Despite better comps and traffic, third-quarter sales came in flat at Big 5 Sporting Goods as unseasonably warm weather in California reduced higher margin apparel sales and tilted growth toward lower margin hardgoods.

Despite better comps and traffic, third-quarter sales came in flat at Big 5 Sporting Goods as unseasonably warm weather in California reduced higher margin apparel sales and tilted growth toward lower margin hardgoods.

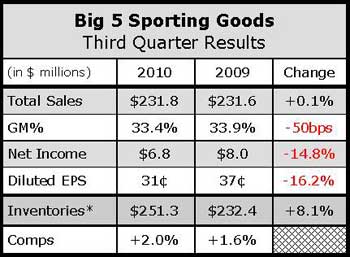

Sales for the quarter ended Sept. 30 reached $231.8 million, up just $200,000 from the year earlier quarter, while same-store sales increased 2.0% on top of a 1.6% increase in the third quarter of 2009. While traffic and comps rose in all three months of the quarter, average tickets declined. Unusually cool weather in California, where the company operates roughly half its 391 stores, hindered summer apparel sales, which comped down in the mid-single-digit range. Footwear rose in the low-single-digits. Hardgoods rose in the upper-middle-single digits on strength of team sports, camping and fitness gear.

The retailer's gross profit margin slipped 50 basis points to 33.4% of sales in the third quarter. That was due primarily to a 50-basis-point decline in merchandise margins reflecting a less profitable sales mix including less apparel sales – and the costs of operating nine more stores than a year earlier.

Selling and administrative expense as a percentage of net sales was 28.6% in the fiscal 2010 third quarter versus 28.2% in the third quarter of the prior year, reflecting an increase of $1 million due to store openings and rising employee benefits and interests expenses. Net income slid 15% to $6.8 million, or 31 cents a share, from $8.0 million, or 37 cents a share, in the year-ago period, with a shift back to a 52-week fiscal calendar from a 53-week calendar in 2009 shaving 7 cents off EPS.

The company grew its inventory 8.6% over the same period a year ago to prepare for new stores, comps growth and ensure timely delivery of items sourced from China. Management said they expect fourth-quarter, same-store sales to be in the positive low-single-digit range and earnings per diluted share of 25 cents to 33 cents despite the shift to a 13-week quarter from a 14-week quarter.