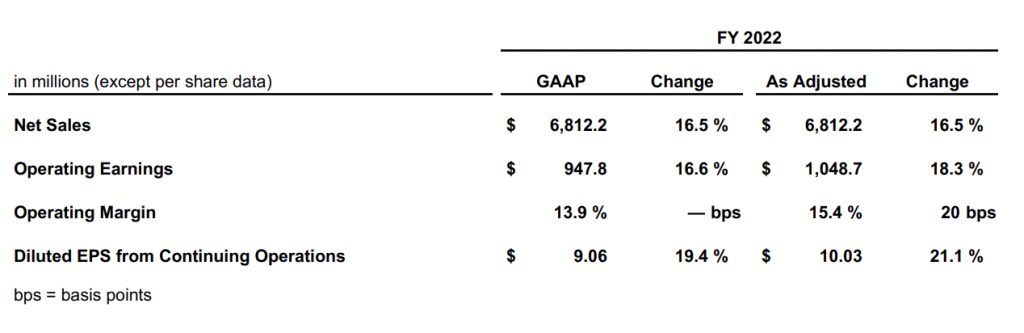

Full-year results: