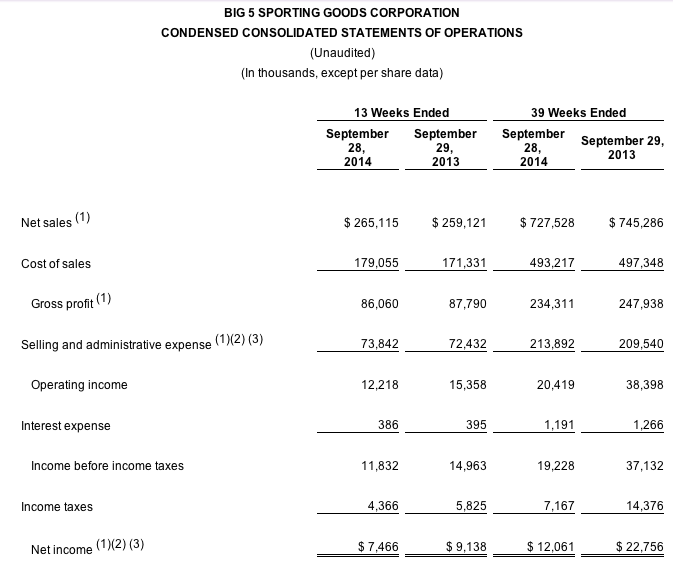

Big 5 Sporting Goods Corporation reported net sales increased to $265.1 million in the third quarter from $259.1 million a year ago. Same store sales increased 1.0 percent.

For comparison purposes, the company’s same store sales increased 1.4 percent for the third quarter of fiscal 2013 over the third quarter of the prior year.

Gross profit for the fiscal 2014 third quarter was $86.1 million, compared to $87.8 million in the third quarter of the prior year. The company’s gross profit margin was 32.5 percent in the fiscal 2014 third quarter versus 33.9 percent in the third quarter of the prior year. The decrease in gross profit margin was driven primarily by a decrease in merchandise margins of 47 basis points reflecting the impact of promotional activity, as well as increases in distribution and store occupancy costs as a percentage of net sales. For comparison purposes, merchandise margins in the third quarter last year increased by 12 basis points versus the third quarter of fiscal 2012.

Selling and administrative expense increased by $1.4 million for the fiscal 2014 third quarter over the prior year, but was unchanged as a percentage of net sales at 27.9 percent. The increase in overall selling and administrative expense was primarily due to higher employee labor and benefit-related expense and higher store-related expense reflecting an increased store count, partially offset by a decrease in legal expense reflecting a pre-tax charge of $1.0 million related to legal settlements recorded in the third quarter of 2013 as well as a decrease in print advertising expense.

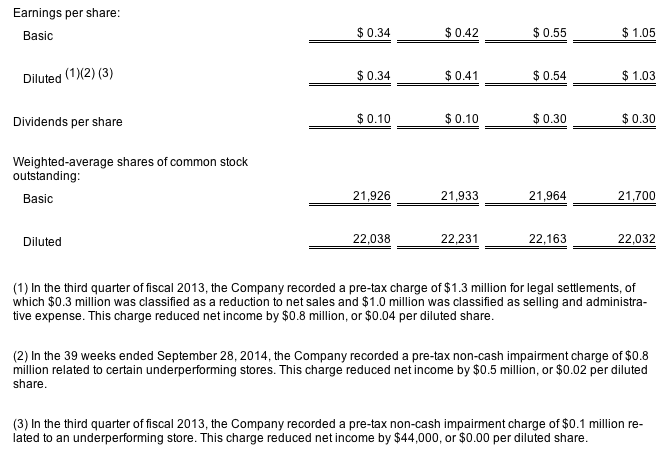

Net income for the third quarter of fiscal 2014 was $7.5 million, or 34 cents per diluted share, including expenses associated with the development of the company’s e-commerce platform of 1 cent per diluted share, compared to net income for the third quarter of fiscal 2013 of $9.1 million, or 41 cents per diluted share, including 4 cents per diluted share for a charge for legal settlements and 1 cent per diluted share for expenses associated with the development of the company’s e-commerce platform.

For the 39-week period ended September 28, 2014, net sales were $727.5 million compared to net sales of $745.3 million in the comparable period last year. Same store sales decreased 3.7 percent in the first 39 weeks of fiscal 2014 versus the comparable period last year. For comparison purposes, the company’s same store sales increased 5.3 percent for the first 39 weeks of fiscal 2013 over the comparable period in fiscal 2012. Net income was $12.1 million, or $0.54 per diluted share, including $0.02 per diluted share of non-cash impairment charges and $0.02 per diluted share of e-commerce development expenses, for the first 39 weeks of fiscal 2014, compared to net income for the first nine months of last year of $22.8 million, or $1.03 per diluted share, including $0.04 per diluted share for a charge for legal settlements and $0.02 per diluted share for expenses associated with the development of the company’s e-commerce platform.

“We are pleased with our third quarter results, which exceeded our earnings guidance,” said Steven G. Miller, the company’s chairman, president and chief executive officer. “After comping negatively in the low single-digit range in the first half of the quarter, sales comped positively in the low-mid single-digit range for the back half of the quarter as we benefited from strong sales of summer products and relatively favorable weather compared to the prior year. Despite the continued reduced demand for firearms-related products and the impact of the ongoing severe drought over much of our western markets, we experienced growth in both customer transactions and average sale. For the quarter, same store sales in our apparel category increased in the high single-digit range, footwear sales were slightly positive and hardgoods sales decreased in the low single-digit range compared to the prior year, reflecting the continued softness of firearms, ammunition and related products. Excluding firearms-related products, hardgoods sales increased in the mid-single-digit range for the quarter. We are encouraged that the positive sales trends have continued into the fourth quarter. While the key holiday selling period lies ahead, we believe we are well positioned to drive traffic and sales with a compelling merchandise assortment and exciting promotional plans.”

Quarterly Cash Dividend

The company’s Board of Directors has declared a quarterly cash dividend of $0.10 per share, which will be paid on December 15, 2014 to stockholders of record as of December 1, 2014.

Share Repurchases

During the fiscal 2014 third quarter, pursuant to its share repurchase program, the company repurchased 114,200 shares of its common stock for a total expenditure of $1.2 million. As of September 28, 2014, the company had $7.3 million available for future share repurchases under its $20.0 million share repurchase program.

Guidance

For the fiscal 2014 fourth quarter, the company expects same store sales to increase in the low single-digit range and earnings per diluted share to be in the range of $0.14 to $0.22. This guidance includes approximately $0.01 per diluted share in anticipated expenses associated with the development of the company’s e-commerce platform. For comparative purposes, the company’s same store sales decreased 0.5 percent and earnings per diluted share were $0.23, including $0.01 per diluted share in e-commerce development expenses, for the fourth quarter of fiscal 2013.

Store Openings

During the third quarter of fiscal 2014, the company opened four new stores, one of which was a relocation, and closed two stores as part of relocations, ending the quarter with 429 stores in operation. During the fiscal 2014 fourth quarter, the company anticipates opening 10 new stores, which would result in a year-end store count of 439.