Big 5 Sporting Goods reported a modest decline in third-quarter earnings due to continued softness in demand for firearms, ammunition and related products and the promotional retail climate. But sales turned positive in the second half of the quarter and earnings came in ahead of its guidance.

Big 5 Sporting Goods reported a modest decline in third-quarter earnings due to continued softness in demand for firearms, ammunition and related products and the promotional retail climate. But sales turned positive in the second half of the quarter and earnings came in ahead of its guidance.

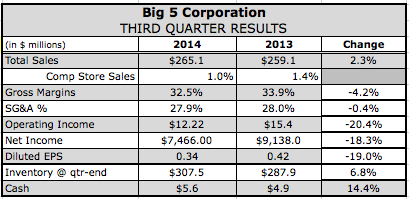

Sales in the period ended Sept. 28 increased 2.3 percent to $265.1 million. Same store sales inched 1.0 percent. In the year-ago quarter, comps advanced 1.4 percent.

Net earnings declined 18.3 percent to $7.5 million, or 34 cents a share, coming in just above its guidance ranging of 24 to 32 cents. Shares of Big Five rose TK in over-the-counter trading on Wednesday, the day after earnings were released.

On a conference call with analysts, Steve Miller, Big 5s president and CEO, said the comp gain was driven by increases in both customer transactions and average ticket.

The gains came despite the reduced demand for firearms, ammunition and related products that impacted same-store sales by nearly 300 basis points in the third quarter. Excluding firearms-related sales, comps were up in the mid-single-digit range for the period. Comps were also impacted by the ongoing severe drought that has taken an economic and recreational toll across much of our western markets, particularly California, said Miller.

Comps were in the negative low single-digit range for the first half of the quarter, but swung to the positive low mid-single-digit range for the back half of the period. Miller said the improvement was driven largely by strong sales of summer-related products as we benefited from relatively favorable warmer weather in many of our markets compared to the prior year, as well as successful summer promotional activities.

By category, apparel was again Big 5s strongest performing category, comping up high-single digits. The increase was on top of a high single-digit increase in the category in last year’s third quarter. Miller attributed the strength to a positive reflection of our increased focus on branded products at stepped-up price points, the continuing benefits of our business analytics, and enhancements to our in-store presentation.

Footwear was slightly positive, while hard goods comped down low-single digits. Excluding firearm-related products, comps in hard goods categories would have been up in the mid-single-digit range.

Merchandise margins decreased 47 basis points and overall gross margins eroded to 32.5 percent from 33.9 percent a year ago. Miller said additional promotions were used to battle the headwinds and drive sales.

SG&A expenses were 27.9 percent of sales, about the same level as last year. On an absolute basis, SG&A expense increased 1.9 percent, due primarily to higher employee labor- and benefit-related expense, and added expense for new stores. The higher expense was partially offset by a decrease in legal expense, reflecting a pre-tax charge of $1.0 million related to legal settlements recorded in the third quarter of 2013, as well as a decrease in print advertising expense.

The latest quarter also included expenses amounting to 1 cent a share associated with the development of the company’s e-commerce platform. Its e-commerce site went live in mid-October. A soft launch is planned with additional product categories and marketing efforts being added in the future. Said Miller, While we dont expect e-commerce sales to be significant to our fourth quarter, we are excited about this launch and the channel’s potential for the future.

Four stores were opened and two closed in the quarter and ten are expected to open in the fourth quarter. It expects the end the year with 439 stores, up from 429 at the close of 2013.

The company provided a conservative outlook for the fourth quarter. Comps are expected to increase in the low single-digit range and EPS to range between 14 to 22 cents. In the 2013 fourth quarter, same store sales decreased 0.5 percent and EPS was 23 cents.

Miller said comps are up in the low single-digit range for the period to date, although he noted that October represents the lowest sales volume month in the quarter.

In the Q&A session, Miller said the comparisons pressures on the firearms category are lessoning but some challenges are expected in the fourth quarter. Said Miller, This has been an erratic category, unusual consumption. There was clearly some, I guess you can call it over consumption, perhaps hoarding, of ammunition. And I guess until that all works its way through the cycles, it’s very difficult to predict.

Regarding the holiday outlook and the state of the consumer, Miller saw a benefit from lower gas prices but admitted its hard to quantify the impact the drought is having on our consumers. The drought is particularly being felt in recreational categories and Miller pointed to a CNBC report that estimated the drought has cost to the California economy at $2.2 billion and 17,000 jobs this year.

Early weather has not been favorable thus far, added Miller around holiday spending. So if we back out the winter and backed out the winter apparel and winter product and the firearms category, were performing very positively in a very solid mid-single range. And hopefully, on the strength that were seeing across a broad array of categories will serve us well as we play through the fourth quarter.