Brunswick Corporation, owner of the Boston Whaler, Lund, Sea Ray, Bayliner, Harris Pontoons, Princecraft, and Quicksilver boat brands, and the Mercury Marine, Mercury Racing, MerCruiser, and Flite marine propulsion brands, said second quarter sales were slightly above the year-ago quarter as steady wholesale ordering by dealers and OEMs, together with modest pricing benefits, offset the impact of continued challenging consumer demand market conditions.

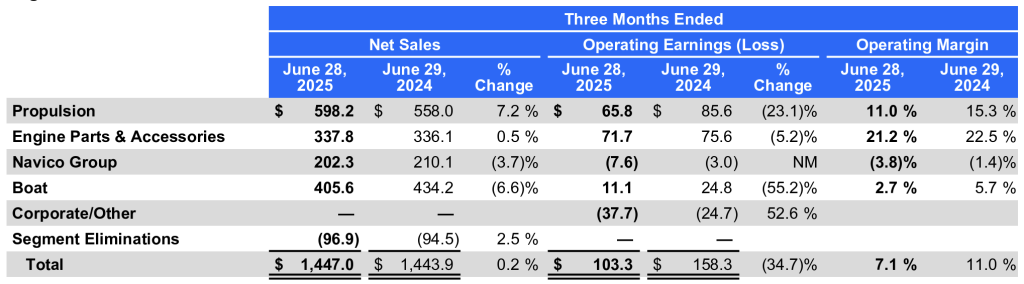

Consolidated net sales amounted to $1.45 billion for the 2025 second quarter, which compares to $1.44 billion in the second quarter of 2024.

The Propulsion segment reported a 7 percent increase in sales resulting primarily from strong orders from U.S. OEMs, while operating earnings were below prior year primarily due to the impact of tariffs, lower absorption from decreased production levels, and the reinstatement of variable compensation, partially offset by cost control measures and the benefits from the increased sales. Sales and operating earnings both grew sequentially versus first quarter 2025.

“Our Propulsion business delivered strong year-over-year sales growth, with shipments to U.S. OEM customers outpacing expectations. Earnings and margins improved sequentially despite the anticipated tariff and absorption headwinds,” offered Brunswick Chairman and CEO, David Foulkes. “Mercury’s outboard engine lineup continues to take market share, gaining over 300 basis points of U.S. retail share in outboard engines over 300 horsepower in the quarter, and 30 basis points of share overall on a rolling twelve-month basis despite heavy wholesale shipments by competitors ahead of tariffs being implemented on Japanese imports. Mercury’s leadership in high horsepower outboard engines will be further reinforced by the new 425 and 350 horsepower engines launched earlier this week with performance, smoothness, quietness, weight, and other attributes far ahead of the competition.”

The Engine Parts and Accessories segment reported a 1 percent increase in sales versus the same period last year due to slightly stronger distribution sales. Sales from the Products business were down 4 percent, while the Distribution business sales were up 4 percent compared to prior year. Segment operating earnings were slightly down versus second quarter 2024, due solely enterprise factors.

“Our engine parts and accessories business had another strong quarter, with slight year-over-year sales growth and steady earnings despite a weather-affected start to the boating season,” Foulkes added. “This primarily aftermarket-based business continues to derive its success from stable boating participation and the world’s largest marine distribution network, which in the U.S. has gained 180 basis points of market share on a rolling twelve-month basis, resulting from our ability to support same day or next day deliveries to most locations in the world.”

The Navico Group segment reported a sales decrease of 4 percent versus second quarter 2024, with sales to both aftermarket channels and marine OEMs down modestly, partially offset by benefits from new product momentum. Segment operating earnings decreased due to the lower sales, tariffs, and the variable compensation reset.

Foulkes said Navico Group had slightly lower sales versus the second quarter of 2024 as aftermarket sales and sales to marine OEMs were modestly lower, however, sales trends continued to improve each month in the quarter. Navico Group earnings remained consistent with first quarter levels and were driven by enthusiastic customer acceptance of new products and steady operational performance.

“Year-to-date revenue for Navico Group is only down 2.5 percent versus the first-half of 2024, led by steady performance by the group’s aftermarket businesses,” the CEO said. “Restructuring actions continue to gain traction despite tariff and market headwinds and, in the quarter, we consolidated two production locations, and transferred European distribution to a 3PL while, in July, we implemented a leaner organizational structure that will reduce expenses and increase agility.”

The Boat Group segment reported a 7 percent decrease in sales resulting from anticipated cautious wholesale ordering patterns by dealers, which was only partially offset by the favorable impact of modest model-year price increases. Freedom Boat Club had another strong quarter, contributing approximately 12 percent of segment sales including the benefits from recent acquisitions. Segment operating earnings were within expectations as the impact of net sales declines and the variable compensation reset was partially offset by pricing and continued cost control.

Foulkes said the lower sales and earnings in the Boat business was consistent with lower planned wholesale shipments, but delivered strong sales and earnings growth versus the first quarter of 2025 as anticipated.

“Our Boat Group remains focused on gaining share in key categories, maintaining balanced field inventory levels, working closely with its channel partners to drive retail activity, and executing multiple structural actions to re-expand margins in the tighter market,” he suggested.

“Year-to-date, boat unit retail sales in the value category are underperforming our initial expectations for the year, but continued overall resilience in the premium and core categories, combined with improving retail sales trends in July, is expected to provide a floor for wholesale performance in the second-half of the year,” Foulkes concluded.

Freedom Boat Club signed its first Middle East franchisee in June, based in Dubai. The club is expected be operational in the coming weeks in time for the boating season in this region, extending the reach of the company’s alternative participation model, which now has 433 global locations.

Profitability

Operating earnings were said to be down versus prior year as the impacts of reinstated variable compensation, lower absorption from decreased production levels, and tariffs were only partially offset by new product momentum, the benefits from the slight sales increase, and ongoing cost control measures throughout the enterprise.

Diluted EPS for the quarter was 90 cents per share on a GAAP basis and $1.16 per share on an adjusted basis.

“Tariffs continue to directly impact our earnings, while adding uncertainty for both our end-consumers and channel partners, but all our businesses are executing strongly on their mitigation plans, resulting in a smaller net tariff impact than originally anticipated,” added Foulkes.

Cash Flow and Balance Sheet Summary

Cash and marketable securities totaled $334.7 million at the end of the second quarter, up $48.0 million from 2024 year-end levels.

Net cash provided by operating activities of continuing operations during the first six months of the year was $309.1 million including net earnings net of non-cash items and the impact of working capital.

Investing and financing activities resulted in net cash used of $251.0 million during the first half of 2025 including $212.7 million of repayments of short-term debt, $127.3 million of repayments of long-term debt, $82.6 million of capital expenditures, $56.6 million of dividend payments, and $43.1 million of share repurchases, net of $267.6 million of proceeds from the issuance of short term debt.

“We had another quarter of outstanding free cash flow generation, with $288 million of free cash generated in the quarter, a record for any second quarter in company history,” Foulkes stated. “This performance also resulted in a record first-half free cash flow of $244 million, a $279 million improvement versus firsthalf 2024. The free cash generated in the past three quarters represents the largest free cash flow generation in any fourth-through-second quarter period in Brunswick history.”

2025 Outlook

“As we pass the midpoint of the prime retail season in the U.S., and despite tariffs and continued challenging macro-economic conditions impacting our businesses, wholesale customers, channel partners, and the end-consumers who buy our products at retail around the world, Brunswick continues to drive steady earnings and extremely strong free cash flow, while focusing on delivering consistent shareholder returns,” the company stated in its earning release. “We’re executing well against our marine-centric strategy and remain focused on: investing in new products and technologies, including increasing investment in specific areas that we expect will drive even further differentiation and market share gains for our brands; working closely and dynamically with our channel partners to maintain healthy and balanced boat, engine and parts pipelines and supporting them with appropriate incentive programs to stimulate demand; and mitigating the direct tariff impact on our businesses.”

The company is reportedly progressing certain rationalization and manufacturing capacity optimization actions in the second-half of the year to improve short- and long-term profitability and cash flow in several of its businesses, while still driving incremental product cost and operating expense reductions, and maximizing the positive impact of cash generation on its capital strategy.

“Growing our technology leadership position will also remain a focus during the remainder of the year,” the company continued.

Brunswick said it has already built significant momentum with implementation of AI for productivity and consumer-facing applications, and Brunswick’s large enterprise-wide software development teams that support all its businesses are trained on, and using, AI-assisted coding tools.

“We will also shortly be launching AI powered customer service tools and, in addition, Brunswick’s autonomous docking system remains on-track to launch later this year,” the company added.

“In these challenging conditions, our resilient, recurring revenue businesses and channels continue demonstrating their earnings and cash flow power, which is helping to mitigate the impacts of market conditions. In addition, our substantial, vertically integrated U.S. manufacturing base, and the fact that we produce almost all our boats in the regions in which they are sold, positions us relatively well in an environment of persistent tariffs,” BC noted. “These tailwinds help to counter the risks remaining related to our 2025 performance and guidance, primarily due to the uncertainties of macro-economic conditions, tariffs and trade policy, the direct and indirect impact of these uncertainties on our consumers, and the interest rate environment.”

The net result is the following updated full-year guidance, which BC said holds the midpoint of its sales and EPS guidance, while raising free cash flow expectations, specifically:

- Net sales of approximately $5.2 billion;

- Adjusted diluted EPS of approximately $3.25 per share;

- Free cash flow in excess of $400 million; and

- Third quarter 2025 revenue of between $1.1 and $1.3 billion, and adjusted diluted EPS of between 75 cents and 90 cents per share.

“Brunswick delivered strong second quarter results as the power of our market-leading products and brands, efficient operational execution and cost control, continued prudent pipeline inventory management, and the benefits from the resilient, recurring, aftermarket-focused portions of our portfolio, resulted in second quarter financial performance ahead of expectations. This was despite the challenging macro environment and uncooperative weather in many parts of the U.S. through the first two months of the quarter,” Foulkes closed.

Image courtesy Sea Ray/Brunswick Corporation