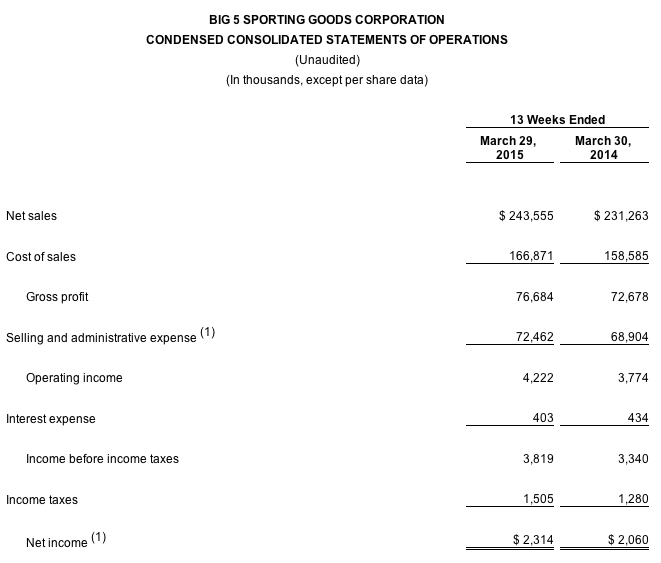

Big 5 Sporting Goods Corporation reported sales during the first quarter increased to $243.6 million from net sales of $231.3 million for the first quarter of fiscal 2014. Same store sales increased 3.9 percent for the first quarter of fiscal 2015.

Gross profit for the fiscal 2015 first quarter was $76.7 million, compared to $72.7 million in the first quarter of the prior year. The company's gross profit margin was 31.5 percent in the fiscal 2015 first quarter versus 31.4 percent in the first quarter of the prior year. The increase in gross profit margin was driven primarily by an increase in merchandise margins of 14 basis points.

Selling and administrative expense increased by $3.6 million for the fiscal 2015 first quarter over the prior year, but was unchanged as a percentage of net sales at 29.8 percent. The increase in overall selling and administrative expense was primarily due to higher employee labor and benefit-related expense and higher store-related expense reflecting an increased store count, as well as a pre-tax charge of $0.4 million related to a legal settlement and expenses of $0.5 million related to the company's publicly-disclosed proxy contest, partially offset by a decrease in advertising expense.

Net income for the first quarter of fiscal 2015 was $2.3 million, or 11 cents per diluted share, including 3 cents per diluted share for charges for a legal settlement and expenses associated with the company's proxy contest, compared to net income for the first quarter of fiscal 2014 of $2.1 million, or 9 cents per diluted share.

“We are pleased to deliver solid sales and earnings growth for the first quarter,” said Steven G. Miller, the company's chairman, president and chief executive officer. “As previously reported, we had a strong start to the quarter with outstanding winter weather conditions in our western U.S. markets and comped very positively in January. Sales turned negative in February due to the unseasonably warm weather and positive again in March as we moved into the spring season. We experienced a low single-digit improvement in both customer traffic and average sale for the quarter, and our same store sales improved for each of our major product categories of apparel, footwear and hardgoods. Our ongoing initiatives to offer more branded products at stepped up price points benefited our apparel and footwear categories, and strength across a number of product areas benefited our hardgoods category. We are particularly pleased with the performance of our hardgoods category given that we continued to be negatively impacted by comparisons in our firearm-related product categories, although to a lesser degree than we experienced over the course of 2014.”

Miller continued, “We are off to a solid start for the second quarter, as we continue to experience strength across a broad array of product categories. We believe that we are well positioned from a merchandise, marketing and operations standpoint as we transition into the summer selling season.”

Quarterly Cash Dividend

The company's Board of Directors has declared a quarterly cash dividend of $0.10 per share, which will be paid on June 15, 2015 to stockholders of record as of June 1, 2015.

Share Repurchases

In the first quarter of fiscal 2015, the company repurchased 76,073 shares of its common stock for a total expenditure of $0.9 million. As of March 29, 2015, the company had $6.2 million available for future share repurchases under its $20.0 million share repurchase program.

Guidance

For the fiscal 2015 second quarter, the company expects same store sales to increase in the low to mid-single-digit range and earnings per diluted share to be in the range of 12 to 17 cents a share, excluding costs incurred related to a publicly-disclosed proxy contest.

Store Openings

During the first quarter of fiscal 2015, the company opened one new store and closed three stores, one of which was part of a relocation, ending the quarter with 437 stores in operation. During the fiscal 2015 second quarter, the company anticipates opening three new stores. For the fiscal 2015 full year, the company currently anticipates opening approximately 10 net new stores.