The Beachbody Company, Inc. narrowed its loss in the second quarter ended June 30 and saw its seventh consecutive quarter of positive adjusted EBITDA, although sales declined 42.0 percent due to its pivot last fall from a multi-level marketing (MLM) to a single-level affiliate program.

Carl Daikeler, Beachbody’s co-founder and chief executive officer, commented, “Our better-than-expected results reflect that the strategic decisions that we have made during our transformation are working. We have significantly reduced our breakeven levels, generated free cash flow for the first half of 2025 and recorded our seventh consecutive quarter of positive adjusted EBITDA. We are now evolving our marketing and distribution models to reach more people with compelling solutions that will significantly broaden our market opportunities. With our dramatically improved cost structure and our strong portfolio of some of the most recognized brands in fitness and nutrition, we will continue to optimize our new agility and efficiencies while developing an exciting product pipeline that we will introduce into new distribution channels that were previously unavailable to us.”

“Looking ahead, we have a line of sight to achieving positive free cash flow for the full year 2025 for the first time since 2020, marking an important milestone in our company’s transformation. We are confident in our direction and encouraged by our progress, while we remain focused on the disciplined execution to position BODi for long-term success.”

Second Quarter 2025 Results

- Total revenue was $63.9 million compared to $110.2 million in the prior year period.

- Digital revenue was $39.7 million compared to $58.8 million in the prior year period and digital subscriptions totaled 0.94 million in the second quarter.

- Nutrition and Other revenue was $24.2 million compared to $50.1 million in the prior year period and nutritional subscriptions totaled 0.07 million in the second quarter.

- Connected Fitness revenue was $0.1 million compared to $1.3 million in the prior year period as we ceased the sale of bike inventory in the first quarter of 2025.

- Total operating expenses were $50.2 million compared to $85.9 million in the prior year period.

- Operating loss improved by $5.5 million to $4.0 million compared to an operating loss of $9.5 million in the prior year period.

- Net loss was $5.9 million, which included $2.5 million of restructuring related costs, compared to a net loss of $10.9 million in the prior year period.

- Adjusted EBITDA was $4.6 million compared to $4.9 million in the prior year period.

- Cash provided by operating activities for the six months ended June 30, 2025 was $6.6 million compared to cash provided by operating activities of $8.2 million in the prior year period, and cash used in investing activities was $2.5 million compared to cash provided by investing activities of $2.7 million in the prior year period. Free cash flow was $4.1 million compared to $5.3 million in the prior year period.

Beachbody stated that the prior year periods do not reflect the impact of the pivot in the company’s business model, which it announced on September 30, 2024, and executed in the fourth quarter of 2024. Therefore, the results are not directly comparable with those of the prior periods.

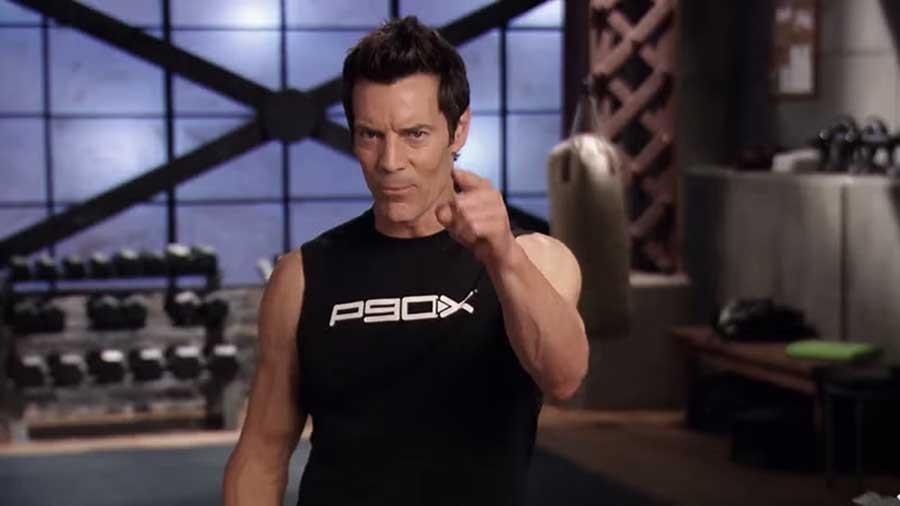

Beachbody is recognized for its fitness and nutrition programs, including P90X, Insanity and 21-Day Fix, as well as the nutrition supplement Shakeology.

Image courtesy Beachbody/P90X