Citing a strong fourth quarter performance, high valuations for premium outdoor brands and its ability to offset federal taxes on asset sales, Black Diamond Inc. said it has hired two global investment banks to explore strategic buyers for its three brands.

- Board says Q4 results show company's strategic pivot is working

- With premium outdoor brands selling at a premium, time is right to consider options

- Sales could help brands shed costs of supporting a small public company

- BDE's net operating loss carryforwards could reduce federal income taxes on any sales

Sales of the fast-growing Black Diamond, POC and PIEPS brands -either as a group or individually- could benefit the brands by removing the burdens of being part of a small public company, BDE co-founder and CEO Peter Metcalf told The B.O.S.S. Report in an interview Tuesday. It could help shareholders by enabling them to sell at current high market multiples with little to no taxes thanks to $167 million in unused net operating loss (NOLS) carryforwards BDE can use to offset future federal income taxes.

Sales of the fast-growing Black Diamond, POC and PIEPS brands -either as a group or individually- could benefit the brands by removing the burdens of being part of a small public company, BDE co-founder and CEO Peter Metcalf told The B.O.S.S. Report in an interview Tuesday. It could help shareholders by enabling them to sell at current high market multiples with little to no taxes thanks to $167 million in unused net operating loss (NOLS) carryforwards BDE can use to offset future federal income taxes.

“The opportunity for shareholders and the brands is that we optimize an ownership structure that reduces the overall burden they have to deal with as part of a public company,” Metcalf explained.

Metcalf declined to comment further, but said the company expects to complete its analysis of strategic alternatives during the second quarter. Shares of BDE closed at $9.64 Tuesday, March 17, up nearly 37 percent in 24 hours.

The Salt Lake City company divulged the decision Monday, March 16 when it reported sales from continuing operations increased 10 percent to $59.4 million in the fourth quarter ended Dec. 31, 2014. The figures exclude results at Gregory Mountain Products, which BDE sold in July, 2014 for 2.3 times projected 2014 revenue. The increase was primarily due to the continued growth of Black Diamond apparel, an increase in preseason bookings at POC and restocking orders for winter gear. Excluding the impact of foreign exchange, sales grew by 13 percent.

In a conference call with analysts, Metcalf said the performance indicates BDE's brands likely gained market share given that point-of-sale data from OIA VantagePoint shows U.S. sales of outdoor products declined approximately 8 percent to $2.2 billion in December, 2014.

“We were certainly exposed to these macro industry dynamics, including poor weather in Europe and the spillover effect to our seasonal winter product,” said Metcalf. “We also experienced slower-than-anticipated ASAP orders in North America due to the lack of winter weather in many parts of the West as well as similar shift in buying behavior over the past several months, especially from the independent specialty retailers. Despite these dynamics, we believe that our brands are outperforming the industry and taking market share.”

As an example, bookings for Black Diamond's Spring 2015 apparel collection, which will include a major expansion of women's apparel, are running up in the double digits in both North America and Europe. At POC, growth was propelled by reorders of in-season ski helmets and independent sales reps who took over sales in Canada, France, Holland and Belgium during the quarter. A limited launch by all three brands of air bags using BDE's new JetForce technology completely sold out.

Gross margin rose 160 basis points (bps) to 39.0 percent during the quarter due to both a favorable mix of higher margin products and higher margin channel mix, partially offset by a 175 basis point impact from foreign exchange. Selling, general and administrative expense dropped 50 bps to 36.8 percent of sales compared with the fourth quarter of 2013. The higher spending was driven by investments in strategic initiatives such as taking POC's distribution in-house in some overseas markets and the continued roll-out of POC's first line of road cycling helmets.

Net loss from continuing operations in the fourth quarter increased 80 percent due to $3.1 million of non-cash items and $1.0 million in restructuring costs related to the company's decision to divest Gregory Mountain in July as part of a “strategic pivot” focused on accelerating growth at the remaining brands.

Since the sales, BDE has whittled down its hardgoods SKU count by about 25 percent, shut down its manufacturing facility in southern China, consolidated manufacturing of climbing hardware in Salt Lake City and outsourced ski manufacturing to a European OEM in a bid to reduce the complexity of its supply chain.

Excluding those costs, adjusted EBITDA and adjusted net income from continuing operations increased 37 percent to $3.4 million and 36 percent to $3.1 million, or 9 cents per diluted share respectively in the fourth quarter of 2014.

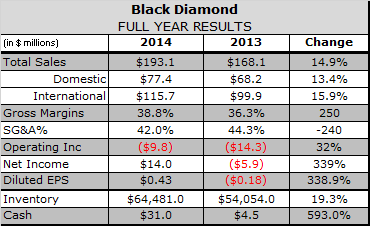

Gains were even higher for the full year ended Dec. 31, 2014. (See related table.)

BDE Chairman Warren Kanders, who owns 23.5 percent of the company's shares, said the fourth quarter performance demonstrates BDE's strategic pivot is working. Given that BDE sold its Gregory Mountain Products business in July, 2014 for 2.4 times projected sales and that BDE can use its NOLS to offset up to $167 million in future federal income taxes, the BDE board opted to explore strategic options.

Regarding the outlook for 2015, BDE anticipates sales of approximately $208 million in 2015, which would represent an increase of approximately 8 percent (11 percent c-n) from 2014 sales. Gross margins are expected to rise to approximately 40 percent. Restructuring initiatives, including an addition $1.0-to-$1.5 million to be taken in 2015, are expected to eliminate $10 million in annual costs by the end of the year.

The forecast assumes a successful launch of the company's most comprehensive women's apparel offering this spring at more than 800 specialty stores worldwide. Plans call for providing select retailers with in-store banners, apparel tech kits, manikins, hangers and product for key shop staff. BDE is also contributing to co-op advertising campaigns at REI.com, Zappos.com and Locally.com.

The forecast is well short of the targets BDE was advertising as recently as mid-2012, when Metcalf told investors he expected sales to reach $375 million by 2015 through acquisitions and the launch of the Black Diamond apparel line. The company backed off those targets in 2013, when it announced its plan to sell Gregory and focus on its faster growing Black Diamond and POC brands.

“We made a great call five years ago that worked really well,” Metcalf said of the decision to merge Gregory and Black Diamond into a publicly traded company in 2010. “But now it appears this may be better way to go. Capital and ownership structure is a means to an end and the end for our company is to continue to build a great company and great brands that are critical to the customers and retailers in their community.”