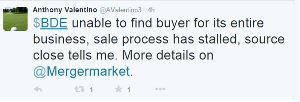

Black Diamond Inc.'s share price fell more than 5.5 percent Thursday afternoon after a journalist for MergeMarket tweeted the company has been unable to find any investors interested in buying it or any of its brands.

In a March announcement, Black Diamond disclosed it had hired two global investment firms to shop its brands to take advantage of high market multiples paid for comparable brands and to free the brands of the high costs of operating as part of a publicly traded company. The company said in early August that it expected the process to culminate in the third quarter.

Since divesting Gregory Mountain Products in 2012 to free up resources

to grow its incipient apparel and direct-to-consumer business, Black

Diamond shut down its manufacturing and distributing hub in China,

repatriated manufacturing of most climbing equipment to Salt Lake City,

and outsourced manufacturing of skis to Europe.

In August, the company reported revenues reached a record $35.1 million in the second quarter ended June 30, up 2 percent from a year earlier as sales of POC's first line of road bike gear and the Black Diamond brand's first complete line of women's spring sportswear easily offset currency headwinds. Excluding the impact of exchange rates, sales grew 7 percent. The company affirmed its full-fiscal year guidance, which calls for sales to grow 11 percent and gross margin to reach 40 percent in currency-neutral terms.

At the time, Black Diamond Inc. CEO Peter Metcalf said the numbers proved the company's strategy was on track.